PJT Partners Investment Banking Pitch Book

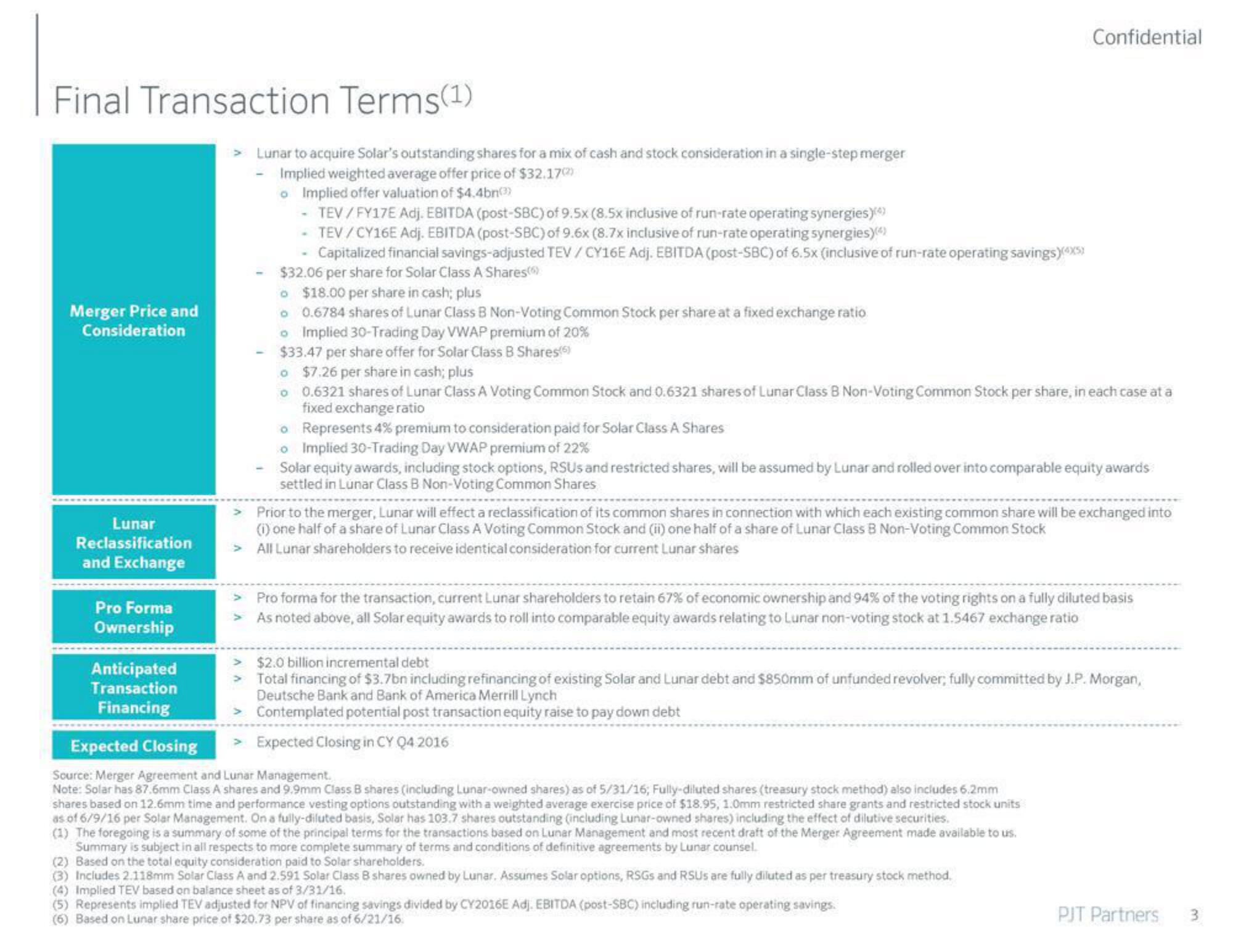

Final Transaction Terms(1)

Merger Price and

Consideration

Lunar

Reclassification

and Exchange

Pro Forma

Ownership

Anticipated

Transaction

Financing

Lunar to acquire Solar's outstanding shares for a mix of cash and stock consideration in a single-step merger

- Implied weighted average offer price of $32.17

o Implied offer valuation of $4.4bn(3)

TEV/FY17E Adj. EBITDA (post-SBC) of 9.5x (8.5x inclusive of run-rate operating synergies)(*)

TEV/CY16E Adj. EBITDA (post-SBC) of 9.6x (8.7x inclusive of run-rate operating synergies)(4)

Capitalized financial savings-adjusted TEV/CY16E Adj. EBITDA (post-SBC) of 6.5x (inclusive of run-rate operating savings)(*XX

$32.06 per share for Solar Class A Shares)

●

o $18.00 per share in cash; plus

0.6784 shares of Lunar Class B Non-Voting Common Stock per share at a fixed exchange ratio

o Implied 30-Trading Day VWAP premium of 20%

$33.47 per share offer for Solar Class B Shares(6)

o $7.26 per share in cash; plus

o

0.6321 shares of Lunar Class A Voting Common Stock and 0.6321 shares of Lunar Class B Non-Voting Common Stock per share, in each case at a

fixed exchange ratio

o

Represents 4% premium to consideration paid for Solar Class A Shares

o Implied 30-Trading Day VWAP premium of 22%

Solar equity awards, including stock options, RSUS and restricted shares, will be assumed by Lunar and rolled over into comparable equity awards

settled in Lunar Class B Non-Voting Common Shares

Confidential

>

Prior to the merger, Lunar will effect a reclassification of its common shares in connection with which each existing common share will be exchanged into

(1) one half of a share of Lunar Class A Voting Common Stock and (ii) one half of a share of Lunar Class B Non-Voting Common Stock

>

All Lunar shareholders to receive identical consideration for current Lunar shares

Pro forma for the transaction, current Lunar shareholders to retain 67% of economic ownership and 94% of the voting rights on a fully diluted basis

As noted above, all Solar equity awards to roll into comparable equity awards relating to Lunar non-voting stock at 1.5467 exchange ratio

$2.0 billion incremental debt

Total financing of $3.7bn including refinancing of existing Solar and Lunar debt and $850mm of unfunded revolver, fully committed by J.P. Morgan,

Deutsche Bank and Bank of America Merrill Lynch

> Contemplated potential post transaction equity raise to pay down debt

Expected Closing in CY Q4 2016

Expected Closing

Source: Merger Agreement and Lunar Management.

Note: Solar has 87.6mm Class A shares and 9.9mm Class B shares (including Lunar-owned shares) as of 5/31/16, Fully-diluted shares (treasury stock method) also includes 6.2mm

shares based on 12.6mm time and performance vesting options outstanding with a weighted average exercise price of $18.95, 1.0mm restricted share grants and restricted stock units

as of 6/9/16 per Solar Management. On a fully-diluted basis, Solar has 103.7 shares outstanding (including Lunar-owned shares) including the effect of dilutive securities.

(1) The foregoing is a summary of some of the principal terms for the transactions based on Lunar Management and most recent draft of the Merger Agreement made available to us.

Summary is subject in all respects to more complete summary of terms and conditions of definitive agreements by Lunar counsel.

(2) Based on the total equity consideration paid to Solar shareholders.

(3) Includes 2.118mm Solar Class A and 2.591 Solar Class 8 shares owned by Lunar. Assumes Solar options, RSGS and RSUS are fully diluted as per treasury stock method.

(4) Implied TEV based on balance sheet as of 3/31/16.

(5) Represents implied TEV adjusted for NPV of financing savings divided by CY2016E Adj. EBITDA (post-SBC) including run-rate operating savings.

(6) Based on Lunar share price of $20.73 per share as of 6/21/16

PJT Partners

3View entire presentation