Hostess SPAC Presentation Deck

PAGE

18

($ in millions)

Net income (loss)

(1)

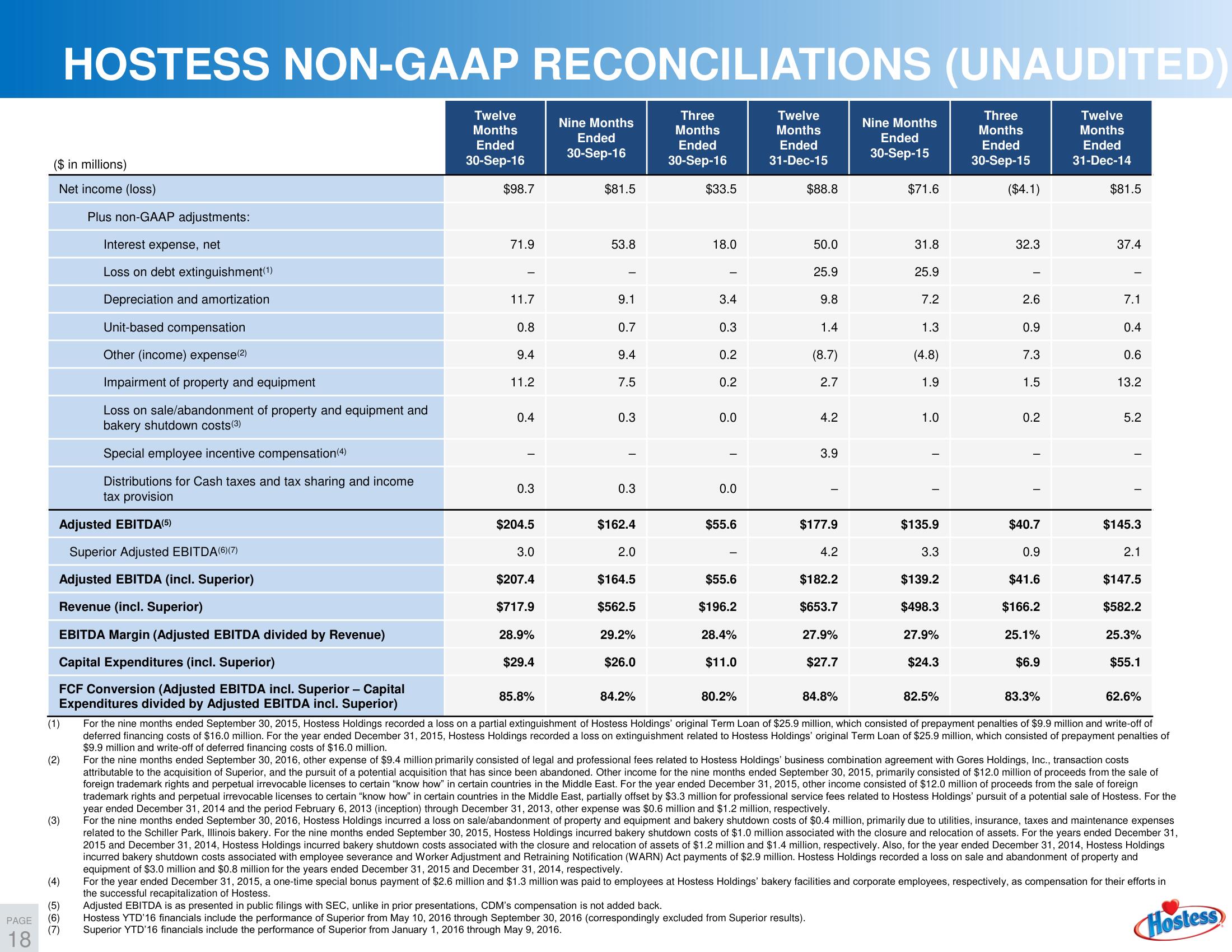

HOSTESS NON-GAAP RECONCILIATIONS (UNAUDITED)

Twelve

Months

Ended

31-Dec-14

Adjusted EBITDA(5)

Superior Adjusted EBITDA(6)(7)

(2)

(3)

Plus non-GAAP adjustments:

Interest expense, net

Loss on debt extinguishment(1)

Depreciation and amortization

Unit-based compensation

(4)

(5)

(6)

(7)

Other (income) expense(²)

Impairment of property and equipment

Loss on sale/abandonment of property and equipment and

bakery shutdown costs (³)

Special employee incentive compensation (4)

Distributions for Cash taxes and tax sharing and income

tax provision

Twelve

Months

Ended

30-Sep-16

$98.7

71.9

11.7

0.8

9.4

11.2

0.4

0.3

$204.5

3.0

$207.4

$717.9

28.9%

$29.4

Nine Months

Ended

30-Sep-16

85.8%

$81.5

53.8

9.1

0.7

9.4

7.5

0.3

0.3

$162.4

2.0

$164.5

$562.5

29.2%

$26.0

Three

Months

Ended

30-Sep-16

84.2%

$33.5

18.0

3.4

0.3

0.2

0.2

0.0

0.0

$55.6

$55.6

$196.2

28.4%

$11.0

Twelve

Months

Ended

31-Dec-15

$88.8

50.0

25.9

9.8

1.4

(8.7)

2.7

4.2

3.9

$177.9

4.2

$182.2

$653.7

27.9%

$27.7

Nine Months

Ended

30-Sep-15

84.8%

$71.6

31.8

25.9

7.2

1.3

(4.8)

1.9

1.0

$135.9

3.3

$139.2

$498.3

27.9%

$24.3

Three

Months

Ended

30-Sep-15

82.5%

($4.1)

32.3

2.6

0.9

7.3

Adjusted EBITDA (incl. Superior)

Revenue (incl. Superior)

EBITDA Margin (Adjusted EBITDA divided by Revenue)

Capital Expenditures (incl. Superior)

80.2%

FCF Conversion (Adjusted EBITDA incl. Superior - Capital

Expenditures divided by Adjusted EBITDA incl. Superior)

For the nine months ended September 30, 2015, Hostess Holdings recorded a loss on a partial extinguishment of Hostess Holdings' original Term Loan of $25.9 million, which consisted of prepayment penalties of $9.9 million and write-off of

deferred financing costs of $16.0 million. For the year ended December 31, 2015, Hostess Holdings recorded a loss on extinguishment related to Hostess Holdings' original Term Loan of $25.9 million, which consisted of prepayment penalties of

$9.9 million and write-off of deferred financing costs of $16.0 million.

For the nine months ended September 30, 2016, other expense of $9.4 million primarily consisted of legal and professional fees related to Hostess Holdings' business combination agreement with Gores Holdings, Inc., transaction costs

attributable to the acquisition of Superior, and the pursuit of a potential acquisition that has since been abandoned. Other income for the nine months ended September 30, 2015, primarily consisted of $12.0 million of proceeds from the sale of

foreign trademark rights and perpetual irrevocable licenses to certain "know how" in certain countries in the Middle East. For the year ended December 31, 2015, other income consisted of $12.0 million of proceeds from the sale of foreign

trademark rights and perpetual irrevocable licenses to certain "know how" in certain countries in the Middle East, partially offset by $3.3 million for professional service fees related to Hostess Holdings' pursuit of a potential sale of Hostess. For the

year ended December 31, 2014 and the period February 6, 2013 (inception) through December 31, 2013, other expense was $0.6 million and $1.2 million, respectively.

For the nine months ended September 30, 2016, Hostess Holdings incurred a loss on sale/abandonment of property and equipment and bakery shutdown costs of $0.4 million, primarily due to utilities, insurance, taxes and maintenance expenses

related to the Schiller Park, Illinois bakery. For the nine months ended September 30, 2015, Hostess Holdings incurred bakery shutdown costs of $1.0 million associated with the closure and relocation of assets. For the years ended December 31,

2015 and December 31, 2014, Hostess Holdings incurred bakery shutdown costs associated with the closure and relocation of assets of $1.2 million and $1.4 million, respectively. Also, for the year ended December 31, 2014, Hostess Holdings

incurred bakery shutdown costs associated with employee severance and Worker Adjustment and Retraining Notification (WARN) Act payments of $2.9 million. Hostess Holdings recorded a loss on sale and abandonment of property and

equipment of $3.0 million and $0.8 million for the years ended December 31, 2015 and December 31, 2014, respectively.

For the year ended December 31, 2015, a one-time special bonus payment of $2.6 million and $1.3 million was paid to employees at Hostess Holdings' bakery facilities and corporate employees, respectively, as compensation for their efforts in

the successful recapitalization of Hostess.

Adjusted EBITDA is as presented in public filings with SEC, unlike in prior presentations, CDM's compensation is not added back.

Hostess YTD'16 financials include the performance of Superior from May 10, 2016 through September 30, 2016 (correspondingly excluded from Superior results).

Superior YTD'16 financials include the performance of Superior from January 1, 2016 through May 9, 2016.

Hostess

1.5

0.2

$40.7

0.9

$41.6

$166.2

25.1%

$6.9

$81.5

83.3%

37.4

7.1

0.4

0.6

13.2

5.2

$145.3

2.1

$147.5

$582.2

25.3%

$55.1

62.6%View entire presentation