Experian ESG Presentation Deck

Executive Summary

68

Improving Financial Health

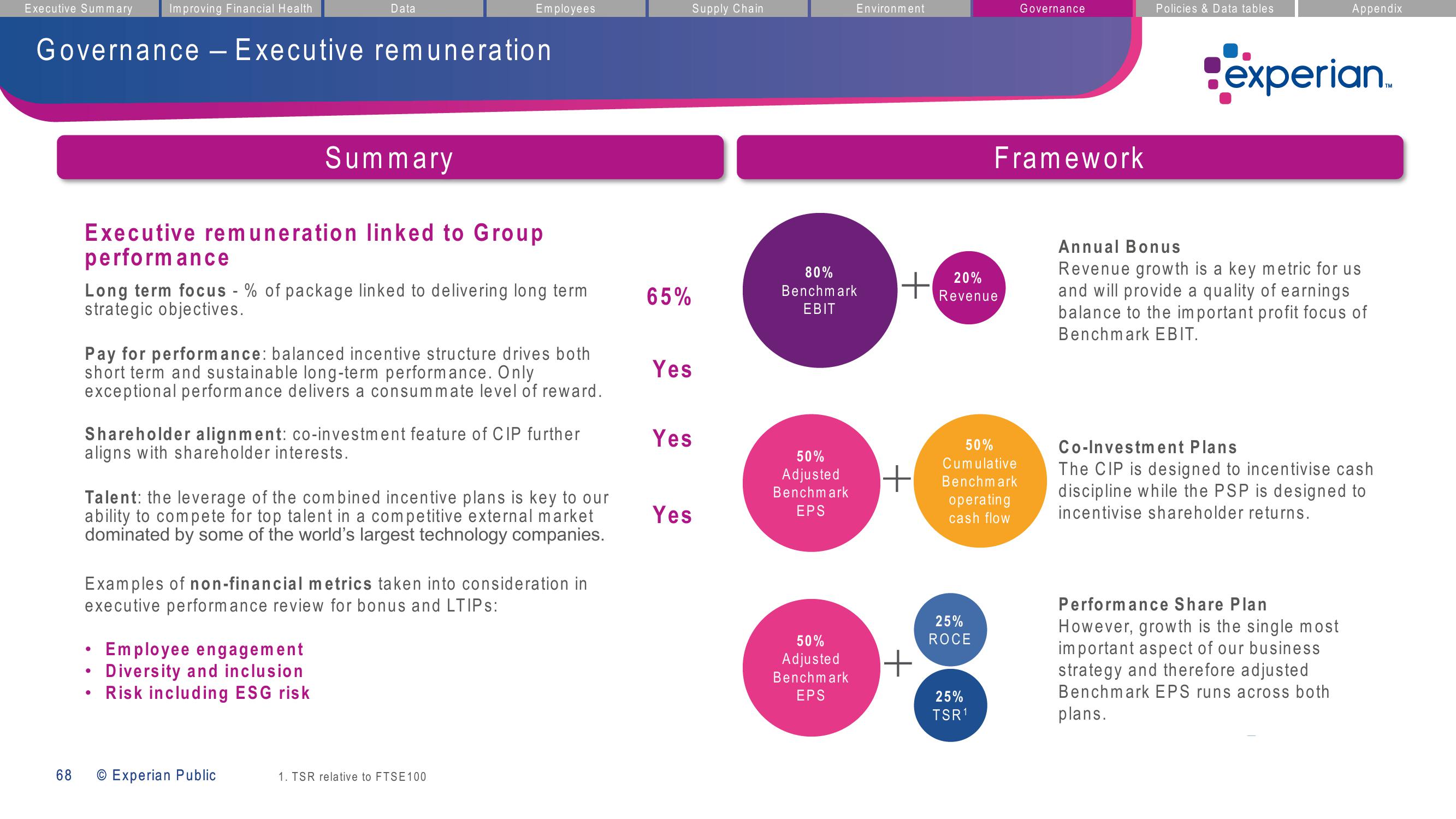

Governance - Executive remuneration

Data

Summary

Executive remuneration linked to Group

performance

Long term focus - % of package linked to delivering long term

strategic objectives.

Employees

Pay for performance: balanced incentive structure drives both

short term and sustainable long-term performance. Only

exceptional performance delivers a consummate level of reward.

Shareholder alignment: co-investment feature of CIP further

aligns with shareholder interests.

●

Talent: the leverage of the combined incentive plans is key to our

ability to compete for top talent in a competitive external market

dominated by some of the world's largest technology companies.

Examples of non-financial metrics taken into consideration in

executive performance review for bonus and LTIPS:

Employee engagement

Diversity and inclusion

Risk including ESG risk

O Experian Public

1. TSR relative to FTSE 100

65%

Supply Chain

Yes

Yes

Yes

80%

Benchmark

EBIT

50%

Adjusted

Benchmark

EPS

Environment

50%

Adjusted

Benchmark

EPS

+

+

+

20%

Revenue

25%

ROCE

Governance

Framework

50%

Cumulative

Benchmark

operating

cash flow

25%

TSR1

Policies & Data tables

Appendix

experian

Annual Bonus

Revenue growth is a key metric for us

and will provide a quality of earnings.

balance to the important profit focus of

Benchmark EBIT.

Co-Investment Plans

The CIP is designed to incentivise cash

discipline while the PSP is designed to

incentivise shareholder returns.

Performance Share Plan

However, growth is the single most

important aspect of our business

strategy and therefore adjusted

Benchmark EPS runs across both

plans.

TMView entire presentation