DraftKings Investor Day Presentation Deck

Billions of Dollars

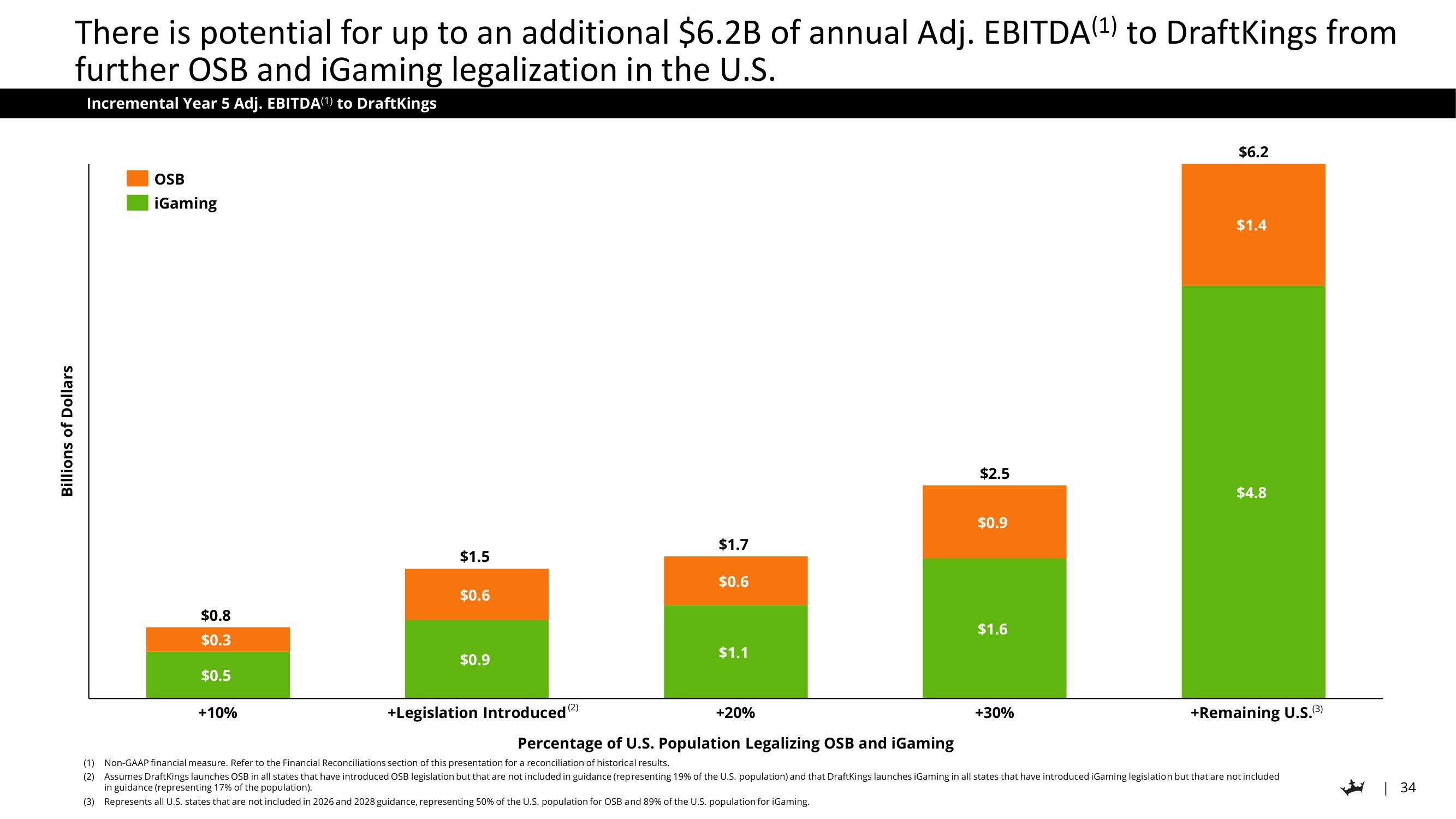

There is potential for up to an additional $6.2B of annual Adj. EBITDA (¹) to DraftKings from

further OSB and iGaming legalization in the U.S.

Incremental Year 5 Adj. EBITDA(1) to DraftKings

OSB

iGaming

$0.8

$0.3

$0.5

+10%

$1.5

$0.6

$0.9

+Legislation Introduced (2)

$1.7

$0.6

$1.1

+20%

$2.5

$0.9

$1.6

+30%

$6.2

$1.4

$4.8

+Remaining U.S.(³)

Percentage of U.S. Population Legalizing OSB and iGaming

(1) Non-GAAP financial measure. Refer to the Financial Reconciliations section of this presentation for a reconciliation of historical results.

(2) Assumes DraftKings launches OSB in all states that have introduced OSB legislation but that are not included in guidance (representing 19% of the U.S. population) and that DraftKings launches iGaming in all states that have introduced iGaming legislation but that are not included

in guidance (representing 17% of the population).

(3) Represents all U.S. states that are not included in 2026 and 2028 guidance, representing 50% of the U.S. population for OSB and 89% of the U.S. population for iGaming.

| 34View entire presentation