Forbes SPAC Presentation Deck

Proposed Transaction Summary

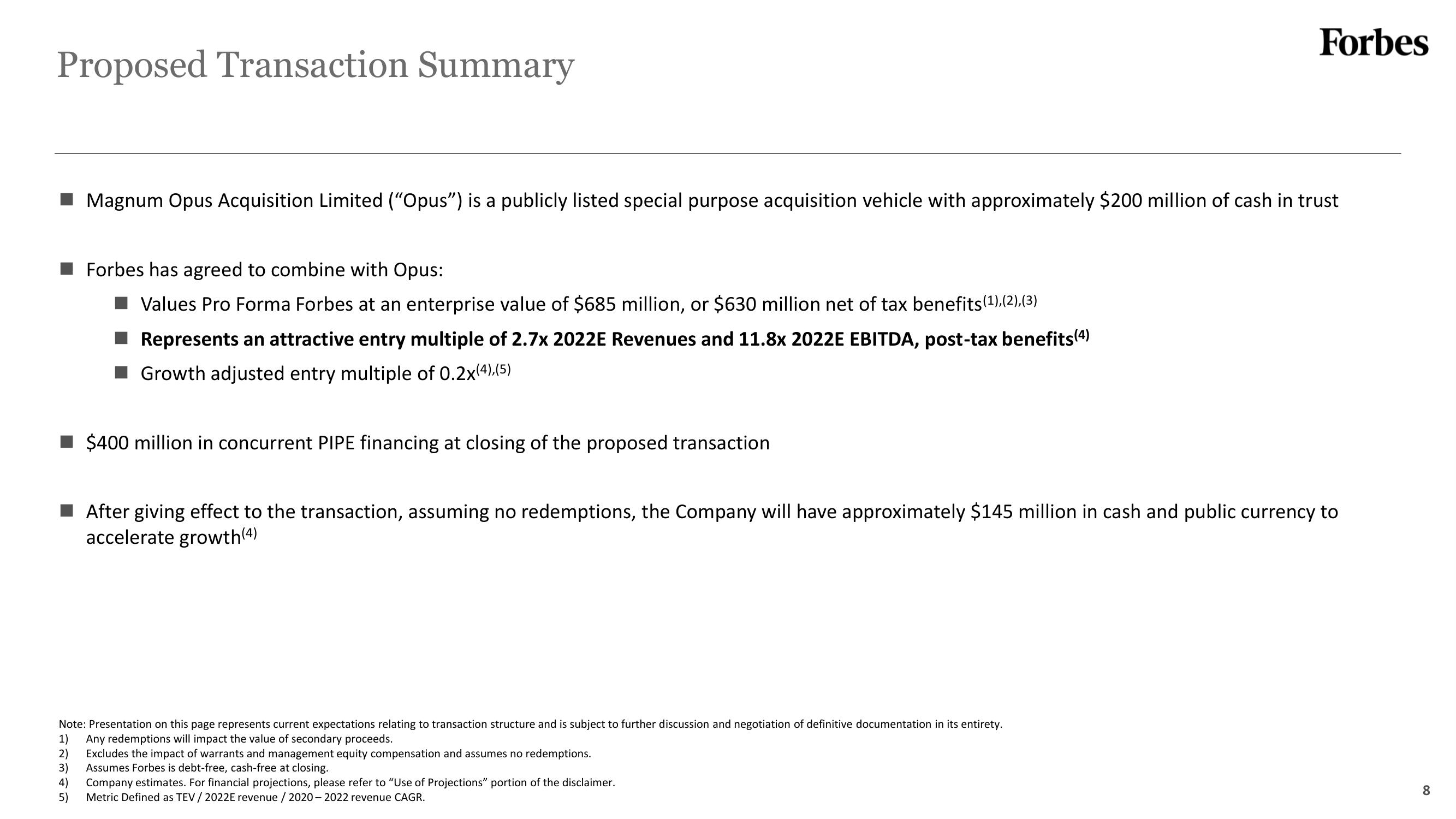

■ Magnum Opus Acquisition Limited ("Opus") is a publicly listed special purpose acquisition vehicle with approximately $200 million of cash in trust

Forbes has agreed to combine with Opus:

Values Pro Forma Forbes at an enterprise value of $685 million, or $630 million net of tax benefits(1), (2),(3)

Represents an attractive entry multiple of 2.7x 2022E Revenues and 11.8x 2022E EBITDA, post-tax benefits (4)

Growth adjusted entry multiple of 0.2x(4),(5)

1)

2)

3)

4)

5)

$400 million in concurrent PIPE financing at closing of the proposed transaction

Note: Presentation on this page represents current expectations relating to transaction structure and is subject to further discussion and negotiation of definitive documentation in its entirety.

Any redemptions will impact the value of secondary proceeds.

Forbes

After giving effect to the transaction, assuming no redemptions, the Company will have approximately $145 million in cash and public currency to

accelerate growth(4)

Excludes the impact of warrants and management equity compensation and assumes no redemptions.

Assumes Forbes is debt-free, cash-free at closing.

Company estimates. For financial projections, please refer to "Use of Projections" portion of the disclaimer.

Metric Defined as TEV / 2022E revenue / 2020-2022 revenue CAGR.

8View entire presentation