Kroger Mergers and Acquisitions Presentation Deck

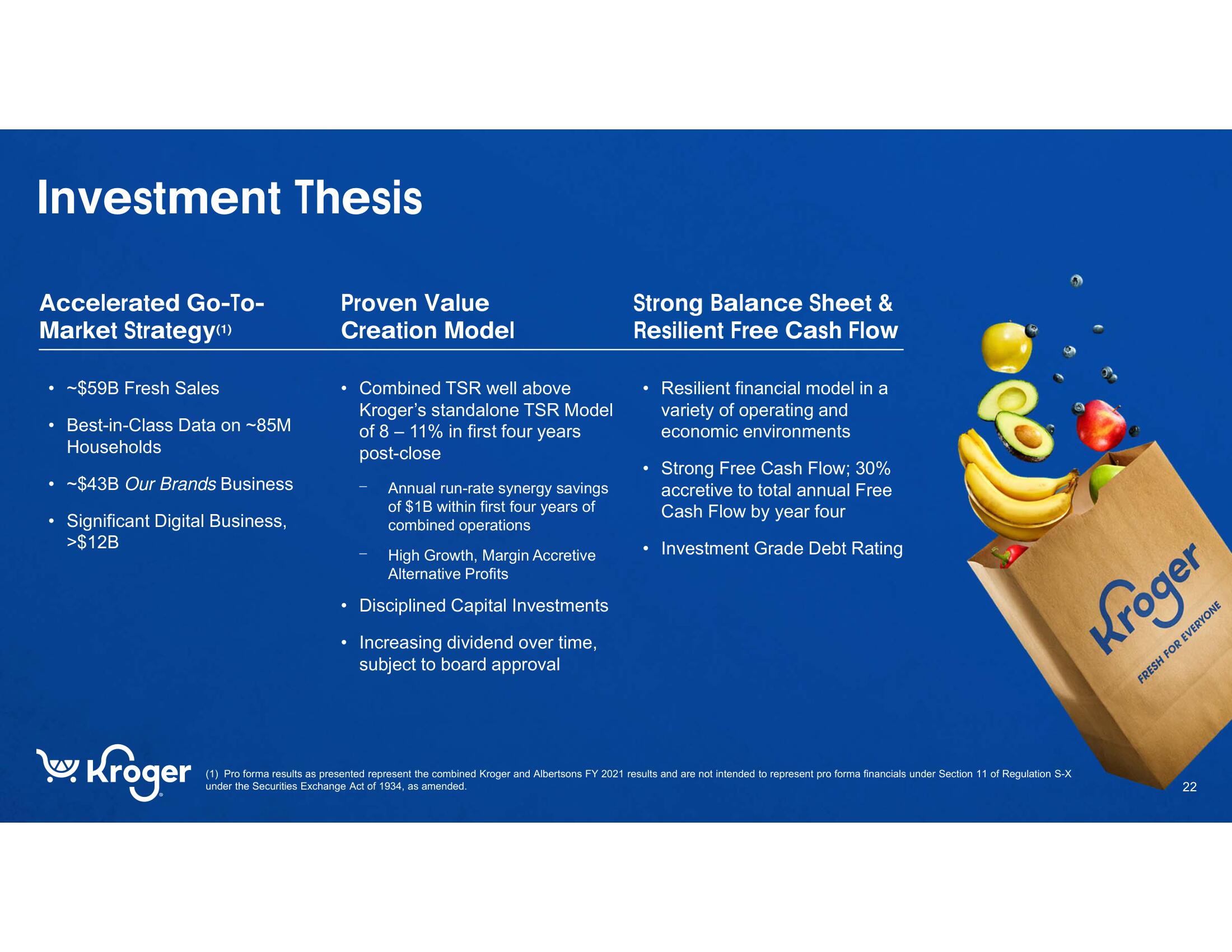

Investment Thesis

Accelerated Go-To-

Market Strategy(¹)

●

●

●

~$59B Fresh Sales

Best-in-Class Data on ~85M

Households

-$43B Our Brands Business

Significant Digital Business,

>$12B

Kroger

Proven Value

Creation Model

●

Combined TSR well above

Kroger's standalone TSR Model

of 8 - 11% in first four years

post-close

Annual run-rate synergy savings

of $1B within first four years of

combined operations

High Growth, Margin Accretive

Alternative Profits

Disciplined Capital Investments

Increasing dividend over time,

subject to board approval

Strong Balance Sheet &

Resilient Free Cash Flow

Resilient financial model in a

variety of operating and

economic environments

Strong Free Cash Flow; 30%

accretive to total annual Free

Cash Flow by year four

Investment Grade Debt Rating

(1) Pro forma results as presented represent the combined Kroger and Albertsons FY 2021 results and are not intended to represent pro forma financials under Section 11 of Regulation S-X

under the Securities Exchange Act of 1934, as amended.

Kroger

FRESH FOR EVERYONE

22View entire presentation