flyExclusive SPAC Presentation Deck

SUMMARY P&L

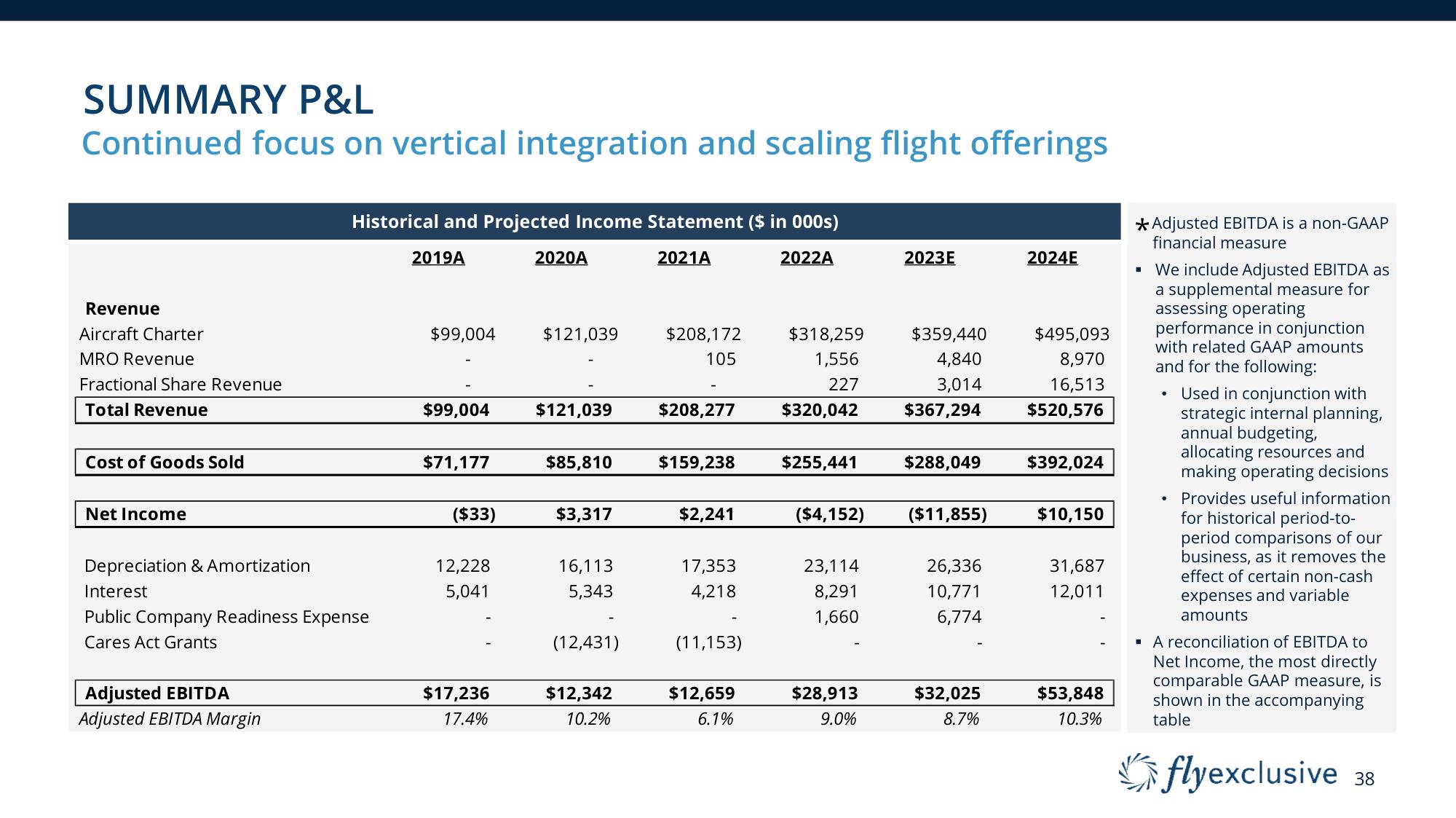

Continued focus on vertical integration and scaling flight offerings

Revenue

Aircraft Charter

MRO Revenue

Fractional Share Revenue

Total Revenue

Cost of Goods Sold

Net Income

Historical and Projected Income Statement ($ in 000s)

2021A

2022A

Depreciation & Amortization

Interest

Public Company Readiness Expense

Cares Act Grants

Adjusted EBITDA

Adjusted EBITDA Margin

2019A

$99,004

$99,004

$71,177

($33)

12,228

5,041

$17,236

17.4%

2020A

$121,039

$121,039

$85,810

$3,317

16,113

5,343

(12,431)

$12,342

10.2%

$208,172

105

$208,277

$159,238

$2,241

17,353

4,218

(11,153)

$12,659

6.1%

$318,259

1,556

227

$320,042

$255,441

23,114

8,291

1,660

2023E

$28,913

9.0%

$359,440

4,840

3,014

$367,294

($4,152) ($11,855)

$288,049

26,336

10,771

6,774

$32,025

8.7%

2024E

$495,093

8,970

16,513

$520,576

$392,024

$10,150

31,687

12,011

$53,848

10.3%

*Adjusted EBITDA is a non-GAAP

financial measure

I

We include Adjusted EBITDA as

a supplemental measure for

assessing operating

performance in conjunction

with related GAAP amounts

and for the following:

●

Used in conjunction with

strategic internal planning,

annual budgeting,

allocating resources and

making operating decisions

Provides useful information

for historical period-to-

period comparisons of our

business, as it removes the

effect of certain non-cash

expenses and variable

amounts

▪ A reconciliation of EBITDA to

Net Income, the most directly

comparable GAAP measure, is

shown in the accompanying

table

flyexclusive 38View entire presentation