AT&T Results Presentation Deck

9

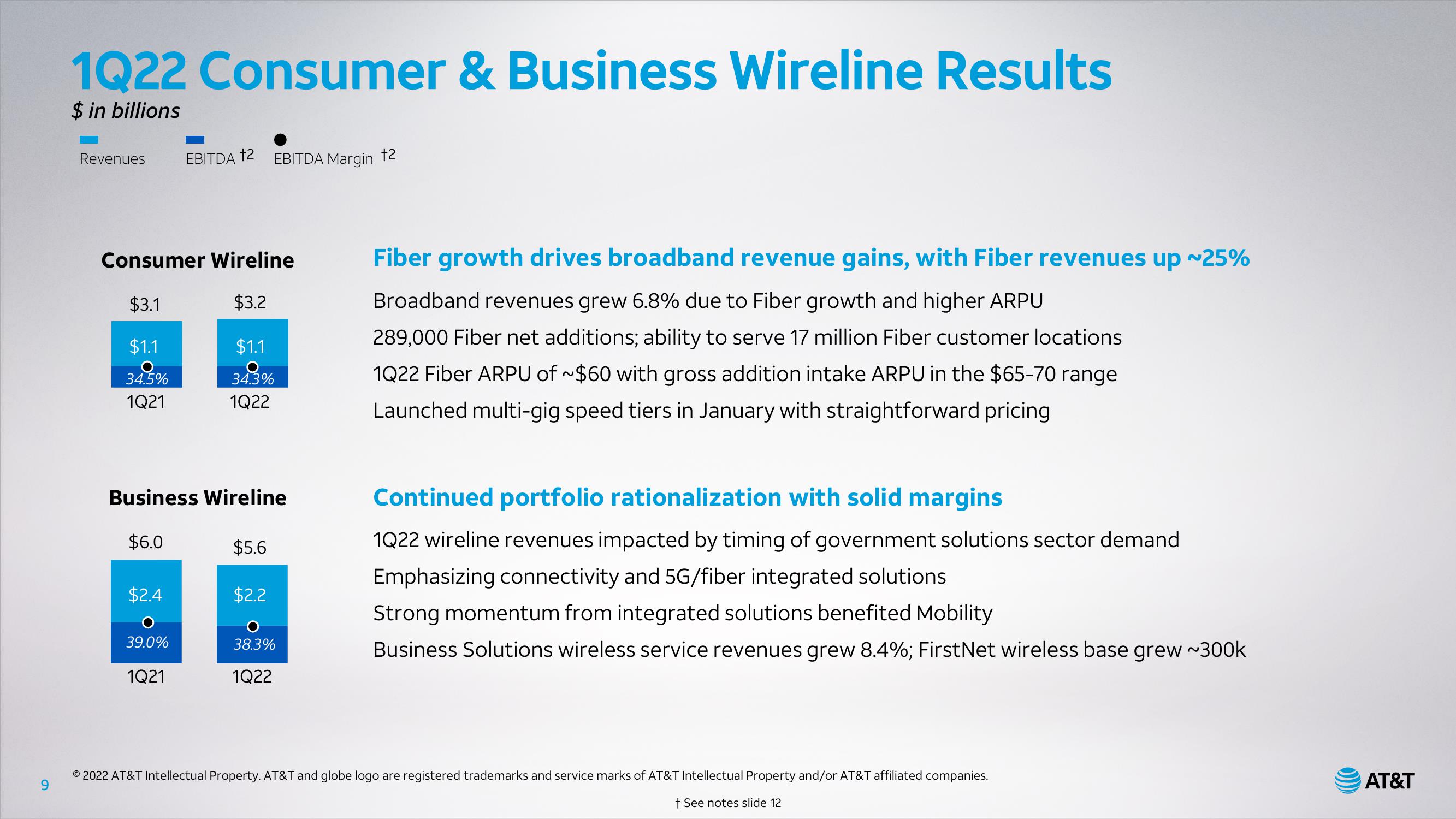

1Q22 Consumer & Business Wireline Results

$ in billions

Revenues

$3.1

$1.1

34.5%

1Q21

Consumer Wireline

$3.2

EBITDA †2

$2.4

39.0%

1Q21

$1.1

O

34.3%

1Q22

Business Wireline

$6.0

$5.6

EBITDA Margin †2

$2.2

38.3%

1Q22

Fiber growth drives broadband revenue gains, with Fiber revenues up ~25%

Broadband revenues grew 6.8% due to Fiber growth and higher ARPU

289,000 Fiber net additions; ability to serve 17 million Fiber customer locations

1Q22 Fiber ARPU of ~$60 with gross addition intake ARPU in the $65-70 range

Launched multi-gig speed tiers in January with straightforward pricing

Continued portfolio rationalization with solid margins

1Q22 wireline revenues impacted by timing of government solutions sector demand

Emphasizing connectivity and 5G/fiber integrated solutions

Strong momentum from integrated solutions benefited Mobility

Business Solutions wireless service revenues grew 8.4%; FirstNet wireless base grew ~300k

© 2022 AT&T Intellectual Property. AT&T and globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies.

+ See notes slide 12

AT&TView entire presentation