Credit Suisse Investment Banking Pitch Book

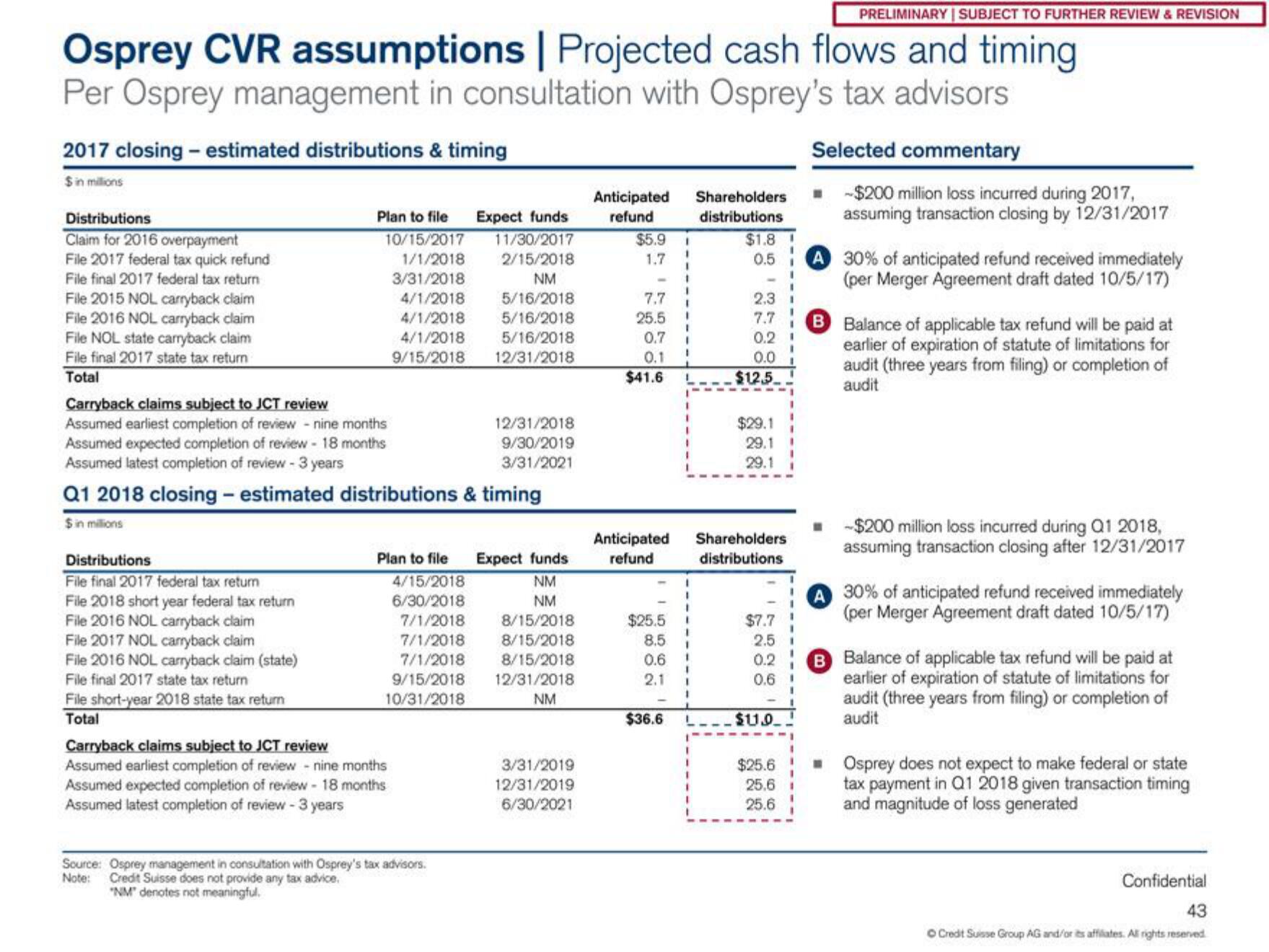

Osprey CVR assumptions | Projected cash flows and timing

Per Osprey management in consultation with Osprey's tax advisors

2017 closing - estimated distributions & timing

$ in millions

Distributions

Claim for 2016 overpayment

File 2017 federal tax quick refund

File final 2017 federal tax return

File 2015 NOL carryback claim

File 2016 NOL carryback claim

File NOL state carryback claim

File final 2017 state tax return

Total

Distributions

File final 2017 federal tax return

File 2018 short year federal tax return

File 2016 NOL carryback claim

File 2017 NOL carryback claim

File 2016 NOL carryback claim (state)

File final 2017 state tax return

Plan to file

10/15/2017

1/1/2018

3/31/2018

4/1/2018

4/1/2018

4/1/2018

9/15/2018

Carryback claims subject to JCT review

Assumed earliest completion of review - nine months

Assumed expected completion of review - 18 months

Assumed latest completion of review - 3 years

Q1 2018 closing - estimated distributions & timing

$ in millions

File short-year 2018 state tax return

Total

Plan to file

4/15/2018

6/30/2018

Carryback claims subject to JCT review

Assumed earliest completion of review - nine months

Assumed expected completion of review - 18 months

Assumed latest completion of review - 3 years

7/1/2018

7/1/2018

7/1/2018

9/15/2018

10/31/2018

Expect funds

11/30/2017

2/15/2018

NM

5/16/2018

5/16/2018

5/16/2018

12/31/2018

Source: Osprey management in consultation with Osprey's tax advisors.

Note: Credit Suisse does not provide any tax advice.

"NM" denotes not meaningful.

12/31/2018

9/30/2019

3/31/2021

Expect funds

NM

NM

8/15/2018

8/15/2018

8/15/2018

12/31/2018

NM

3/31/2019

12/31/2019

6/30/2021

Anticipated

refund

$5.9

1.7

7.7

25.5

0.7

0.1

$41.6

I

$25.5

8.5

0.6

2.1

1

Shareholders

distributions

$36.6 1

Anticipated Shareholders

refund

distributions

2.3 i

7.7

0.2 1

0.0

$12.5

$1.8

0.5 A 30% of anticipated refund received immediately

(per Merger Agreement draft dated 10/5/17)

$29.1

29.1

29.1

$7.7

2.5

0.2

0.6

$11.0

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

$25.6

25.6

25.6

Selected commentary

-$200 million loss incurred during 2017,

assuming transaction closing by 12/31/2017

B Balance of applicable tax refund will be paid at

earlier of expiration of statute of limitations for

audit (three years from filing) or completion of

audit

A

-$200 million loss incurred during Q1 2018,

assuming transaction closing after 12/31/2017

30% of anticipated refund received immediately

(per Merger Agreement draft dated 10/5/17)

B Balance of applicable tax refund will be paid at

earlier of expiration of statute of limitations for

audit (three years from filing) or completion of

audit

■ Osprey does not expect to make federal or state

tax payment in Q1 2018 given transaction timing

and magnitude of loss generated

Confidential

43

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation