Baird Investment Banking Pitch Book

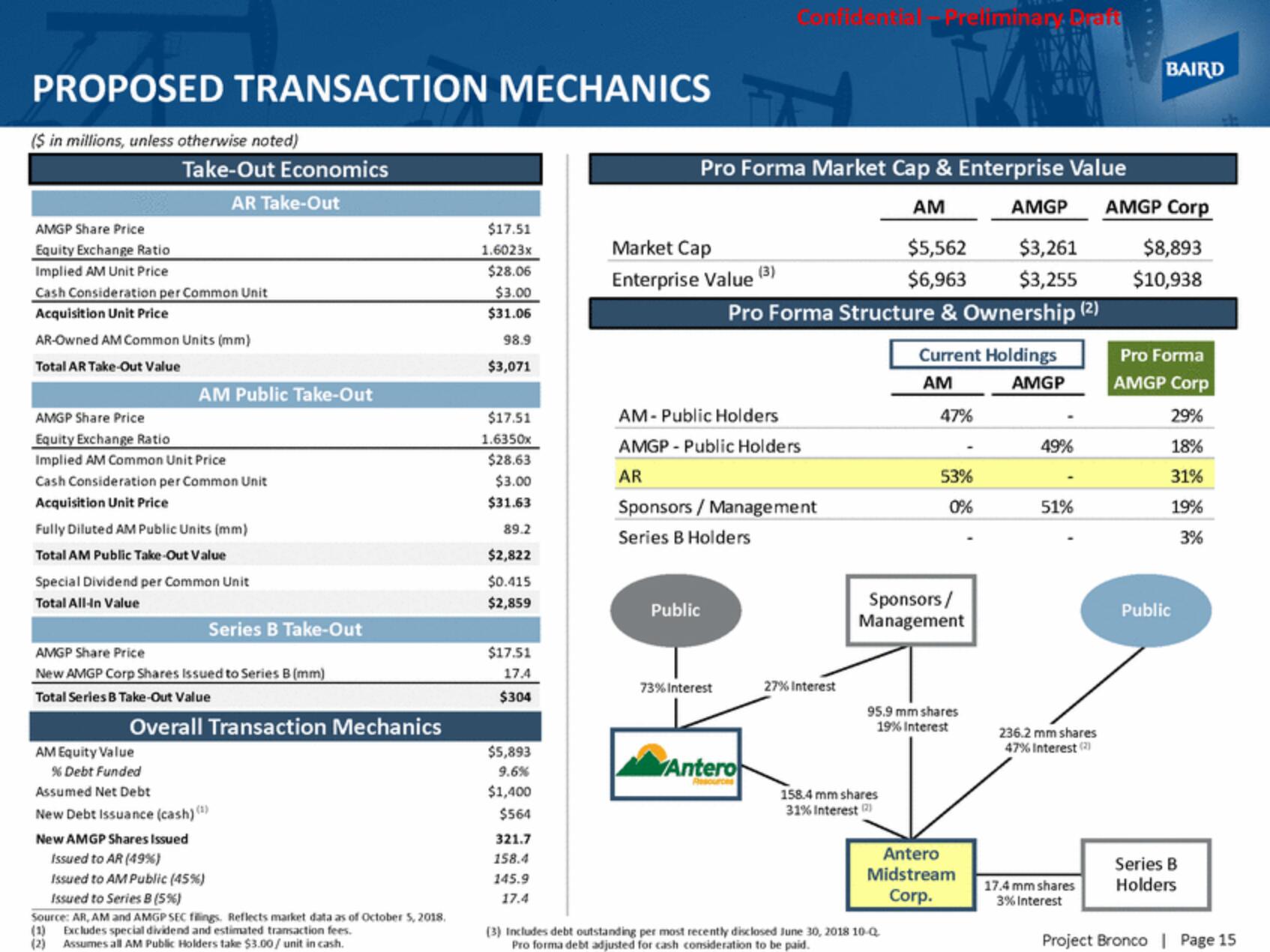

PROPOSED TRANSACTION MECHANICS

($ in millions, unless otherwise noted)

AMGP Share Price

Equity Exchange Ratio

Implied AM Unit Price

Take-Out Economics

AR Take-Out

Cash Consideration per Common Unit

Acquisition Unit Price

AR-Owned AM Common Units (mm)

Total AR Take-Out Value

AM Public Take-Out

AMGP Share Price

Equity Exchange Ratio

Implied AM Common Unit Price

Cash Consideration per Common Unit

Acquisition Unit Price

Fully Diluted AM Public Units (mm)

Total AM Public Take-Out Value

Special Dividend per Common Unit

Total All-In Value

AM Equity Value

% Debt Funded

Series B Take-Out

AMGP Share Price

New AMGP Corp Shares Issued to Series B (mm)

Total Series B Take-Out Value

Overall Transaction Mechanics

Assumed Net Debt

New Debt Issuance (cash) (*)

New AMGP Shares Issued

Issued to AR (49%)

Issued to AM Public (45%)

Issued to Series B (5%)

Source: AR, AM and AMGP SEC filings. Reflects market data as of October 5, 2018.

(1) Excludes special dividend and estimated transaction fees.

(2)

Assumes all AM Public Holders take $3.00/ unit in cash.

$17.51

1.6023x

$28.06

$3.00

$31.06

98.9

$3,071

$17.51

1.6350x

$28.63

$3.00

$31.63

89.2

$2,822

$0.415

$2,859

$17.51

17.4

$304

$5,893

9.6%

$1,400

$564

321.7

158.4

145.9

17.4

Market Cap

Enterprise Value (3)

7

Pro Forma Market Cap & Enterprise Value

AM

AMGP AMGP Corp

$5,562

$3,261

$6,963 $3,255

Pro Forma Structure & Ownership (²)

AM - Public Holders

AMGP - Public Holders

AR

Sponsors / Management

Series B Holders

Public

73% Interest

Antero

27% Interest

Preliminan. Draft

158.4 mm shares

31% Interest (2)

Current Holdings

AM

AMGP

47%

Sponsors/

Management

(3) Includes debt outstanding per most recently disclosed June 30, 2018 10-Q

Pro forma debt adjusted for cash consideration to be paid.

53%

0%

95.9 mm shares

19% Interest

Antero

Midstream

Corp.

49%

51%

236.2 mm shares

47% Interest (2)

BAIRD

17.4 mm shares

3% Interest

$8,893

$10,938

Pro Forma

AMGP Corp

29%

18%

31%

19%

3%

Public

Series B

Holders

Project Bronco | Page 15View entire presentation