J.P.Morgan Investment Banking Pitch Book

APPENDIX

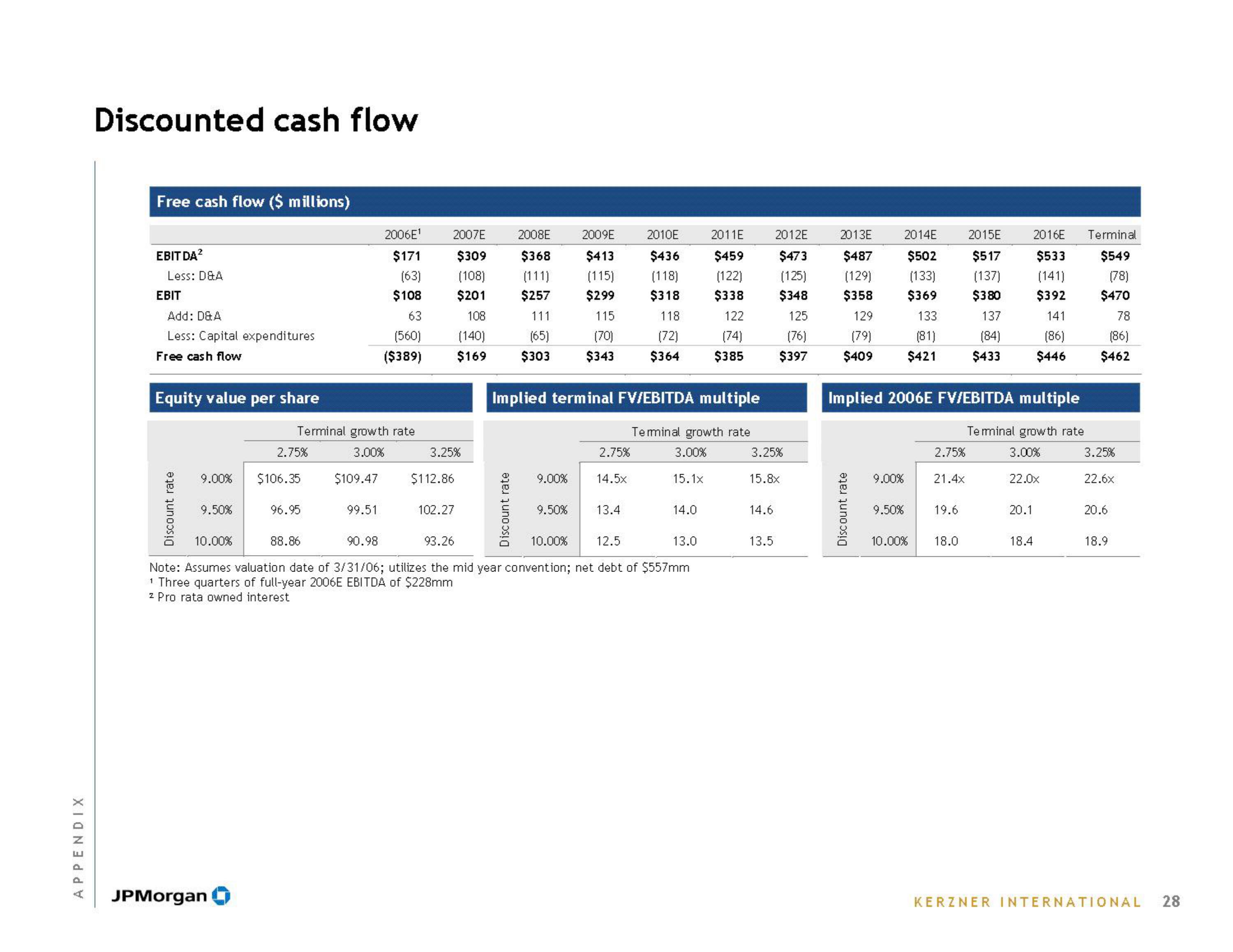

Discounted cash flow

Free cash flow ($ millions)

EBIT DA²

Less: D&A

EBIT

Add: D&A

Less: Capital expenditures

Free cash flow

Equity value per share

Discount rate

9.00%

9.50%

JPMorgan

Terminal growth rate

3.00%

2.75%

$106.35

96.95

$109.47

88.86

2006E¹

$171

(63)

$108

63

(560)

($389)

99.51

2007E

$309

(108)

$201

108

(140)

$169

3.25%

$112.86

102.27

2008E

$368

(111)

$257

111

(65)

$303

Discount rate

9.00%

2009E

$413

(115)

$299

115

(70)

$343

9.50%

Implied terminal FV/EBITDA multiple

Terminal growth rate

3.00%

2.75%

14.5×

2010E

$436

(118)

$318

118

(72)

$364

13.4

15.1x

10.00%

90.98

93.26

10.00%

12.5

Note: Assumes valuation date of 3/31/06; utilizes the mid year convention; net debt of $557mm

1 Three quarters of full-year 2006E EBITDA of $228mm

2 Pro rata owned interest

14.0

2011E

$459

(122)

$338

122

13.0

(74)

$385

3.25%

15.8x

14.6

2012E

$473

(125)

$348

125

(76)

$397

13.5

2013E

$487

(129)

$358

129

(79)

$409

Discount rate

9.00%

2014E

$502

(133)

$369

133

(81)

$421

Implied 2006E FV/EBITDA multiple

Terminal growth rate

3.00%

22.0x

9.50%

10.00%

2.75%

21.4x

19.6

2015E

$517

(137)

$380

137

(84)

$433

18.0

2016E

$533

(141)

$392

141

(86)

$446

20.1

18.4

Terminal

$549

(78)

$470

78

(86)

$462

3.25%

22.6x

20.6

18.9

KERZNER INTERNATIONAL

28View entire presentation