Zegna Results Presentation Deck

FY 2021 PROFITABILITY & CASH: DYNAMIC PROGRESS

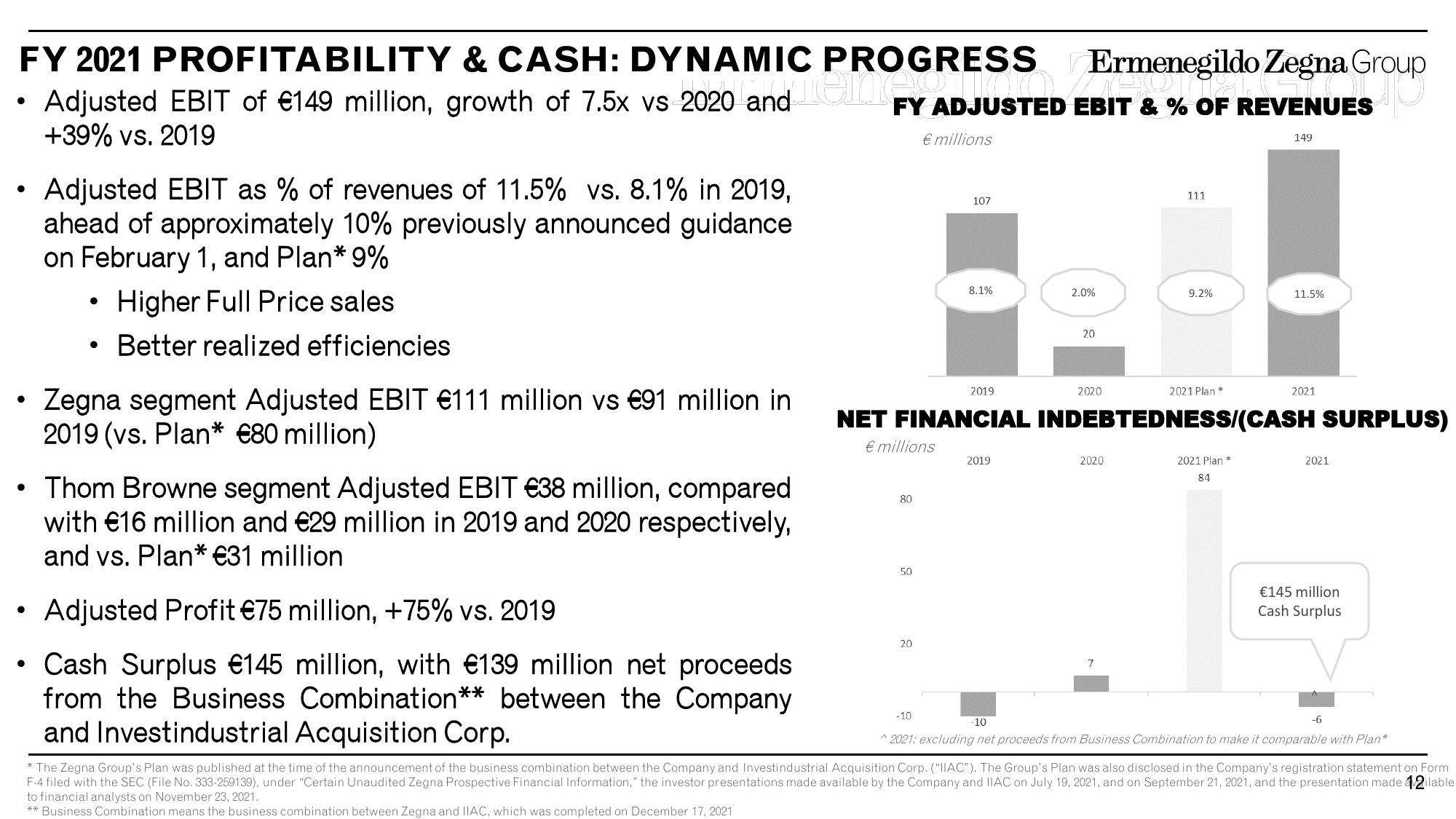

Adjusted EBIT of €149 million, growth of 7.5x vs 2020 and cont

+39% vs. 2019

Adjusted EBIT as % of revenues of 11.5% vs. 8.1% in 2019,

ahead of approximately 10% previously announced guidance

on February 1, and Plan* 9%

• Higher Full Price sales

Better realized efficiencies

●

Zegna segment Adjusted EBIT €111 million vs €91 million in

2019 (vs. Plan* €80 million)

Thom Browne segment Adjusted EBIT €38 million, compared

with €16 million and €29 million in 2019 and 2020 respectively,

and vs. Plan* €31 million

Adjusted Profit €75 million, +75% vs. 2019

• Cash Surplus €145 million, with €139 million net proceeds

from the Business Combination** between the Company

and Investindustrial Acquisition Corp.

FY ADJUSTED EBIT & % OF REVENUES

€ millions

80

50

20

107

-10

8.1%

2019

Ermenegildo Zegna Group

Dongh

2019

2.0%

20

2020

2021 Plan *

NET FINANCIAL INDEBTEDNESS/(CASH SURPLUS)

€ millions

2020

111

7

9.2%

149

2021 Plan *

84

11.5%

2021

2021

€145 million.

Cash Surplus

-6

-10

^2021: excluding net proceeds from Business Combination to make it comparable with Plan*

* The Zegna Group's Plan was published at the time of the announcement of the business combination between the Company and Investindustrial Acquisition Corp. ("IIAC"). The Group's Plan was also disclosed in the Company's registration statement on Form

F-4 filed with the SEC (File No. 333-259139), under "Certain Unaudited Zegna Prospective Financial Information," the investor presentations made available by the Company and IIAC on July 19, 2021, and on September 21, 2021, and the presentation made 12ilable.

to financial analysts on November 23, 2021.

** Business Combination means the business combination between Zegna and IIAC, which was completed on December 17, 2021View entire presentation