Enact IPO Presentation Deck

Enact | Investor Presentation

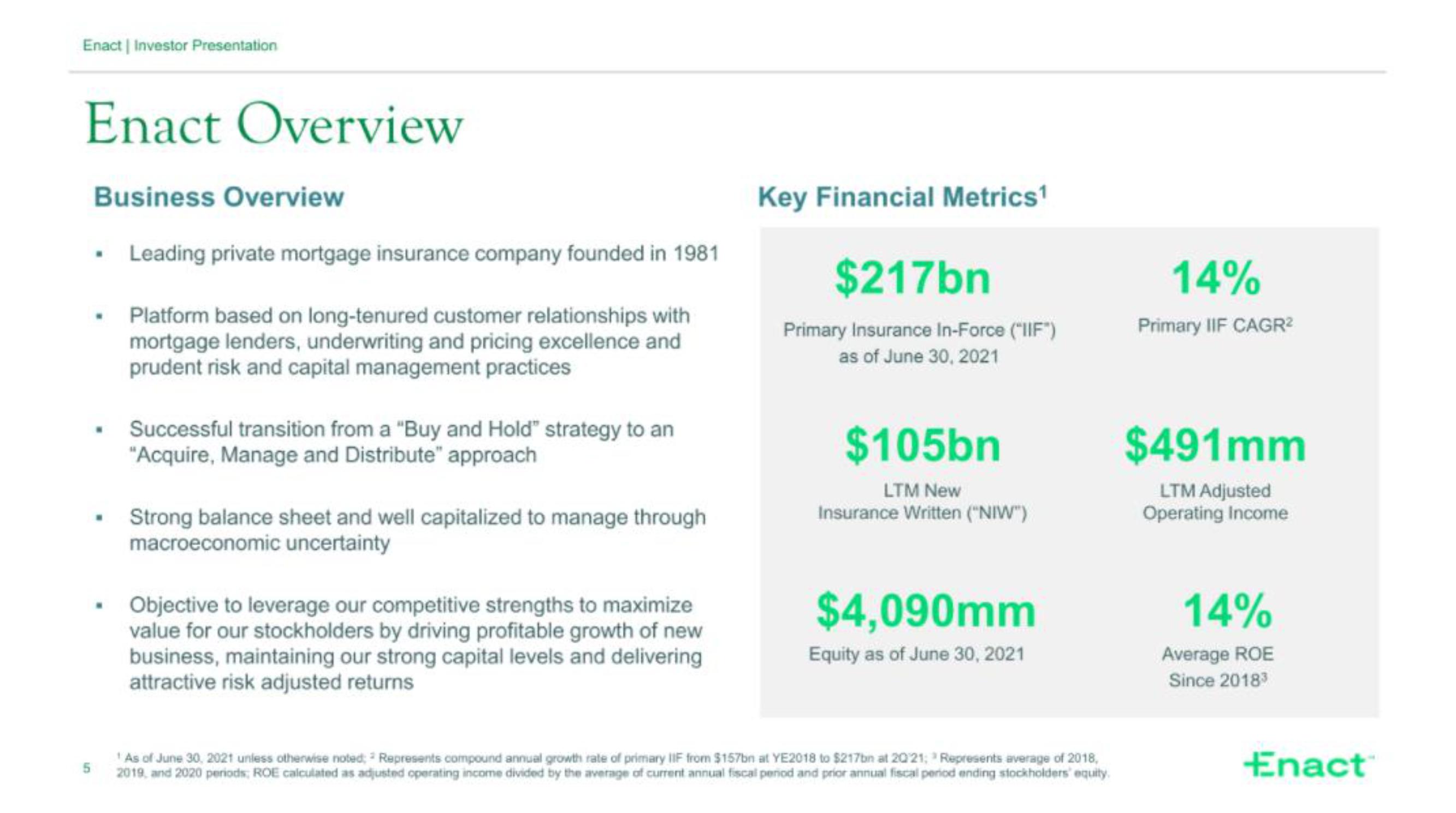

Enact Overview

Business Overview

.

• Leading private mortgage insurance company founded in 1981

5

Platform based on long-tenured customer relationships with

mortgage lenders, underwriting and pricing excellence and

prudent risk and capital management practices

Successful transition from a "Buy and Hold" strategy to an

"Acquire, Manage and Distribute" approach

Strong balance sheet and well capitalized to manage through

macroeconomic uncertainty

Objective to leverage our competitive strengths to maximize

value for our stockholders by driving profitable growth of new

business, maintaining our strong capital levels and delivering

attractive risk adjusted returns

Key Financial Metrics¹

$217bn

Primary Insurance In-Force ("IIF")

as of June 30, 2021

$105bn

LTM New

Insurance Written ("NIW")

$4,090mm

Equity as of June 30, 2021

As of June 30, 2021 unless otherwise noted; Represents compound annual growth rate of primary IIF from $157bn at YE2018 to $217bn at 2021; Represents average of 2018,

2019, and 2020 periods; ROE calculated as adjusted operating income divided by the average of current annual fiscal period and prior annual fiscal period ending stockholders' equity.

14%

Primary IIF CAGR²

$491mm

LTM Adjusted

Operating Income

14%

Average ROE

Since 20183

EnactView entire presentation