SoftBank Results Presentation Deck

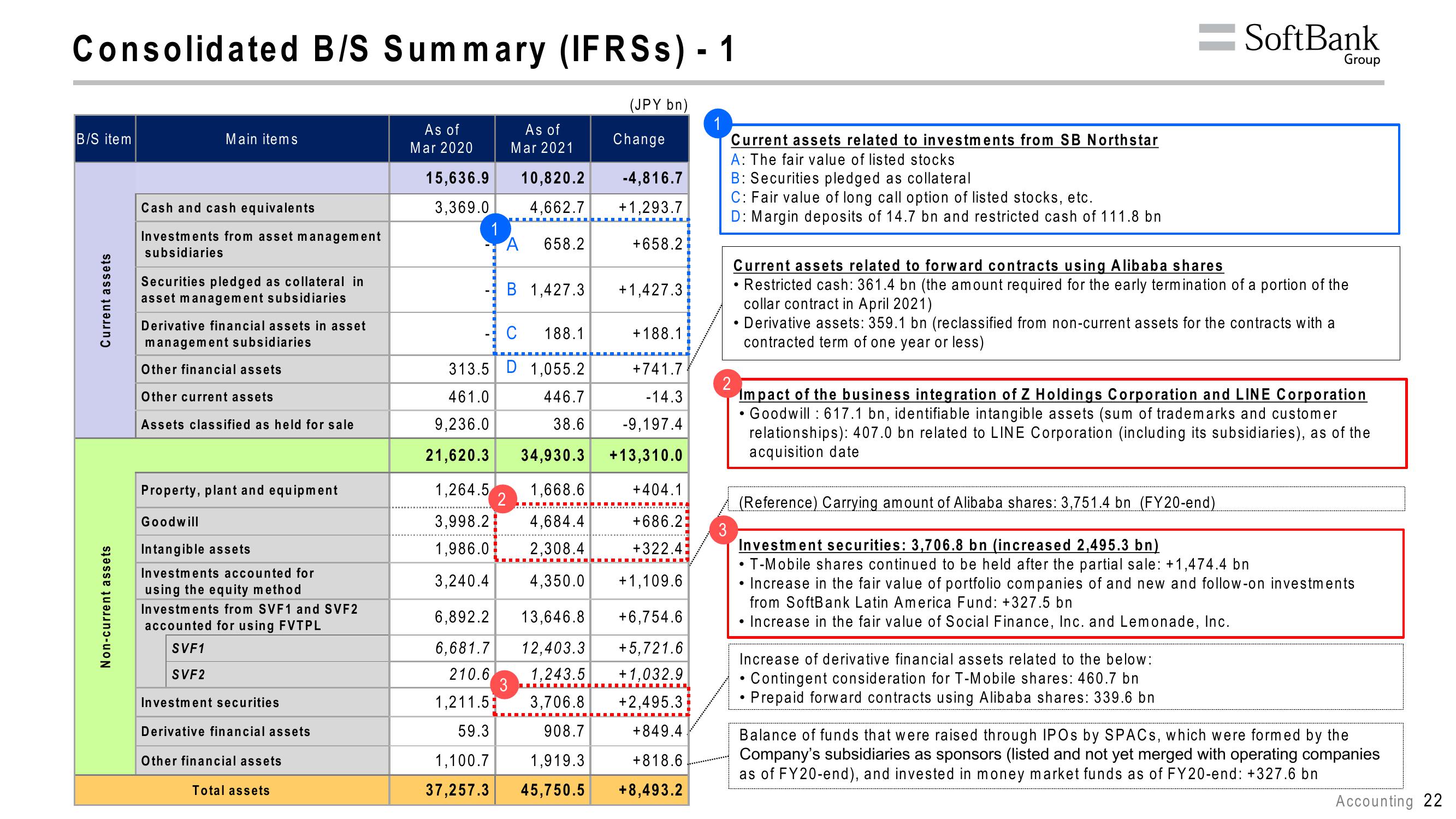

Consolidated B/S Summary (IFRSs) - 1

B/S item

Current assets

Non-current assets

Main items

Cash and cash equivalents

Investments from asset management

subsidiaries

Securities pledged as collateral in

asset management subsidiaries

Derivative financial assets in asset

management subsidiaries

Other financial assets

Other current assets

Assets classified as held for sale

Property, plant and equipment

Goodwill

Intangible assets

Investments accounted for

using the equity method

Investments from SVF1 and SVF2

accounted for using FVTPL

SVF1

SVF2

Investmen securities

Derivative financial assets

Other financial assets

Total assets

As of

Mar 2020

15,636.9

3,369.0

313.5

461.0

9,236.0

21,620.3

1,264.5

3,998.2

1,986.0

3,240.4

As of

Mar 2021

10,820.2

4,662.7

A 658.2

B 1,427.3

2

(JPY bn)

6,892.2 13,646.8

6,681.7 12,403.3

210.6 1,243.5

1,211.5 3,706.8

59.3

908.7

1,919.3

3

1,100.7

37,257.3

45,750.5

Change

-4,816.7

+1,293.7

+658.2

+188.1

C 188.1

D 1,055.2 +741.7.

446.7

-14.3

38.6 -9,197.4

34,930.3 +13,310.0

1,668.6

4,684.4

2,308.4

+404.1

+686.2

+322.45

4,350.0

+1,427.3

+1,109.6

+6,754.6

+5,721.6

+1,032.9

+2,495.3

+849.4

+818.6

+8,493.2

1

Current assets related to investments from SB Northstar

A: The fair value of listed stocks

B: Securities pledged as collateral

C: Fair value of long call option of listed stocks, etc.

D: Margin deposits of 14.7 bn and restricted cash of 111.8 bn

2

3

Current assets related to forward contracts using Alibaba shares

• Restricted cash: 361.4 bn (the amount required for the early termination of a portion of the

collar contract in April 2021)

Derivative assets: 359.1 bn (reclassified from non-current assets for the contracts with a

contracted term of one year or less)

●

SoftBank

Impact of the business integration of Z Holdings Corporation and LINE Corporation

Goodwill: 617.1 bn, identifiable intangible assets (sum of trademarks and customer

relationships): 407.0 bn related to LINE Corporation (including its subsidiaries), as of the

acquisition date

(Reference) Carrying amount of Alibaba shares: 3,751.4 bn (FY20-end)

Group

●

• Increase in the fair value of Social Finance, Inc. and Lemonade, Inc.

Investment securities: 3,706.8 bn (increased 2,495.3 bn)

T-Mobile shares continued to be held after the partial sale: +1,474.4 bn

●

• Increase in the fair value of portfolio companies of and new and follow-on investments

from SoftBank Latin America Fund: +327.5 bn

Increase of derivative financial assets related to the below:

• Contingent consideration for T-Mobile shares: 460.7 bn

Prepaid forward contracts using Alibaba shares: 339.6 bn

Balance of funds that were raised through IPOs by SPACs, which were formed by the

Company's subsidiaries as sponsors (listed and not yet merged with operating companies

as of FY20-end), and invested in money market funds as of FY20-end: +327.6 bn

Accounting 22View entire presentation