Greenlight Company Presentation

Large On-Going Share Repurchases

$(billions)

Forecast cash flow

Tax on repatriated cash

Free cash flow

Domestic cash

Foreign cash

Total cash

Dividends

Repurchases

Total return of capital

Greenlight Capital, Inc.

9 months ended 9/30/13

24.0

24.0

25.1

112.0

137.1

7.2

16.8

24.0

FY 2014

50.1

1.6

48.5

0

137.1

137.1

9.0

39.5

48.5

FY 2015

53.4

7.0

46.4

0

137.1

137.1

8.4

38.0

46.4

24

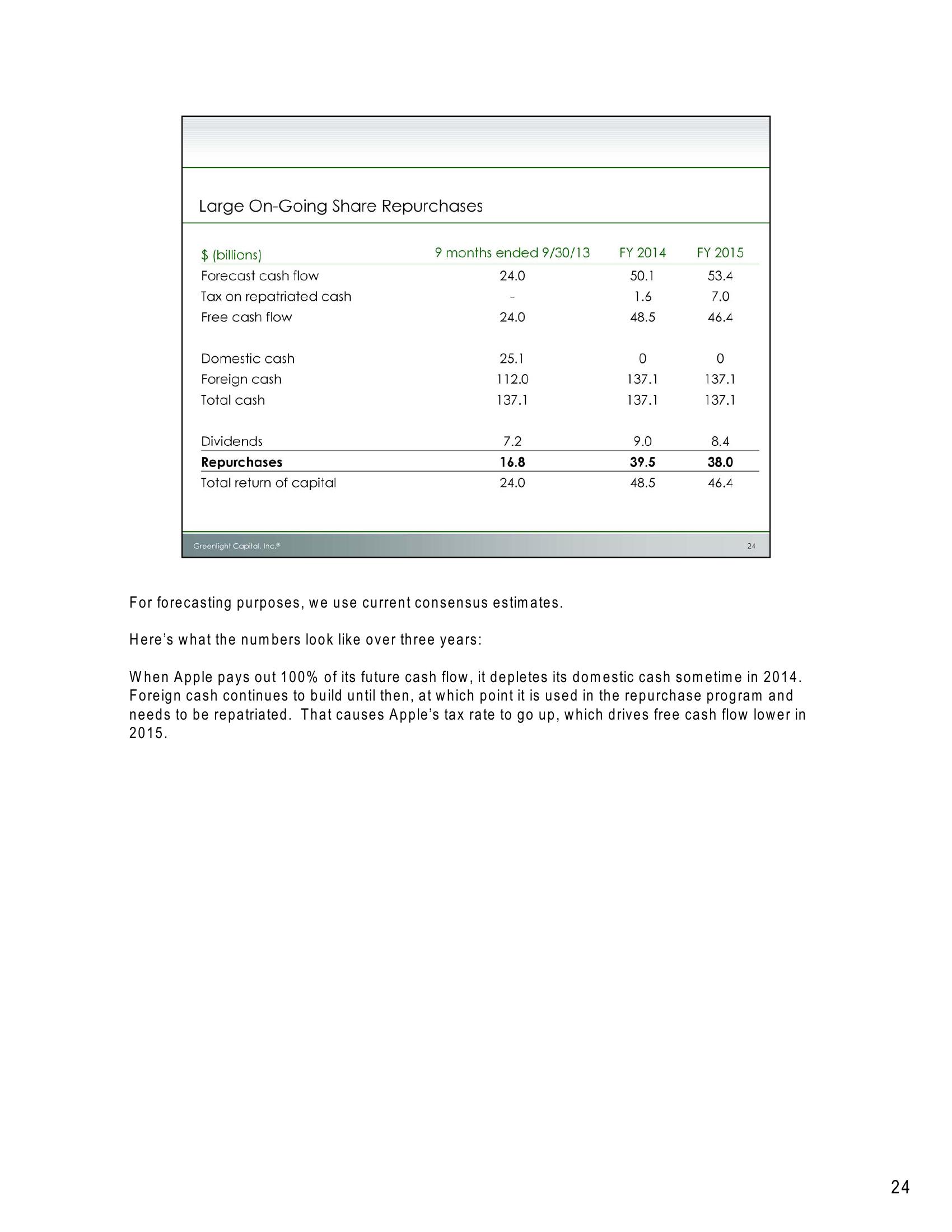

For forecasting purposes, we use current consensus estimates.

Here's what the numbers look like over three years:

When Apple pays out 100% of its future cash flow, it depletes its domestic cash sometime in 2014.

Foreign cash continues to build until then, at which point it is used in the repurchase program and

needs to be repatriated. That causes Apple's tax rate to go up, which drives free cash flow lower in

2015.

24View entire presentation