IGI SPAC Presentation Deck

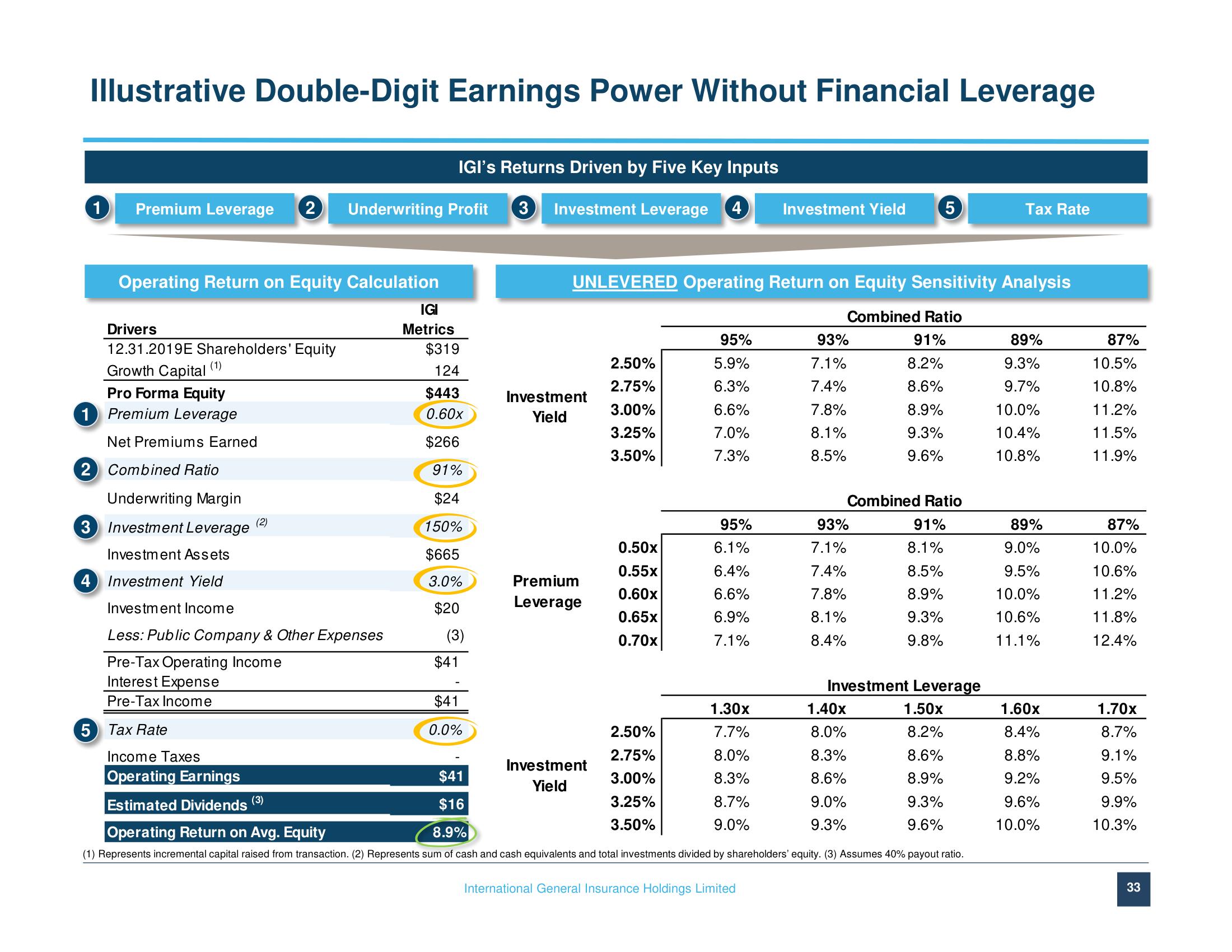

Illustrative Double-Digit Earnings Power Without Financial Leverage

1

IGI's Returns Driven by Five Key Inputs

Premium Leverage 2 Underwriting Profit 3 Investment Leverage 4

Operating Return on Equity Calculation

Drivers

12.31.2019E Shareholders' Equity

Growth Capital (1)

Pro Forma Equity

1 Premium Leverage

Net Premiums Earned

2 Combined Ratio

Underwriting Margin

3 Investment Leverage

Investment Assets

4 Investment Yield

Investment Income

(2)

Less: Public Company & Other Expenses

Pre-Tax Operating Income

Interest Expense

Pre-Tax Income

5 Tax Rate

IGI

Metrics

(3)

$319

124

$443

0.60x

$266

91%

$24

150%

$665

3.0%

$20

(3)

$41

$41

0.0%

Investment

Yield

Premium

Leverage

UNLEVERED Operating Return on Equity Sensitivity Analysis

Combined Ratio

91%

8.2%

8.6%

8.9%

9.3%

9.6%

2.50%

2.75%

3.00%

3.25%

3.50%

Investment

Yield

0.50x

0.55x

0.60x

0.65x

0.70x

2.50%

2.75%

3.00%

3.25%

3.50%

95%

5.9%

6.3%

6.6%

7.0%

7.3%

95%

6.1%

6.4%

6.6%

6.9%

7.1%

1.30x

7.7%

8.0%

8.3%

Investment Yield

8.7%

9.0%

International General Insurance Holdings Limited

93%

7.1%

7.4%

7.8%

8.1%

8.5%

5

93%

7.1%

7.4%

7.8%

8.1%

8.4%

Income Taxes

Operating Earnings

$41

Estimated Dividends

$16

8.9%

Operating Return on Avg. Equity

(1) Represents incremental capital raised from transaction. (2) Represents sum of cash and cash equivalents and total investments divided by shareholders' equity. (3) Assumes 40% payout ratio.

Combined Ratio

91%

8.1%

8.5%

8.9%

9.3%

9.8%

1.40x

8.0%

8.3%

8.6%

9.0%

9.3%

Investment Leverage

1.50x

8.2%

8.6%

8.9%

9.3%

9.6%

Tax Rate

89%

9.3%

9.7%

10.0%

10.4%

10.8%

89%

9.0%

9.5%

10.0%

10.6%

11.1%

1.60x

8.4%

8.8%

9.2%

9.6%

10.0%

87%

10.5%

10.8%

11.2%

11.5%

11.9%

87%

10.0%

10.6%

11.2%

11.8%

12.4%

1.70x

8.7%

9.1%

9.5%

9.9%

10.3%

33View entire presentation