Rocket Companies Investor Presentation Deck

Endnotes

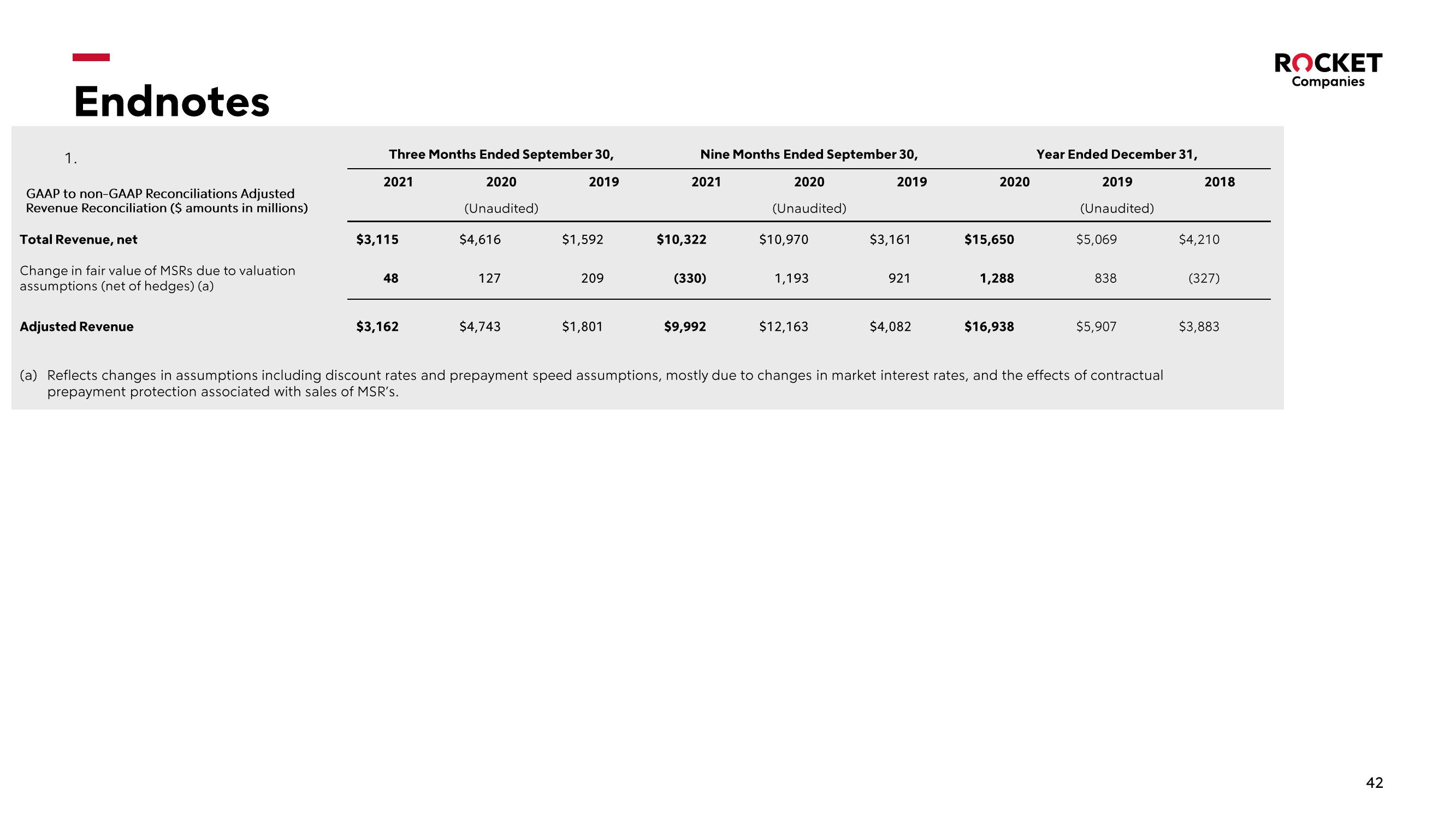

1.

GAAP to non-GAAP Reconciliations Adjusted

Revenue Reconciliation ($ amounts in millions)

Total Revenue, net

Change in fair value of MSRs due to valuation

assumptions (net of hedges) (a)

Adjusted Revenue

Three Months Ended September 30,

2020

2019

2021

$3,115

48

$3,162

(Unaudited)

$4,616

127

$4,743

$1,592

209

$1,801

Nine Months Ended September 30,

2021

2019

2020

(Unaudited)

$10,322

(330)

$9,992

$10,970

1,193

$12,163

$3,161

921

$4,082

2020

$15,650

1,288

$16,938

Year Ended December 31,

2019

(Unaudited)

$5,069

838

$5,907

(a) Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, and the effects of contractual

prepayment protection associated with sales of MSR's.

2018

$4,210

(327)

$3,883

ROCKET

Companies

42View entire presentation