Zegna Investor Presentation Deck

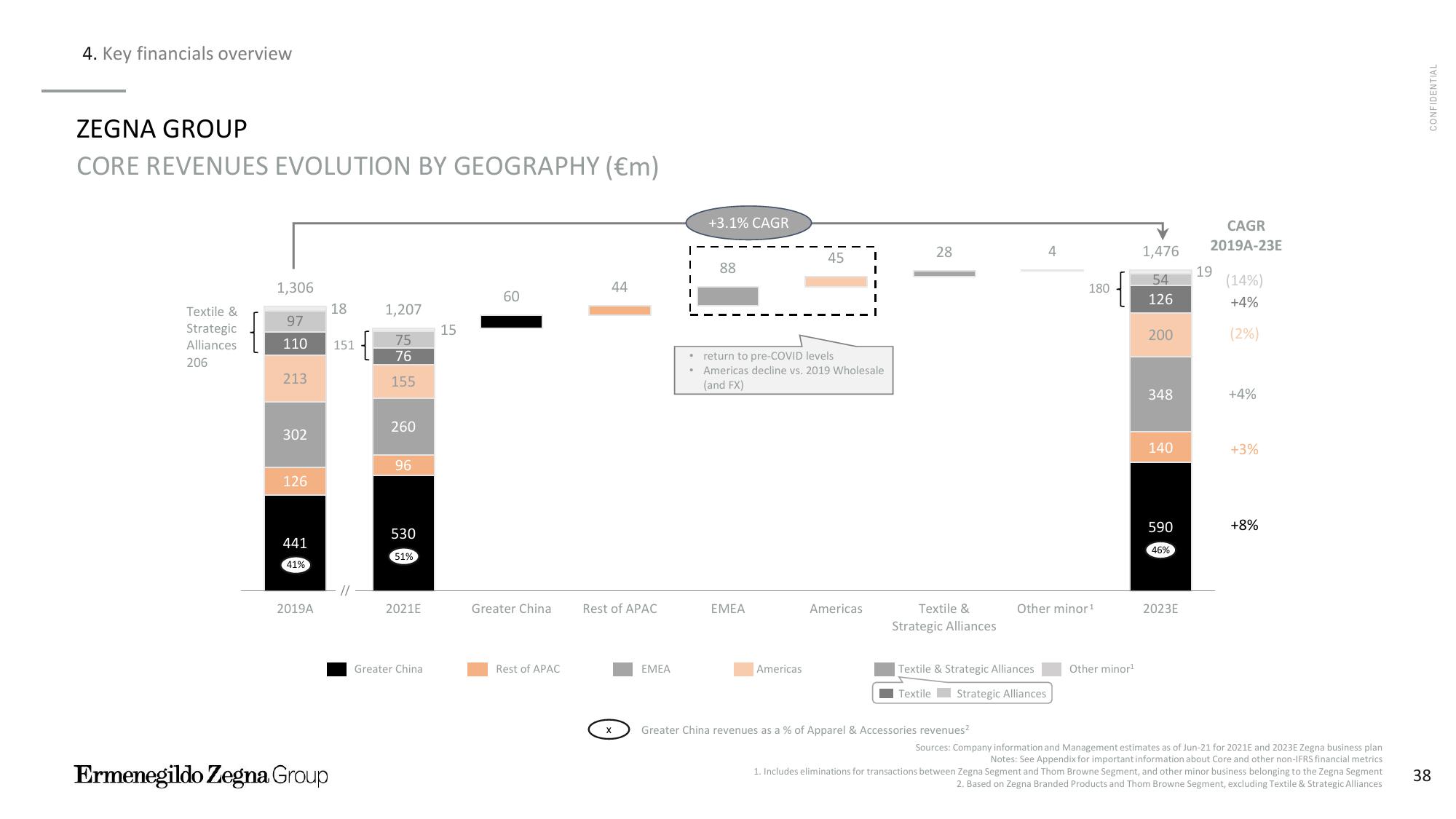

4. Key financials overview

ZEGNA GROUP

CORE REVENUES EVOLUTION BY GEOGRAPHY (€m)

Textile &

Strategic

Alliances

206

1,306

97

110 151

213

302

126

441

41%

2019A

Ermenegildo Zegna Group

18

//

1,207

75

76

155

260

96

530

51%

2021E

Greater China

15

60

Greater China

Rest of APAC

44

Rest of APAC

EMEA

1

I

+3.1% CAGR

•

88

return to pre-COVID levels

• Americas decline vs. 2019 Wholesale

(and FX)

EMEA

45

Americas

Americas

28

Textile &

Strategic Alliances

Textile & Strategic Alliances

Textile Strategic Alliances

Greater China revenues as a % of Apparel & Accessories revenues²

4

180

Other minor ¹

Other minor¹

1,476

54

126

200

348

140

590

46%

2023E

CAGR

2019A-23E

19

(14%)

+4%

(2%)

+4%

+3%

+8%

Sources: Company information and Management estimates as of Jun-21 for 2021E and 2023E Zegna business plan

Notes: See Appendix for important information about Core and other non-IFRS financial metrics

1. Includes eliminations for transactions between Zegna Segment and Thom Browne Segment, and other minor business belonging to the Zegna Segment

2. Based on Zegna Branded Products and Thom Browne Segment, excluding Textile & Strategic Alliances

CONFIDENTIAL

38View entire presentation