2nd Quarter 2021 Investor Presentation

Noninterest Income

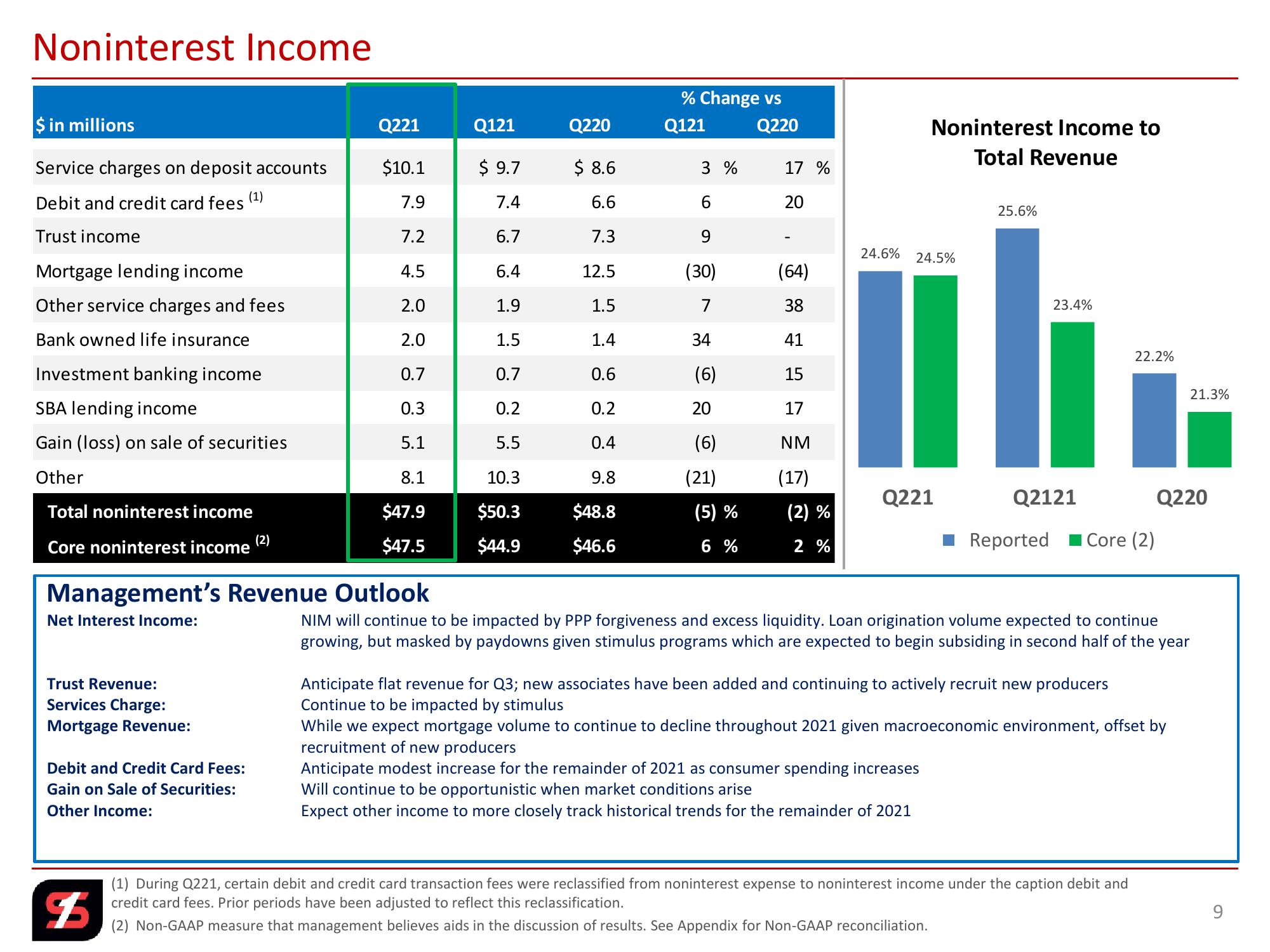

Noninterest Income to

Total Revenue

$ in millions

Q221

Q121

Q220

Q121

% Change vs

Q220

Service charges on deposit accounts

$10.1

$ 9.7

$ 8.6

3 %

17 %

Debit and credit card fees

(1)

7.9

7.4

6.6

6

20

Trust income

7.2

6.7

7.3

9

.

24.6%

24.5%

Mortgage lending income

4.5

6.4

12.5

(30)

(64)

Other service charges and fees

2.0

1.9

1.5

7

38

8 000

Bank owned life insurance

2.0

1.5

1.4

34

41

Investment banking income

0.7

0.7

0.6

(6)

15

SBA lending income

0.3

0.2

0.2

20

17

Gain (loss) on sale of securities

5.1

5.5

0.4

(6)

NM

Other

8.1

10.3

9.8

(21)

(17)

Q221

Total noninterest income

$47.9

$50.3

$48.8

(5) %

(2) %

(2)

Core noninterest income

$47.5

$44.9

$46.6

6%

2 %

25.6%

23.4%

Q2121

22.2%

21.3%

■ Reported Core (2)

Q220

Management's Revenue Outlook

Net Interest Income:

Trust Revenue:

Services Charge:

Mortgage Revenue:

Debit and Credit Card Fees:

Gain on Sale of Securities:

Other Income:

NIM will continue to be impacted by PPP forgiveness and excess liquidity. Loan origination volume expected to continue

growing, but masked by paydowns given stimulus programs which are expected to begin subsiding in second half of the year

Anticipate flat revenue for Q3; new associates have been added and continuing to actively recruit new producers

Continue to be impacted by stimulus

While we expect mortgage volume to continue to decline throughout 2021 given macroeconomic environment, offset by

recruitment of new producers

Anticipate modest increase for the remainder of 2021 as consumer spending increases

Will continue to be opportunistic when market conditions arise

Expect other income to more closely track historical trends for the remainder of 2021

$

(1) During Q221, certain debit and credit card transaction fees were reclassified from noninterest expense to noninterest income under the caption debit and

credit card fees. Prior periods have been adjusted to reflect this reclassification.

(2) Non-GAAP measure that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation.

9View entire presentation