Faraday Future SPAC Presentation Deck

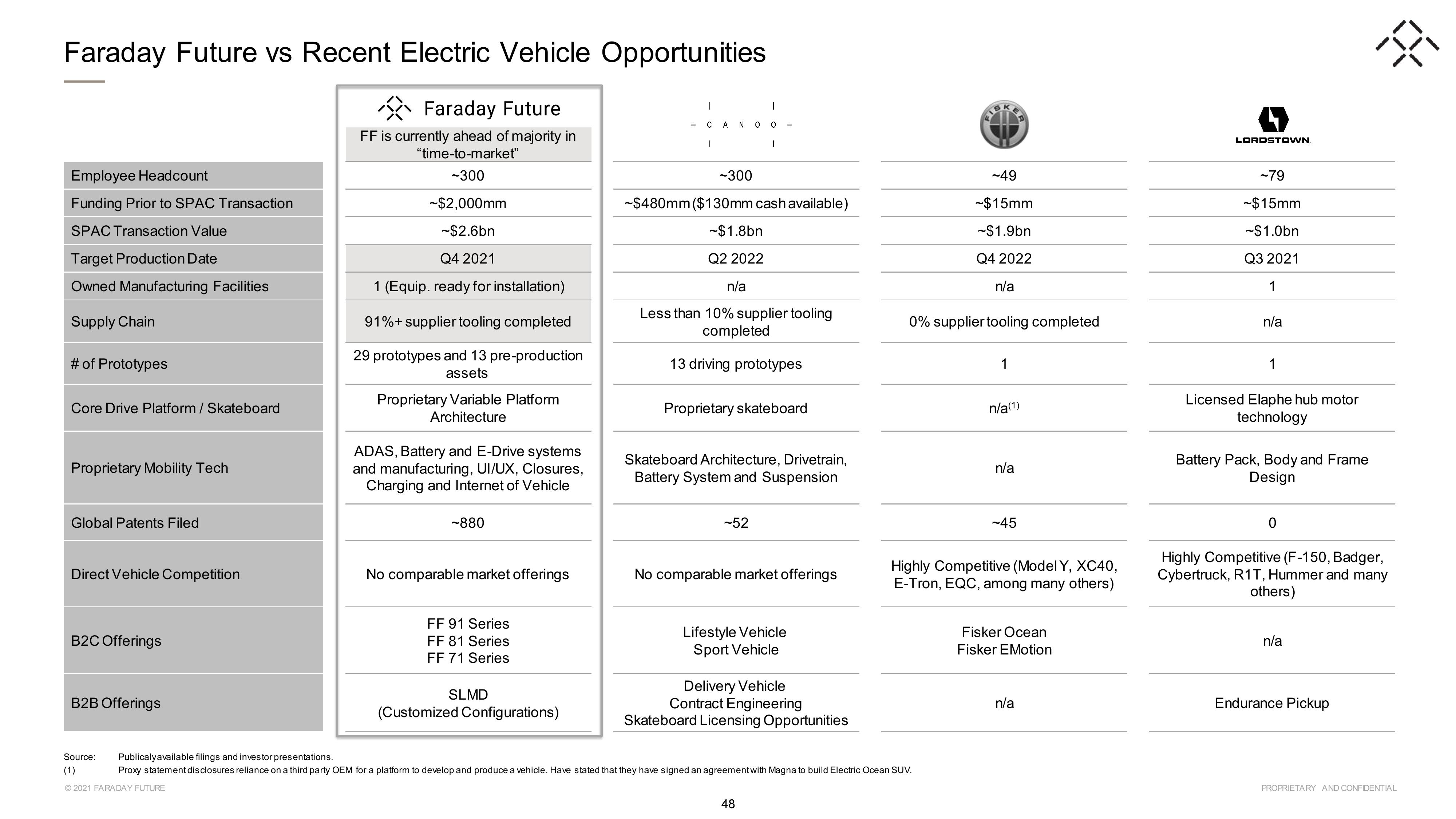

Faraday Future vs Recent Electric Vehicle Opportunities

A

Faraday Future

FF is currently ahead of majority in

"time-to-market"

-300

-$2,000mm

-$2.6bn

Employee Headcount

Funding Prior to SPAC Transaction

SPAC Transaction Value

Target Production Date

Owned Manufacturing Facilities

Supply Chain

# of Prototypes

Core Drive Platform / Skateboard

Proprietary Mobility Tech

Global Patents Filed

Direct Vehicle Competition

B2C Offerings

B2B Offerings

Q4 2021

1 (Equip. ready for installation)

91%+ supplier tooling completed

29 prototypes and 13 pre-production

assets

Proprietary Variable Platform

Architecture

ADAS, Battery and E-Drive systems

and manufacturing, UI/UX, Closures,

Charging and Internet of Vehicle

-880

No comparable market offerings

FF 91 Series

FF 81 Series

FF 71 Series

SLMD

(Customized Configurations)

1

I

- CAN OO

I

-300

-$480mm ($130mm cash available)

-$1.8bn

Q2 2022

n/a

Less than 10% supplier tooling

completed

I

13 driving prototypes

Proprietary skateboard

Skateboard Architecture, Drivetrain,

Battery System and Suspension

-52

No comparable market offerings

Lifestyle Vehicle

Sport Vehicle

Delivery Vehicle

Contract Engineering

Skateboard Licensing Opportunities

48

-49

-$15mm

-$1.9bn

Q4 2022

n/a

0% supplier tooling completed

Source: Publicalyavailable filings and investor presentations.

(1)

Proxy statement disclosures reliance on a third party OEM for a platform to develop and produce a vehicle. Have stated that they have signed an agreement with Magna to build Electric Ocean SUV.

Ⓒ2021 FARADAY FUTURE

1

n/a(1)

n/a

-45

Highly Competitive (Model Y, XC40,

E-Tron, EQC, among many others)

Fisker Ocean

Fisker EMotion

n/a

LORDSTOWN

-79

-$15mm

-$1.0bn

Q3 2021

1

n/a

1

Licensed Elaphe hub motor

technology

Battery Pack, Body and Frame

Design

0

Highly Competitive (F-150, Badger,

Cybertruck, R1T, Hummer and many

others)

n/a

38

Endurance Pickup

PROPRIETARY AND CONFIDENTIALView entire presentation