Orthofix Investor Presentation Deck

IN

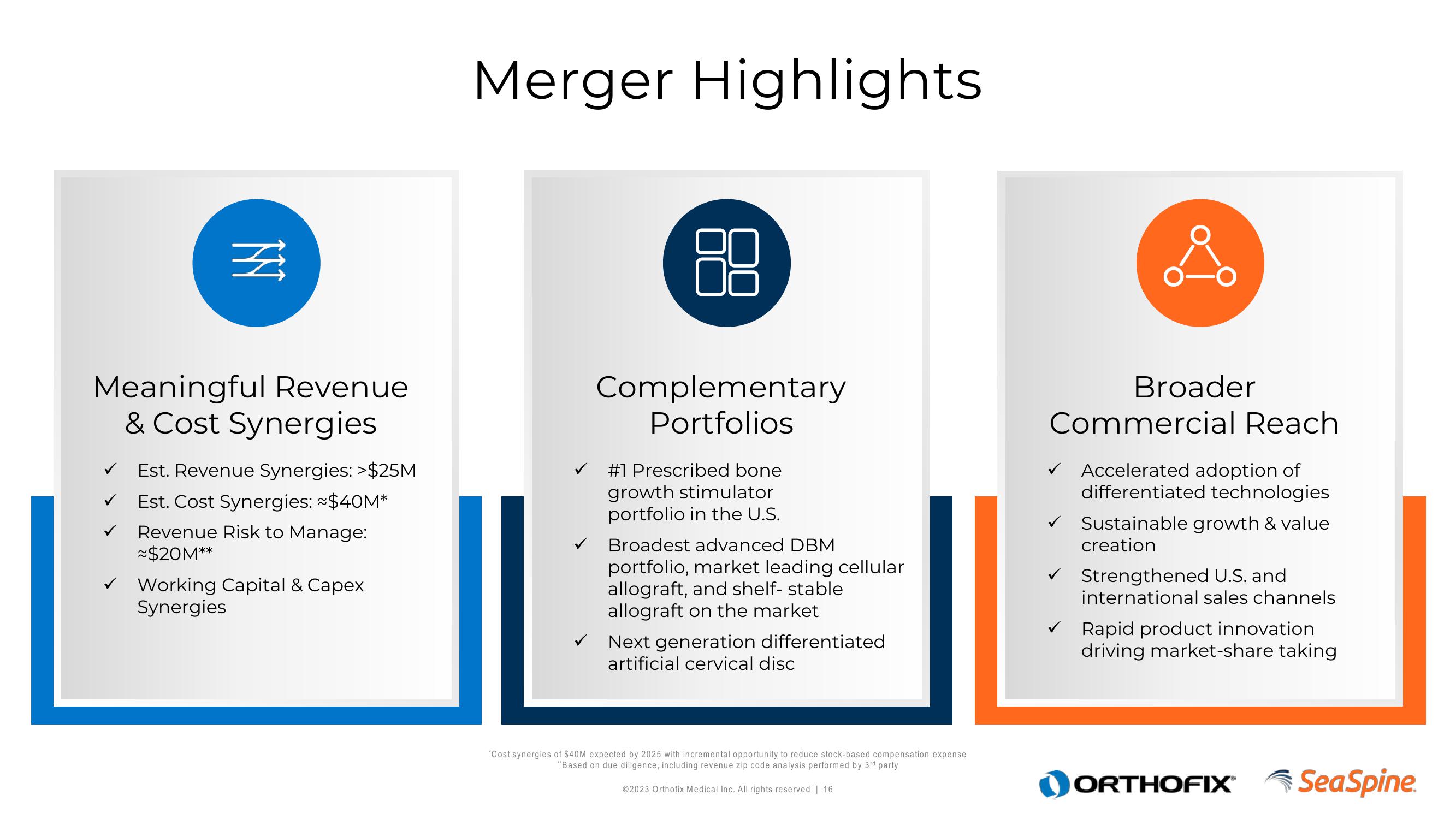

Meaningful Revenue

& Cost Synergies

✓

Est. Revenue Synergies: >$25M

Est. Cost Synergies:~$40M*

Revenue Risk to Manage:

~$20M**

Working Capital & Capex

Synergies

Merger Highlights

88

Complementary

Portfolios

#1 Prescribed bone

growth stimulator

portfolio in the U.S.

Broadest advanced DBM

portfolio, market leading cellular

allograft, and shelf- stable

allograft on the market

Next generation differentiated

artificial cervical disc

'Cost synergies of $40M expected by 2025 with incremental opportunity to reduce stock-based compensation expense

"Based on due diligence, including revenue zip code analysis performed by 3rd party

©2023 Orthofix Medical Inc. All rights reserved | 16

Å

Broader

Commercial Reach

✓ Accelerated adoption of

differentiated technologies

Sustainable growth & value

creation

Strengthened U.S. and

international sales channels

Rapid product innovation

driving market-share taking

ORTHOFIX®

SeaSpine.View entire presentation