Intertek Results Presentation Deck

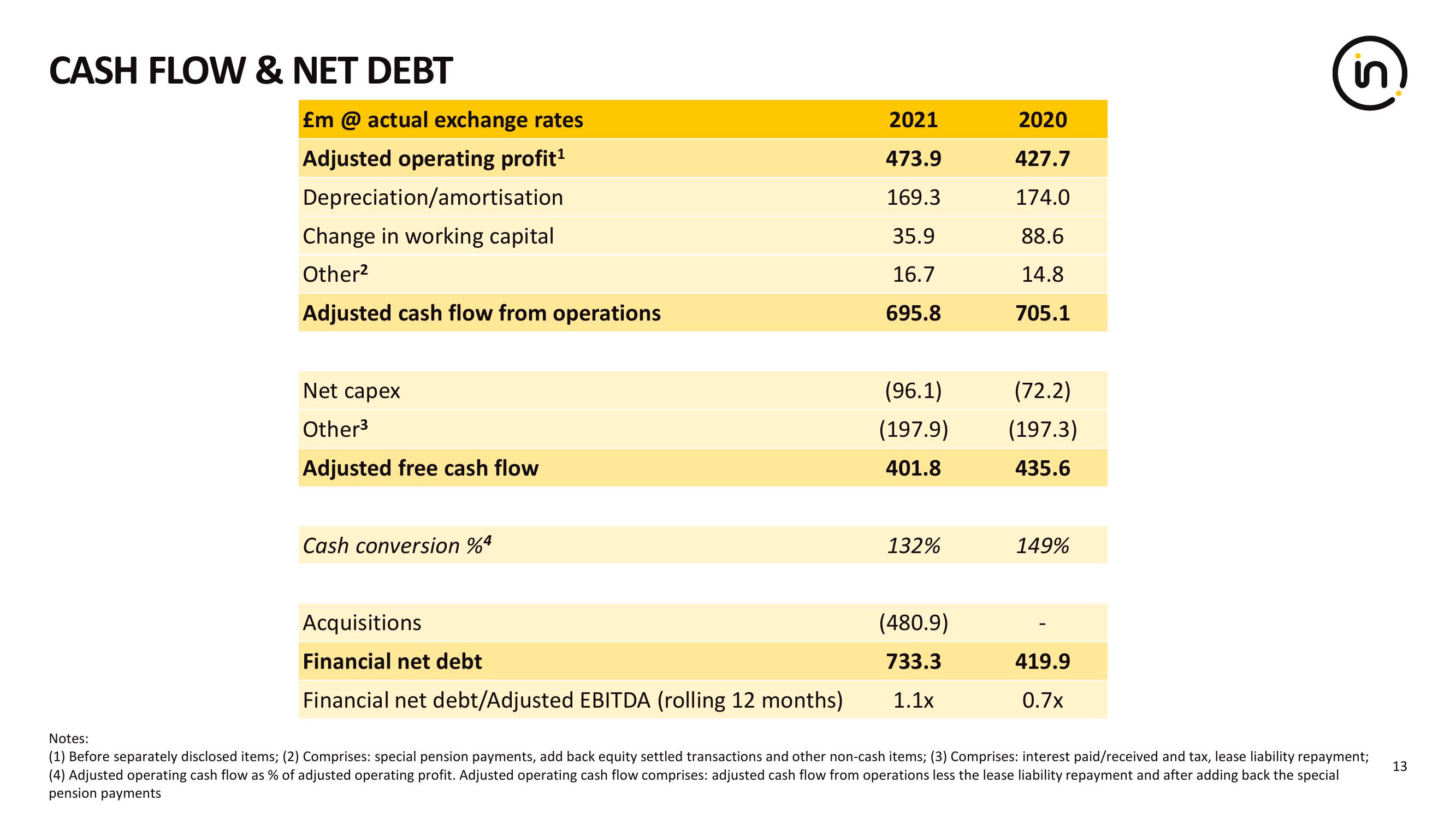

CASH FLOW & NET DEBT

£m @ actual exchange rates

Adjusted operating profit¹

Depreciation/amortisation

Change in working capital

Other²

Adjusted cash flow from operations

Net capex

Other³

Adjusted free cash flow

Cash conversion %4

Acquisitions

Financial net debt

Financial net debt/Adjusted EBITDA (rolling 12 months)

2021

473.9

169.3

35.9

16.7

695.8

(96.1)

(197.9)

401.8

132%

(480.9)

733.3

1.1x

2020

427.7

174.0

88.6

14.8

705.1

(72.2)

(197.3)

435.6

149%

419.9

0.7x

in

Notes:

(1) Before separately disclosed items; (2) Comprises: special pension payments, add back equity settled transactions and other non-cash items; (3) Comprises: interest paid/received and tax, lease liability repayment;

(4) Adjusted operating cash flow as % of adjusted operating profit. Adjusted operating cash flow comprises: adjusted cash flow from operations less the lease liability repayment and after adding back the special

pension payments

13View entire presentation