Maersk Investor Presentation Deck

Highlights Q3 2020

Ocean

●

●

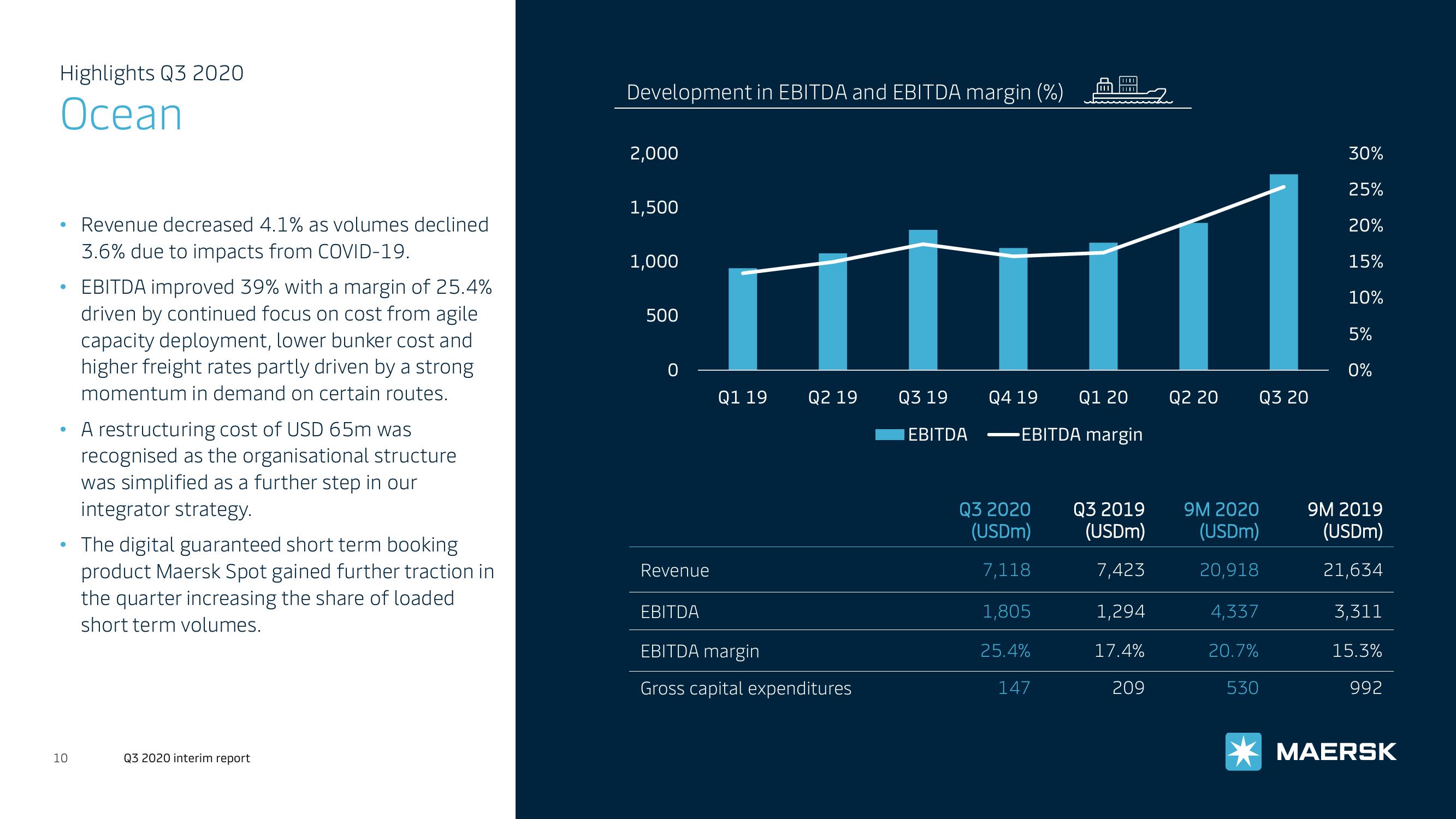

Revenue decreased 4.1% as volumes declined

3.6% due to impacts from COVID-19.

10

EBITDA improved 39% with a margin of 25.4%

driven by continued focus on cost from agile

capacity deployment, lower bunker cost and

higher freight rates partly driven by a strong

momentum in demand on certain routes.

A restructuring cost of USD 65m was

recognised as the organisational structure

was simplified as a further step in our

integrator strategy.

• The digital guaranteed short term booking

product Maersk Spot gained further traction in

the quarter increasing the share of loaded

short term volumes.

Q3 2020 interim report

Development in EBITDA and EBITDA margin (%)

2,000

1,500

1,000

500

0

Revenue

Q1 19

Q2 19

EBITDA

EBITDA margin

Gross capital expenditures

Q3 19

EBITDA

Q4 19 Q1 20

EBITDA margin

Q3 2020

(USDm)

7,118

1,805

25.4%

147

Q3 2019

(USDM)

7,423

1,294

17.4%

209

Q2 20

Q3 20

9M 2020

(USDM)

20,918

4,337

20.7%

530

30%

25%

20%

15%

10%

5%

0%

9M 2019

(USDM)

21,634

3,311

15.3%

992

MAERSKView entire presentation