Allwyn Results Presentation Deck

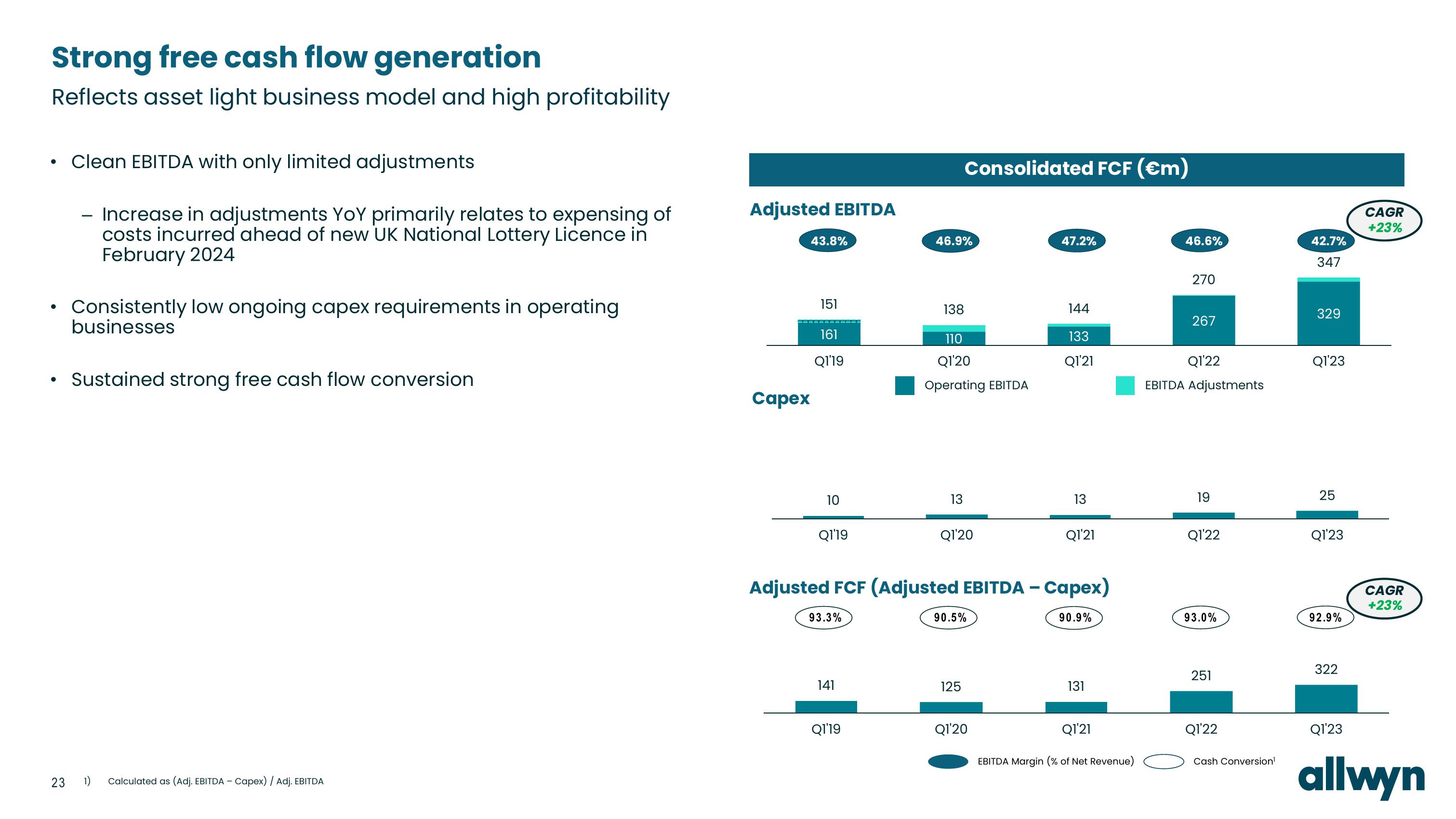

Strong free cash flow generation

Reflects asset light business model and high profitability

●

●

●

Clean EBITDA with only limited adjustments

- Increase in adjustments YoY primarily relates to expensing of

costs incurred ahead of new UK National Lottery Licence in

February 2024

Consistently low ongoing capex requirements in operating

businesses

Sustained strong free cash flow conversion

23 1)

Calculated as (Adj. EBITDA - Capex) / Adj. EBITDA

Adjusted EBITDA

43.8%

Capex

151

161

Q1'19

10

Q1'19

93.3%

141

Q1'19

46.9%

138

Consolidated FCF (€m)

110

Q1'20

Operating EBITDA

13

Q1'20

Adjusted FCF (Adjusted EBITDA - Capex)

90.9%

90.5%

125

47.2%

Q1'20

144

133

Q1'21

13

Q1'21

131

Q1'21

EBITDA Margin (% of Net Revenue)

46.6%

270

267

Q1'22

EBITDA Adjustments

19

Q1'22

93.0%

251

Q1'22

Cash Conversion¹

42.7%

347

329

Q1'23

25

Q1'23

92.9%

322

Q1'23

CAGR

+23%

CAGR

+23%

allwynView entire presentation