Telia Company Results Presentation Deck

FINLAND-Q4 2020

LO

5

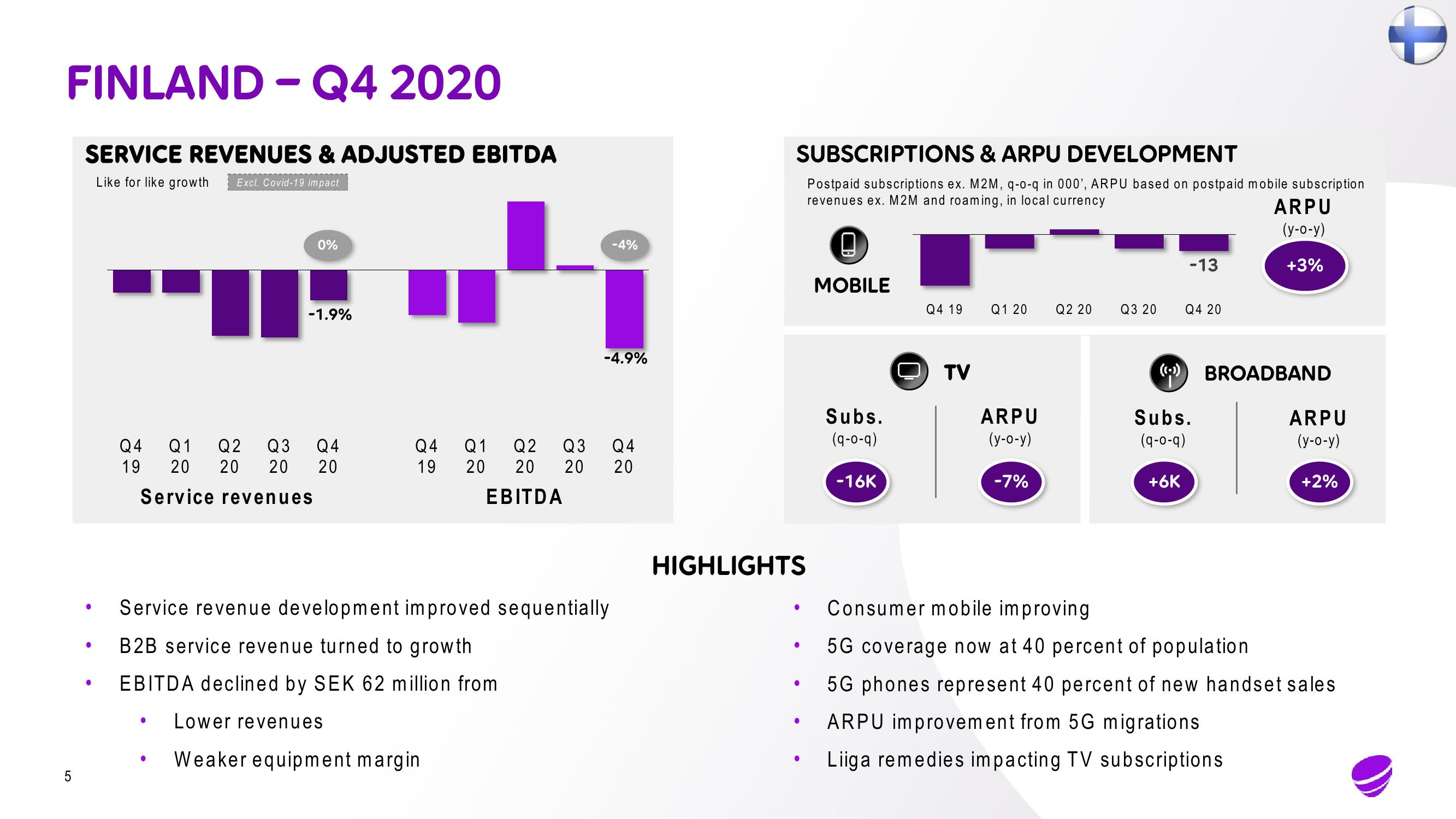

SERVICE REVENUES & ADJUSTED EBITDA

Like for like growth Excl. Covid-19 impact

●

●

●

0%

-1.9%

Q4 Q1 Q2 Q3 Q4

19 20 20 20 20

Service revenues

-4%

-4.9%

Q4 Q1 Q2 Q3 Q4

19 20 20 20 20

EBITDA

Service revenue development improved sequentially

B2B service revenue turned to growth

EBITDA declined by SEK 62 million from

Lower revenues

Weaker equipment margin

SUBSCRIPTIONS & ARPU DEVELOPMENT

Postpaid subscriptions ex. M2M, q-o-q in 000', ARPU based on postpaid mobile subscription

revenues ex. M2M and roaming, in local currency

HIGHLIGHTS

●

●

●

●

●

MOBILE

Subs.

(9-0-9)

-16K

U

Q4 19

TV

Q1 20

ARPU

(y-o-y)

-7%

Q2 20

Q3 20

((:))

-13

+6K

Q4 20

Subs.

(9-0-9)

ARPU

(y-o-y)

+3%

BROADBAND

ARPU

(y-o-y)

+2%

Consumer mobile improving

5G coverage now at 40 percent of population.

5G phones represent 40 percent of new handset sales

ARPU improvement from 5G migrations

Liiga remedies impacting TV subscriptionsView entire presentation