Better SPAC Presentation Deck

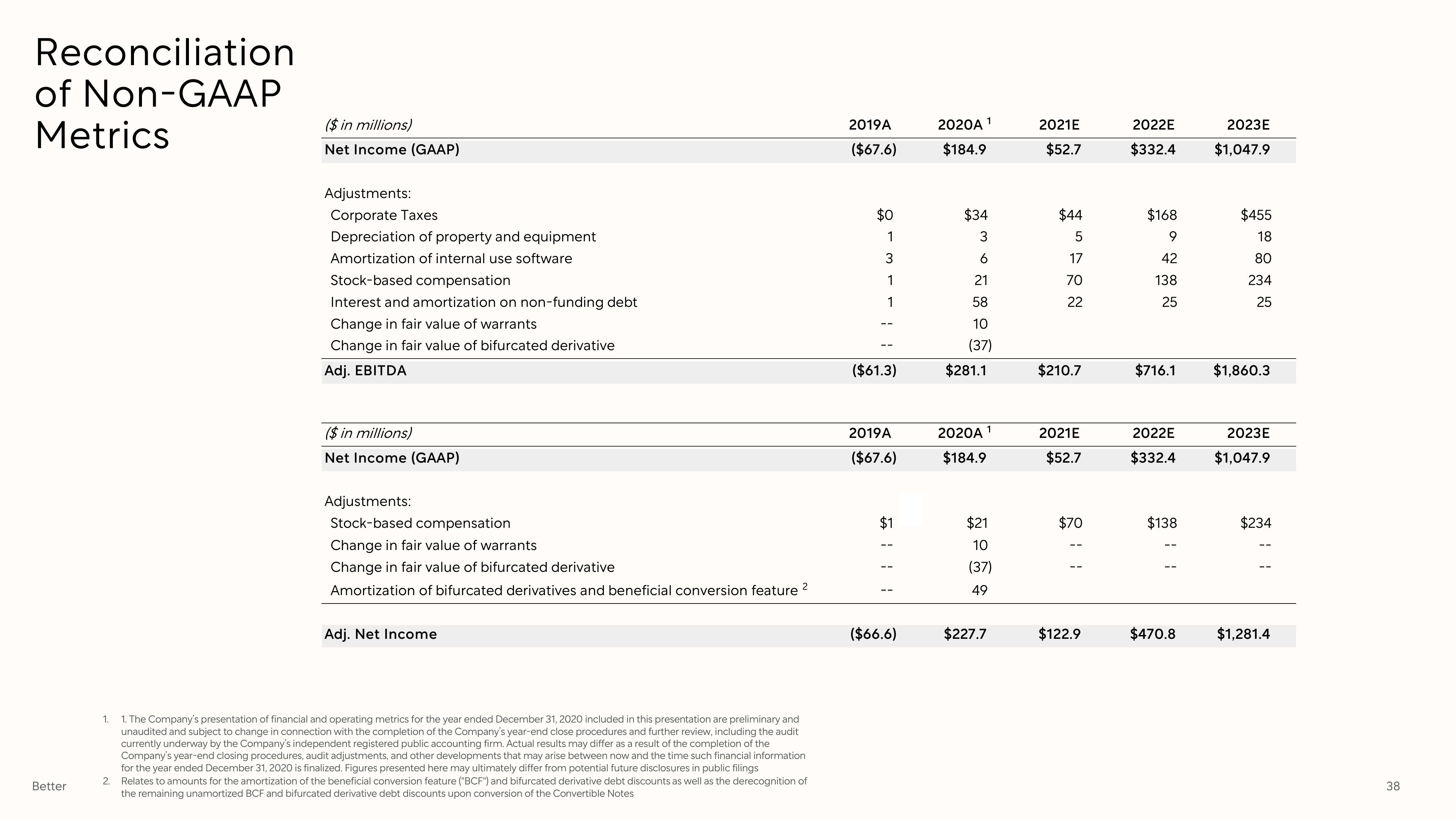

Reconciliation

of Non-GAAP

Metrics

Better

($ in millions)

Net Income (GAAP)

2.

Adjustments:

Corporate Taxes

Depreciation of property and equipment

Amortization of internal use software

Stock-based compensation

Interest and amortization on non-funding debt

Change in fair value of warrants

Change in fair value of bifurcated derivative

Adj. EBITDA

($ in millions)

Net Income (GAAP)

Adjustments:

Stock-based compensation

Change in fair value of warrants

Change in fair value of bifurcated derivative

Amortization of bifurcated derivatives and beneficial conversion feature 2

Adj. Net Income

1.

1. The Company's presentation of financial and operating metrics for the year ended December 31, 2020 included in this presentation are preliminary and

unaudited and subject to change in connection with the completion of the Company's year-end close procedures and further review, including the audit

currently underway by the Company's independent registered public accounting firm. Actual results may differ as a result of the completion of the

Company's year-end closing procedures, audit adjustments, and other developments that may arise between now and the time such financial information

for the year ended December 31, 2020 is finalized. Figures presented here may ultimately differ from potential future disclosures in public filings

Relates to amounts for the amortization of the beneficial conversion feature ("BCF") and bifurcated derivative debt discounts as well as the derecognition of

the remaining unamortized BCF and bifurcated derivative debt discounts upon conversion of the Convertible Notes

2019A

($67.6)

$0

1

3

1

1

($61.3)

2019A

($67.6)

$1

($66.6)

2020A 1

$184.9

$34

3

6

21

58

10

(37)

$281.1

2020A ¹

$184.9

$21

10

(37)

49

$227.7

2021E

$52.7

$44

5

17

70

22

$210.7

2021E

$52.7

$70

$122.9

2022E

$332.4

$168

9

42

138

25

$716.1

2022E

$332.4

$138

$470.8

2023E

$1,047.9

$455

18

80

234

25

$1,860.3

2023E

$1,047.9

$234

$1,281.4

38View entire presentation