Investor Presentation

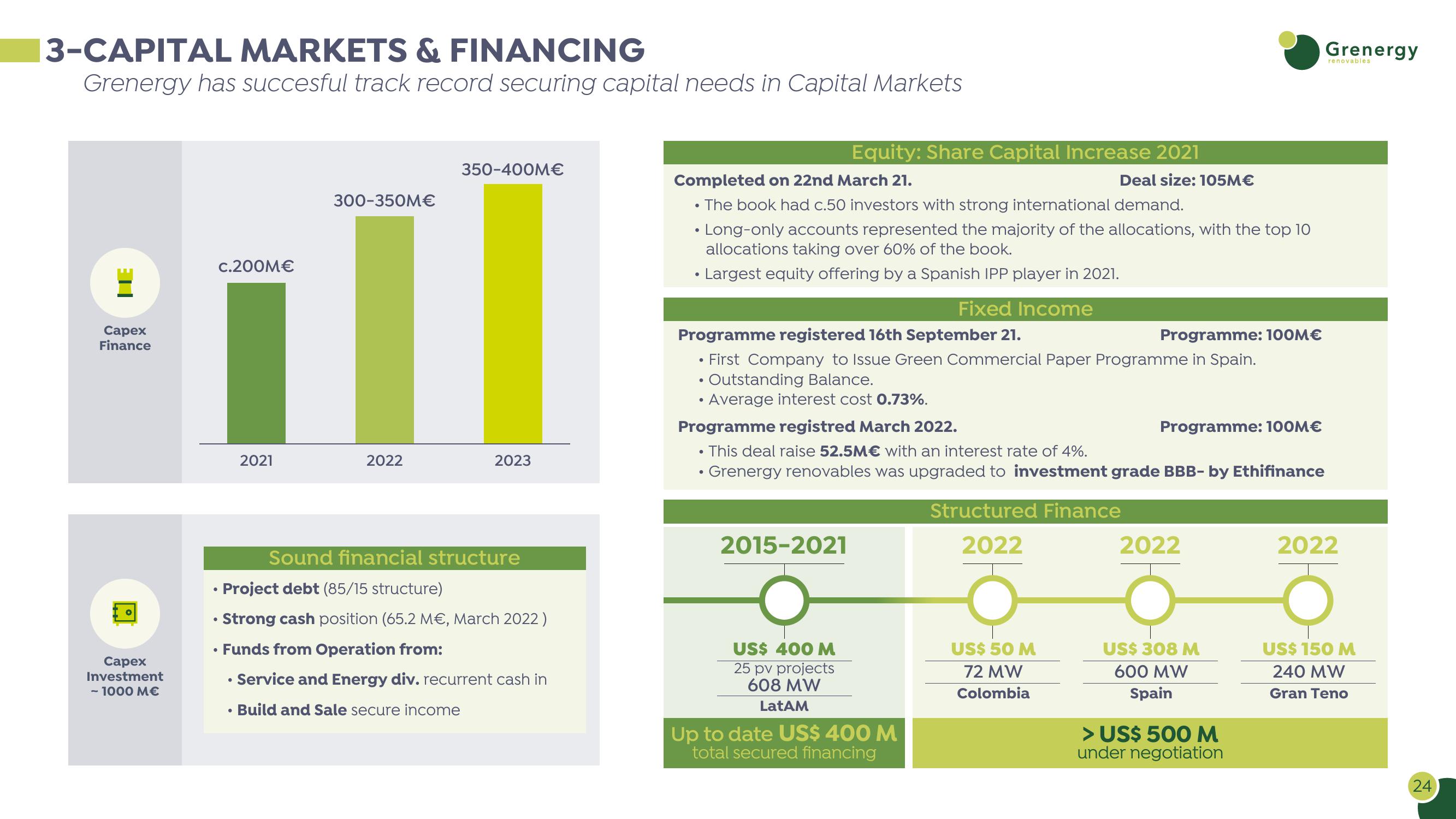

3-CAPITAL MARKETS & FINANCING

Grenergy has succesful track record securing capital needs in Capital Markets

LE

Capex

Finance

c.200M€

350-400M€

300-350M€

Equity: Share Capital Increase 2021

Deal size: 105M€

Completed on 22nd March 21.

The book had c.50 investors with strong international demand.

Long-only accounts represented the majority of the allocations, with the top 10

allocations taking over 60% of the book.

• Largest equity offering by a Spanish IPP player in 2021.

Fixed Income

Programme registered 16th September 21.

Programme: 100M€

First Company to Issue Green Commercial Paper Programme in Spain.

•

• Outstanding Balance.

• Average interest cost 0.73%.

Programme registred March 2022.

•

2021

2022

This deal raise 52.5M€ with an interest rate of 4%.

2023

Programme: 100M€

Grenergy renovables was upgraded to investment grade BBB- by Ethifinance

Structured Finance

2015-2021

2022

Capex

Investment

- 1000 M€

Sound financial structure

• Project debt (85/15 structure)

• Strong cash position (65.2 M€, March 2022)

• Funds from Operation from:

•

⚫ Service and Energy div. recurrent cash in

• Build and Sale secure income

25 pv projects

US$ 400 M

US$ 50 M

72 MW

Colombia

608 MW

LatAM

Up to date US$ 400 M

total secured financing

2022

2022

US$ 308 M

600 MW

Spain

> US$ 500 M

under negotiation

US$ 150 M

240 MW

Gran Teno

Grenergy

renovables

24View entire presentation