Roblox Results Presentation Deck

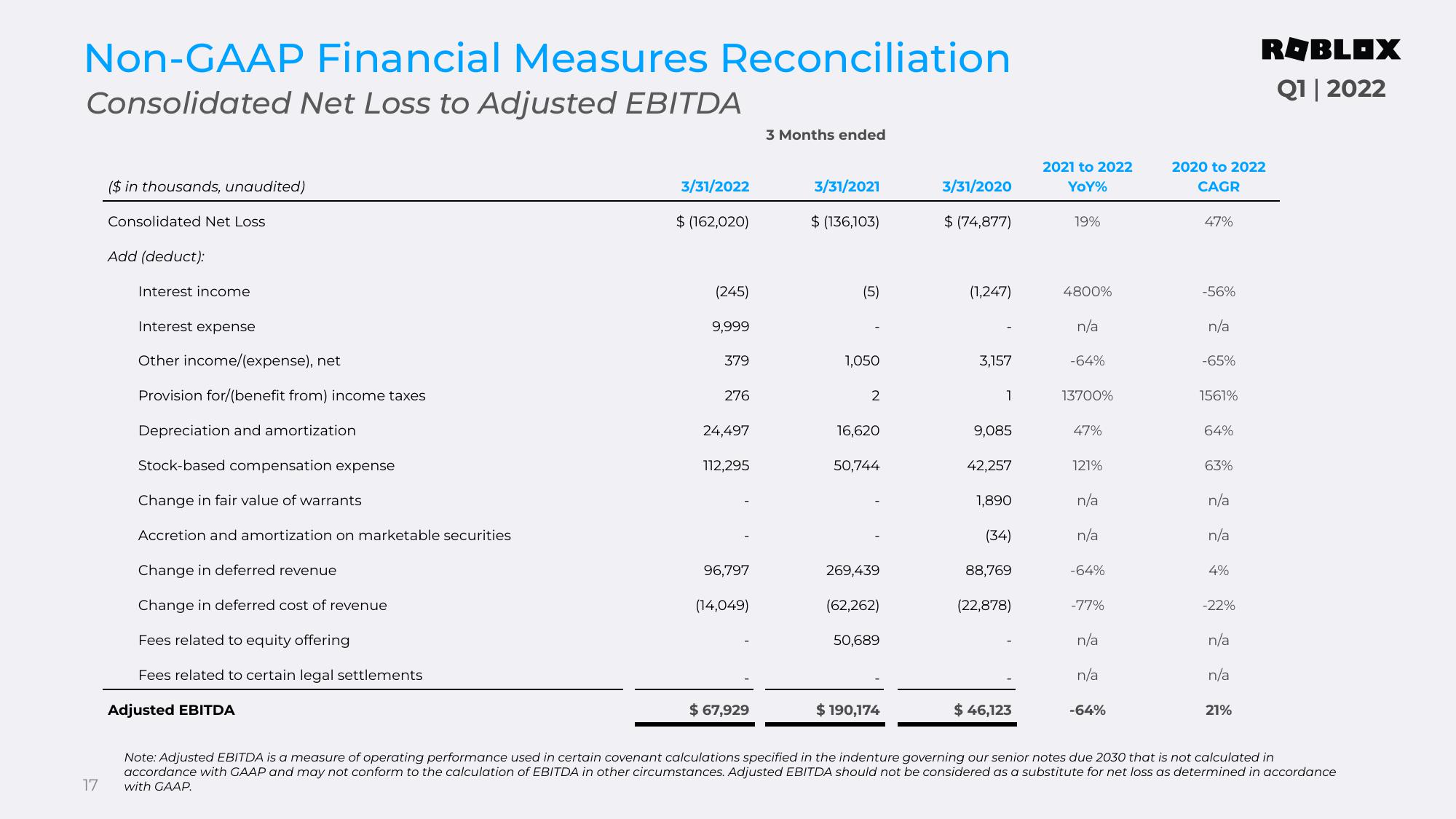

Non-GAAP Financial Measures Reconciliation

Consolidated Net Loss to Adjusted EBITDA

17

($ in thousands, unaudited)

Consolidated Net Loss

Add (deduct):

Interest income

Interest expense

Other income/(expense), net

Provision for/(benefit from) income taxes

Depreciation and amortization

Stock-based compensation expense

Change in fair value of warrants

Accretion and amortization on marketable securities

Change in deferred revenue

Change in deferred cost of revenue

Fees related to equity offering

Fees related to certain legal settlements

Adjusted EBITDA

3/31/2022

$ (162,020)

(245)

9,999

379

276

24,497

112,295

96,797

(14,049)

$ 67,929

3 Months ended

3/31/2021

$ (136,103)

(5)

1,050

2

16,620

50,744

269,439

(62,262)

50,689

$ 190,174

3/31/2020

$ (74,877)

(1,247)

3,157

1

9,085

42,257

1,890

(34)

88,769

(22,878)

$ 46,123

2021 to 2022

YOY%

19%

4800%

n/a

-64%

13700%

47%

121%

n/a

n/a

-64%

-77%

n/a

n/a

-64%

2020 to 2022

CAGR

47%

-56%

n/a

-65%

1561%

64%

63%

n/a

n/a

4%

-22%

n/a

n/a

ROBLOX

Q1 2022

21%

Note: Adjusted EBITDA is a measure of operating performance used in certain covenant calculations specified in the indenture governing our senior notes due 2030 that is not calculated in

accordance with GAAP and may not conform to the calculation of EBITDA in other circumstances. Adjusted EBITDA should not be considered as a substitute for net loss as determined in accordance

with GAAP.View entire presentation