Apollo Global Management Investor Day Presentation Deck

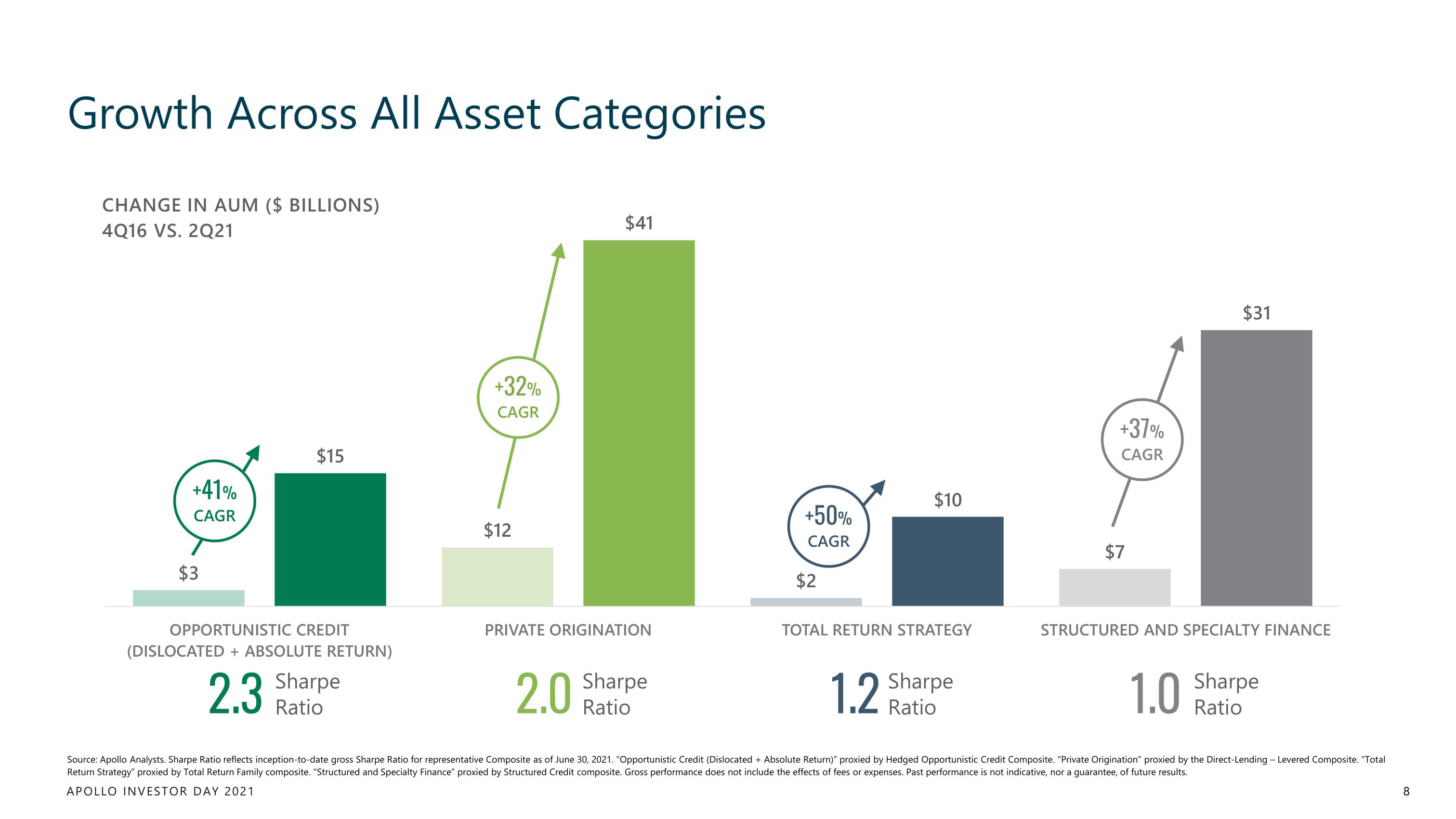

Growth Across All Asset Categories

CHANGE IN AUM ($ BILLIONS)

4Q16 VS. 2Q21

+41%

CAGR

$3

$15

OPPORTUNISTIC CREDIT

(DISLOCATED + ABSOLUTE RETURN)

2.3

Sharpe

Ratio

+32%

CAGR

$12

$41

PRIVATE ORIGINATION

2.0

Sharpe

Ratio

+50%

CAGR

$2

$10

TOTAL RETURN STRATEGY

1.2

Sharpe

Ratio

+37%

CAGR

$7

$31

STRUCTURED AND SPECIALTY FINANCE

1.0

Sharpe

Ratio

Source: Apollo Analysts. Sharpe Ratio reflects inception-to-date gross Sharpe Ratio for representative Composite as of June 30, 2021. "Opportunistic Credit (Dislocated + Absolute Return)" proxied by Hedged Opportunistic Credit Composite. "Private Origination" proxied by the Direct-Lending - Levered Composite. "Total

Return Strategy" proxied by Total Return Family composite. "Structured and Specialty Finance" proxied by Structured Credit composite. Gross performance does not include the effects of fees or expenses. Past performance is not indicative, nor a guarantee, of future results.

APOLLO INVESTOR DAY 2021

8View entire presentation