Engine No. 1 Activist Presentation Deck

We believe shareholders need a Board that will maintain a

consistent strategy of capital allocation discipline

●

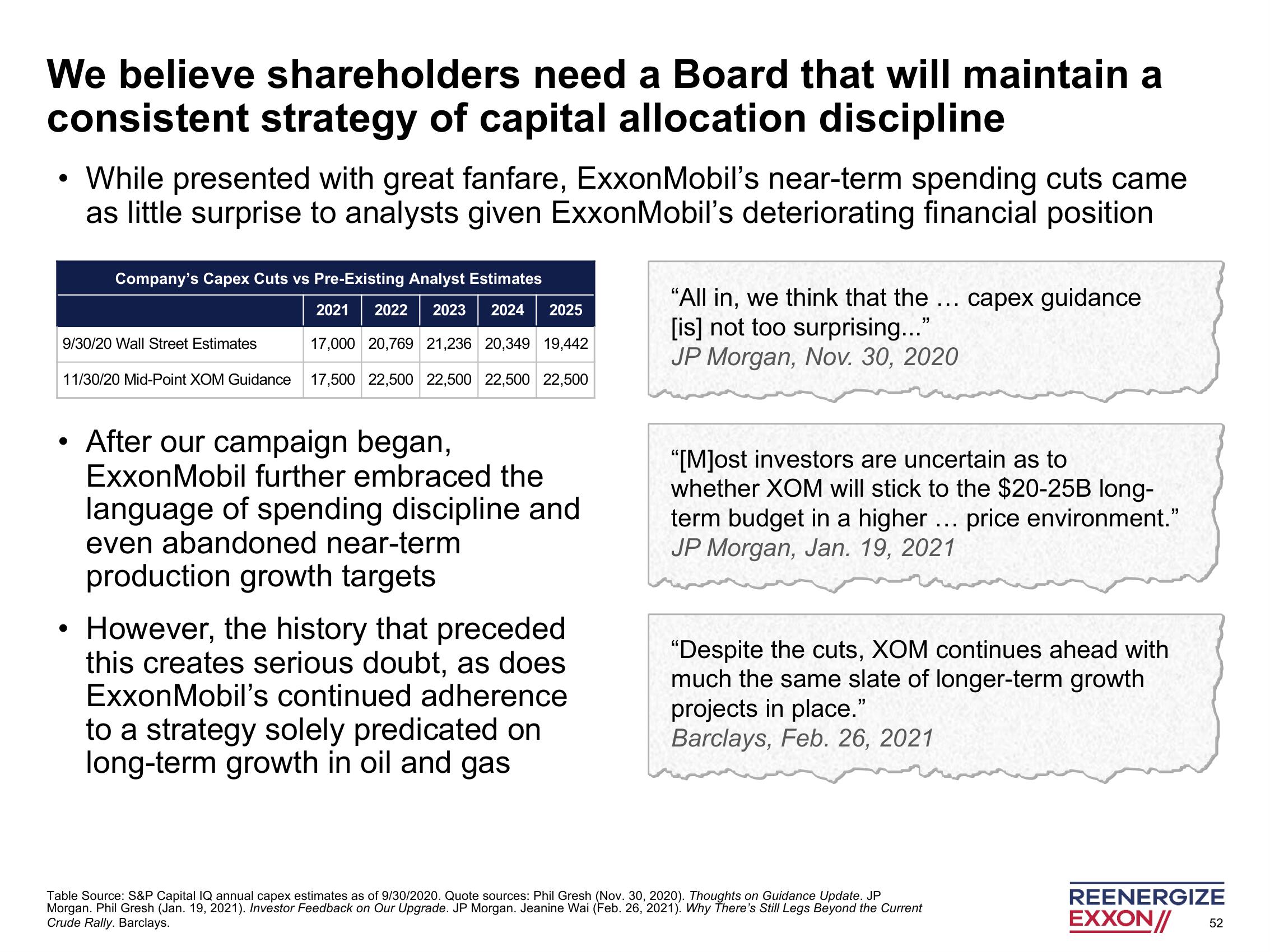

While presented with great fanfare, ExxonMobil's near-term spending cuts came

as little surprise to analysts given ExxonMobil's deteriorating financial position

Company's Capex Cuts vs Pre-Existing Analyst Estimates

2021 2022 2023 2024 2025

17,000 20,769 21,236 20,349 19,442

11/30/20 Mid-Point XOM Guidance 17,500 22,500 22,500 22,500 22,500

9/30/20 Wall Street Estimates

• After our campaign began,

ExxonMobil further embraced the

language of spending discipline and

even abandoned near-term

production growth targets

●

However, the history that preceded

this creates serious doubt, as does

ExxonMobil's continued adherence

to a strategy solely predicated on

long-term growth in oil and gas

"All in, we think that the ... capex guidance

[is] not too surprising..."

JP Morgan, Nov. 30, 2020

"[M]ost investors are uncertain as to

whether XOM will stick to the $20-25B long-

term budget in a higher ... price environment."

JP Morgan, Jan. 19, 2021

"Despite the cuts, XOM continues ahead with

much the same slate of longer-term growth

projects in place."

Barclays, Feb. 26, 2021

Table Source: S&P Capital IQ annual capex estimates as of 9/30/2020. Quote sources: Phil Gresh (Nov. 30, 2020). Thoughts on Guidance Update. JP

Morgan. Phil Gresh (Jan. 19, 2021). Investor Feedback on Our Upgrade. JP Morgan. Jeanine Wai (Feb. 26, 2021). Why There's Still Legs Beyond the Current

Crude Rally. Barclays.

REENERGIZE

EXXON//

52View entire presentation