First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

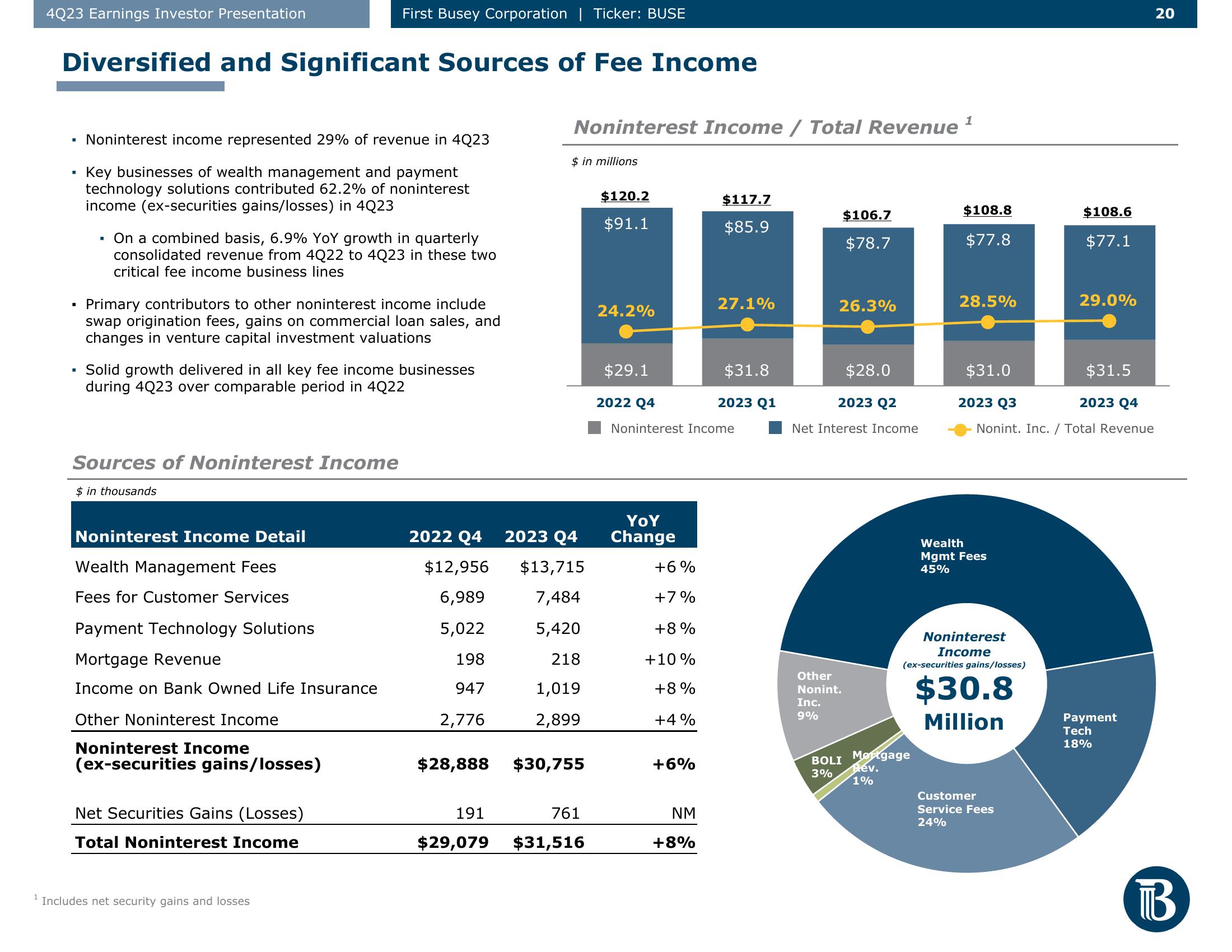

Diversified and Significant Sources of Fee Income

▪ Noninterest income represented 29% of revenue in 4Q23

Key businesses of wealth management and payment

technology solutions contributed 62.2% of noninterest

income (ex-securities gains/losses) in 4Q23

■

■

■

On a combined basis, 6.9% YoY growth in quarterly

consolidated revenue from 4Q22 to 4Q23 in these two

critical fee income business lines

Primary contributors to other noninterest income include

swap origination fees, gains on commercial loan sales, and

changes in venture capital investment valuations

Solid growth delivered in all key fee income businesses

during 4Q23 over comparable period in 4Q22

Sources of Noninterest Income

$ in thousands

Noninterest Income Detail

First Busey Corporation | Ticker: BUSE

Wealth Management Fees

Fees for Customer Services

Payment Technology Solutions

Mortgage Revenue

Income on Bank Owned Life Insurance

Other Noninterest Income

Noninterest Income

(ex-securities gains/losses)

Net Securities Gains (Losses)

Total Noninterest Income

Includes net security gains and losses

2022 Q4

$12,956

6,989

5,022

198

947

2,776

Noninterest Income / Total Revenue

$ in millions

2023 Q4

$13,715

7,484

5,420

218

1,019

2,899

$28,888 $30,755

191

761

$29,079 $31,516

$120.2

$91.1

24.2%

$29.1

2022 Q4

YOY

Change

+6%

+7%

+8%

+10%

+8%

+4%

+6%

$117.7

$85.9

Noninterest Income

NM

+8%

27.1%

$31.8

2023 Q1

26.3%

Other

Nonint.

Inc.

9%

$106.7

$78.7

2023 Q2

Net Interest Income

BOLI

3%

$28.0

1

Mortgage

Rev.

1%

$108.8

$77.8

28.5%

$31.0

$31.5

2023 Q4

Nonint. Inc. / Total Revenue

2023 Q3

Wealth

Mgmt Fees

45%

Noninterest

Income

(ex-securities gains/losses)

$30.8

Million

$108.6

$77.1

Customer

Service Fees

24%

29.0%

Payment

Tech

18%

20

BView entire presentation