Hanmi Financial Results Presentation Deck

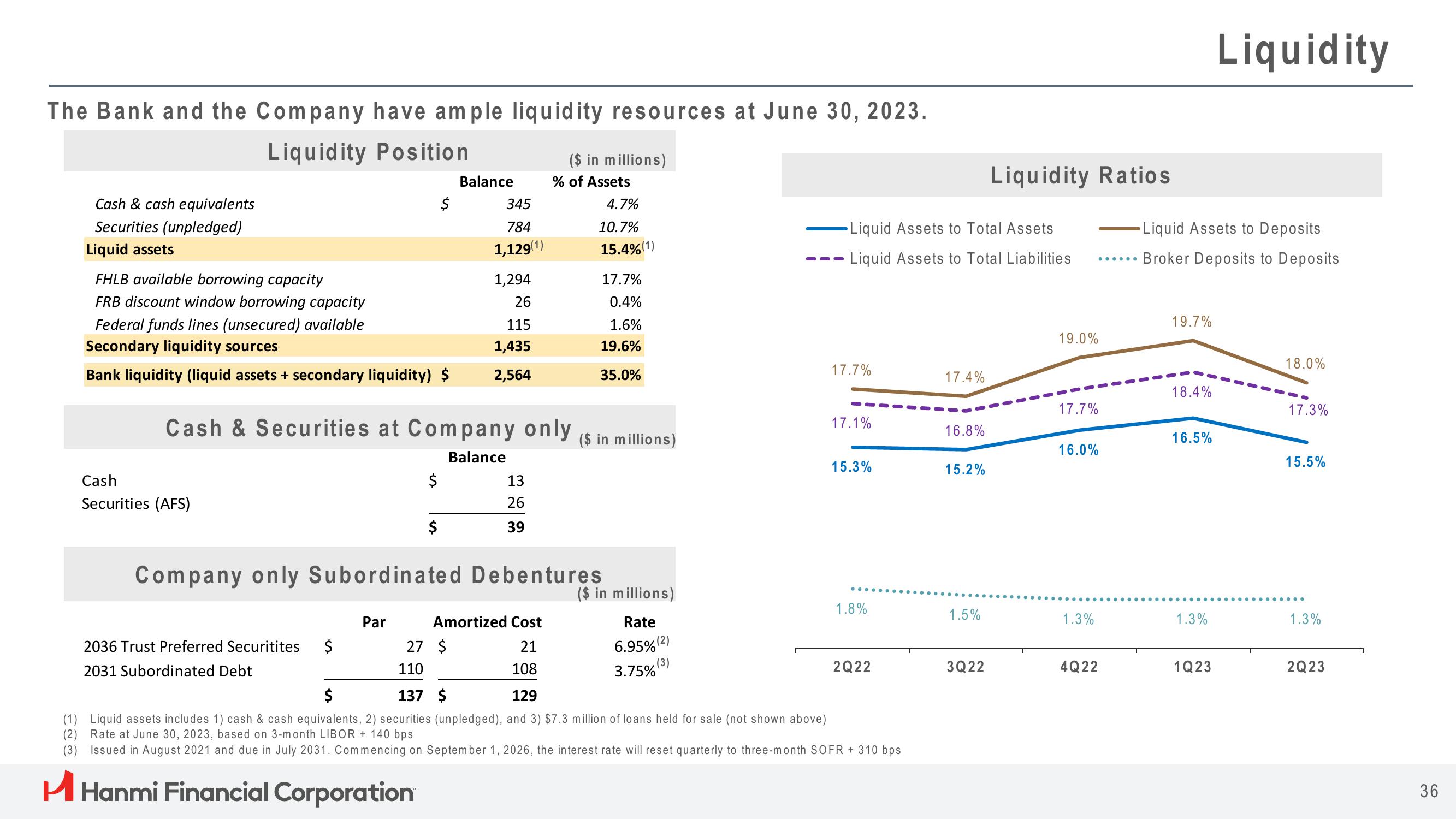

The Bank and the Company have ample liquidity resources at June 30, 2023.

Liquidity Position

Cash & cash equivalents

Securities (unpledged)

Liquid assets

FHLB available borrowing capacity

1,294

FRB discount window borrowing capacity

26

115

Federal funds lines (unsecured) available

Secondary liquidity sources

1,435

Bank liquidity (liquid assets + secondary liquidity) $ 2,564

Cash

Securities (AFS)

2036 Trust Preferred Securitites

2031 Subordinated Debt

$

Par

$

Cash & Securities at Company only

Balance

$

Balance

345

784

1,129(1)

27 $

110

13

26

39

($ in millions)

Amortized Cost

21

108

% of Assets

Company only Subordinated Debentures

4.7%

10.7%

15.4%(1)

17.7%

0.4%

1.6%

19.6%

35.0%

($ in millions)

($ in millions)

Rate

(2)

6.95% (2

(3)

3.75%

-Liquid Assets to Total Assets

Liquid Assets to Total Liabilities

17.7%

17.1%

15.3%

1.8%

2Q22

$

137 $

129

(1) Liquid assets includes 1) cash & cash equivalents, 2) securities (unpledged), and 3) $7.3 million of loans held for sale (not shown above)

(2) Rate at June 30, 2023, based on 3-month LIBOR + 140 bps

Issued in August 2021 and due in July 2031. Commencing on September 1, 2026, the interest rate will reset quarterly to three-month SOFR + 310 bps

H Hanmi Financial Corporation

17.4%

16.8%

15.2%

1.5%

Liquidity Ratios

3Q22

19.0%

......

17.7%

16.0%

1.3%

4Q22

-Liquid Assets to Deposits

Broker Deposits to Deposits

19.7%

18.4%

16.5%

1.3%

Liquidity

1Q23

18.0%

17.3%

15.5%

1.3%

2Q23

36View entire presentation