Mondee Investor Presentation Deck

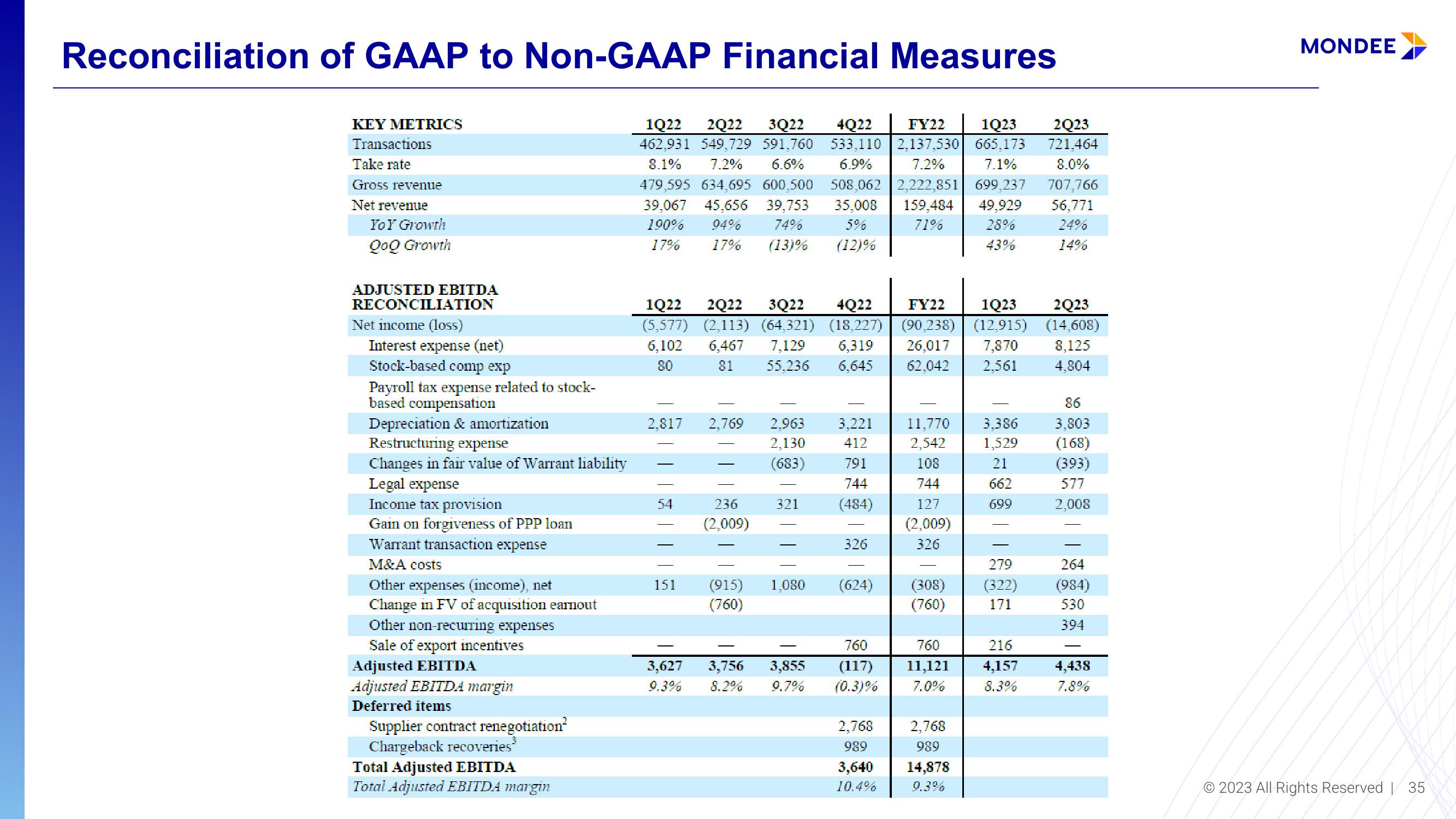

Reconciliation of GAAP to Non-GAAP Financial Measures

1Q22 2Q22 3Q22 4Q22 FY22 1Q23 2Q23

462,931 549,729 591,760 533,110 2,137,530 665,173 721.464

8.1% 7.2% 6.6%

6.9%

7.2%

7.1%

8.0%

479,595 634,695 600,500 508,062 2,222,851 699,237 707,766

39,067 45,656 39,753 35,008 159,484 49,929 56,771

190% 94% 74%

71%

28%

24%

17% 17% (13)% (12)%

43%

14%

KEY METRICS

Transactions

Take rate

Gross revenue

Net revenue

Yo Y Growth

QoQ Growth

ADJUSTED EBITDA

RECONCILIATION

Net income (loss)

Interest expense (net)

Stock-based comp exp

Payroll tax expense related to stock-

based compensation

Depreciation & amortization

Restructuring expense

Changes in fair value of Warrant liability

Legal expense

Income tax provision

Gain on forgiveness of PPP loan

Warrant transaction expense

M&A costs

Other expenses (income), net

Change in FV of acquisition earnout

Other non-recurring expenses

Sale of export incentives

Adjusted EBITDA

Adjusted EBITDA margin

Deferred items

Supplier contract renegotiation²

Chargeback recoveries

Total Adjusted EBITDA

Total Adjusted EBITDA margin

FY22

1Q22 2Q22 3Q22 4Q22

1Q23

(5,577) (2,113) (64,321) (18,227)| (90,238) (12,915)

6,102 6,467 7,129 6,319

80

81 55,236 6,645

26,017 7,870

62,042 2,561

2,817 2,769

||||||5

54

236

(2,009)

| |

2,963

2,130

(683)

321

3,627 3,756

9.3%

1

151 (915) 1,080

(760)

3,221

412

791

744

(484)

326

(624)

760

(117)

3,855

8.2% 9.7% (0.3)%

2,768

989

3,640

10.4%

11,770

2,542

108

744

127

(2,009)

326

(308)

(760)

760

11,121

7.0%

2,768

989

14,878

9.3%

3,386

1,529

21

662

699

279

(322)

171

216

4,157

8.3%

2Q23

(14,608)

8,125

4,804

86

3.803

(168)

(393)

577

2,008

264

(984)

530

394

4,438

7.8%

MONDEE

© 2023 All Rights Reserved | 35View entire presentation