Evercore Investment Banking Pitch Book

Why Evercore?

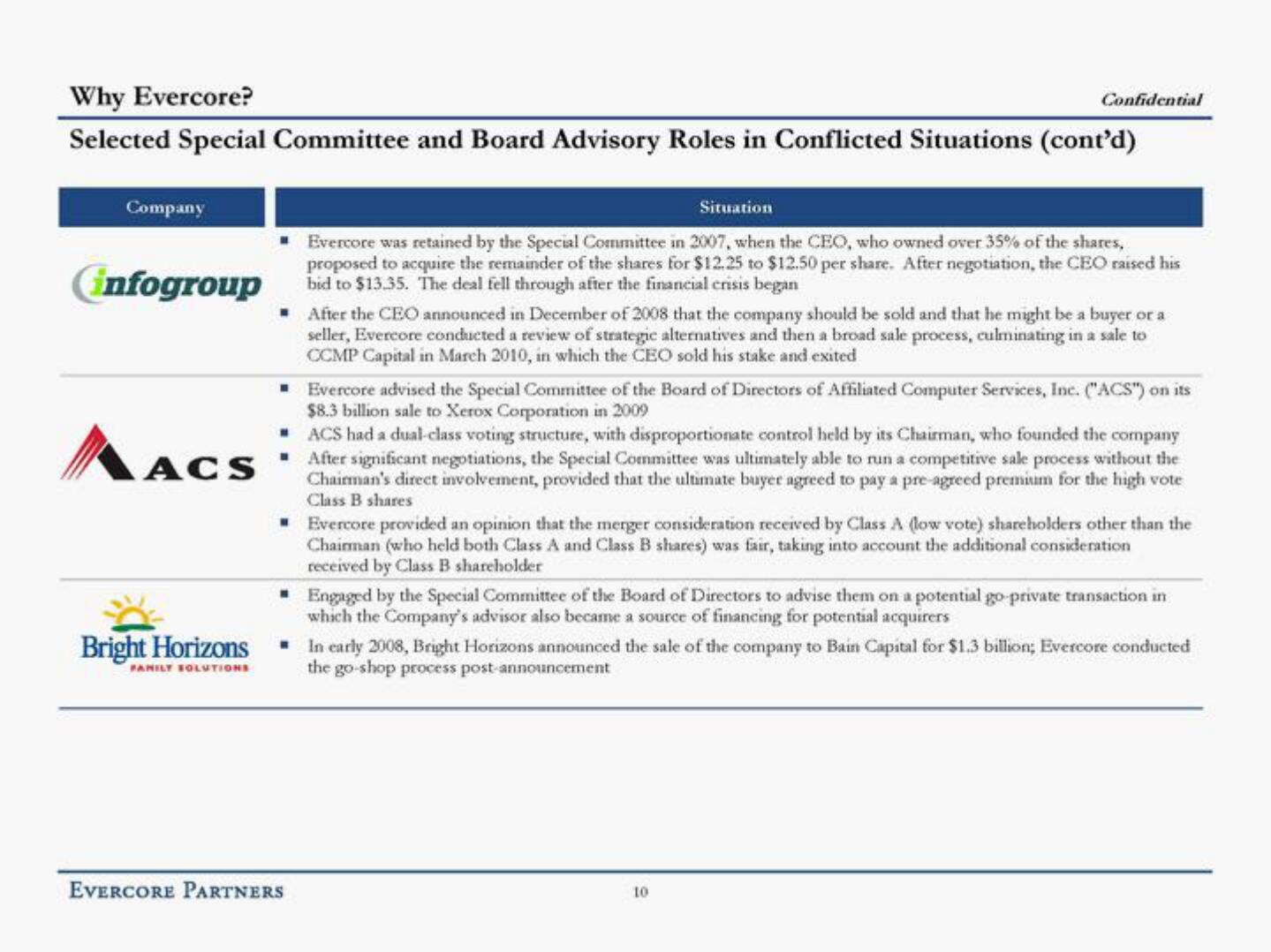

Selected Special Committee and Board Advisory Roles in Conflicted Situations (cont'd)

Company

infogroup

ACS

Bright Horizons

FAMILY SOLUTIONS

▪

■

■

Situation

■ After the CEO announced in December of 2008 that the company should be sold and that he might be a buyer or a

seller, Evercore conducted a review of strategic alternatives and then a broad sale process, culminating in a sale to

CCMP Capital in March 2010, in which the CEO sold his stake and exited

EVERCORE PARTNERS

Confidential

Evercore was retained by the Special Committee in 2007, when the CEO, who owned over 35% of the shares,

proposed to acquire the remainder of the shares for $12.25 to $12.50 per share. After negotiation, the CEO raised his

bid to $13.35. The deal fell through after the financial crisis began

Evercore advised the Special Committee of the Board of Directors of Affiliated Computer Services, Inc. ("ACS") on its

$8.3 billion sale to Xerox Corporation in 2009

ACS had a dual-class voting structure, with disproportionate control held by its Chairman, who founded the company

After significant negotiations, the Special Committee was ultimately able to run a competitive sale process without the

Chairman's direct involvement, provided that the ultimate buyer agreed to pay a pre-agreed premium for the high vote

Class B shares

■ Evercore provided an opinion that the merger consideration received by Class A (low vote) shareholders other than the

Chairman (who held both Class A and Class B shares) was fair, taking into account the additional consideration

received by Class B shareholder

Engaged by the Special Committee of the Board of Directors to advise them on a potential go-private transaction in

which the Company's advisor also became a source of financing for potential acquirers

10

In early 2008, Bright Horizons announced the sale of the company to Bain Capital for $1.3 billion, Evercore conducted

the go-shop process post-announcementView entire presentation