Credit Suisse Results Presentation Deck

Swiss Bank

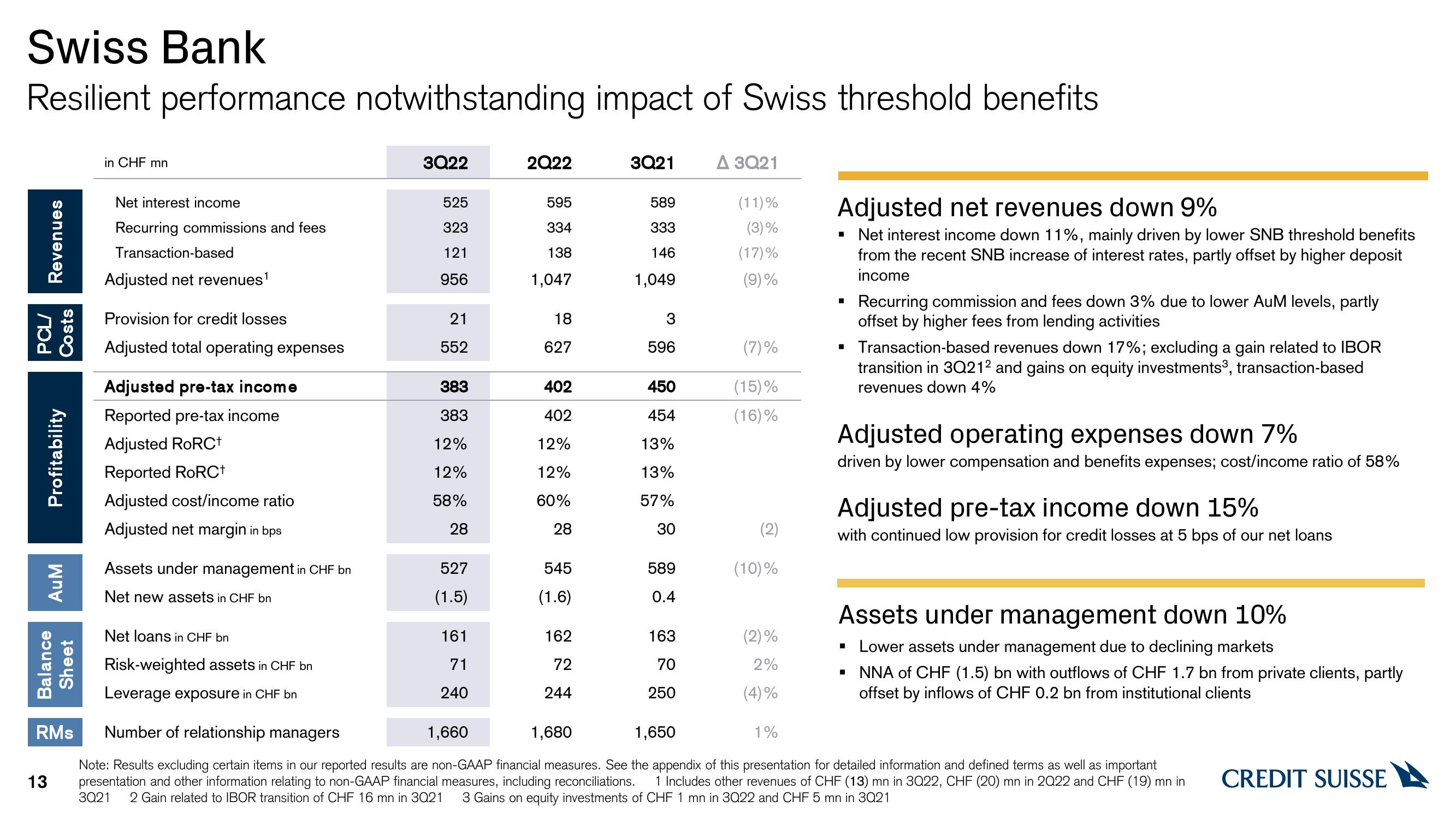

Resilient performance notwithstanding impact of Swiss threshold benefits

Revenues

PCL/

Costs

Profitability

AuM

Balance

Sheet

in CHF mn

13

Net interest income

Recurring commissions and fees

Transaction-based

Adjusted net revenues¹

Provision for credit losses

Adjusted total operating expenses

pre-tax income

Adjusted

Reported pre-tax income

Adjusted RoRC+

Reported RoRC+

Adjusted cost/income ratio

Adjusted net margin in bps

Assets under management in CHF bn

Net new assets in CHF bn

Net loans in CHF bn

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

3Q22

525

323

121

956

21

552

383

383

12%

12%

58%

28

527

(1.5)

161

71

240

2022

595

334

138

1,047

18

627

402

402

12%

12%

60%

28

545

(1.6)

162

72

244

3Q21

1,680

589

333

146

1,049

3

596

450

454

13%

13%

57%

30

589

0.4

163

70

250

A 3Q21

(11)%

(3)%

(17)%

(9)%

(7)%

(15)%

(16) %

(2)

(10)%

(2)%

2%

(4)%

Adjusted net revenues down 9%

▪ Net interest income down 11%, mainly driven by lower SNB threshold benefits

from the recent SNB increase of interest rates, partly offset by higher deposit

income

1%

Recurring commission and fees down 3% due to lower AuM levels, partly

offset by higher fees from lending activities

▪ Transaction-based revenues down 17%; excluding a gain related to IBOR

transition in 3Q212 and gains on equity investments³, transaction-based

revenues down 4%

Adjusted operating expenses down 7%

driven by lower compensation and benefits expenses; cost/income ratio of 58%

Adjusted pre-tax income down 15%

with continued low provision for credit losses at 5 bps of our net loans

RMs Number of relationship managers

1,660

1,650

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes other revenues of CHF (13) mn in 3Q22, CHF (20) mn in 2022 and CHF (19) mn in

3Q21 2 Gain related to IBOR transition of CHF 16 mn in 3Q21 3 Gains on equity investments of CHF 1 mn in 3022 and CHF 5 mn in 3Q21

Assets under management down 10%

Lower assets under management due to declining markets

▪NNA of CHF (1.5) bn with outflows of CHF 1.7 bn from private clients, partly

offset by inflows of CHF 0.2 bn from institutional clients

■

CREDIT SUISSEView entire presentation