First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

Previously Announced 4Q23 Balance Sheet Repositioning

Securities

Sold

Visa Class B

Common

Shares Sold

Net Gain

from

combined

transactions

Use of

Proceeds

Net Interest

Income

Impact

Regulatory

Capital

Impact

¹ Non-GAAP, see Appendix

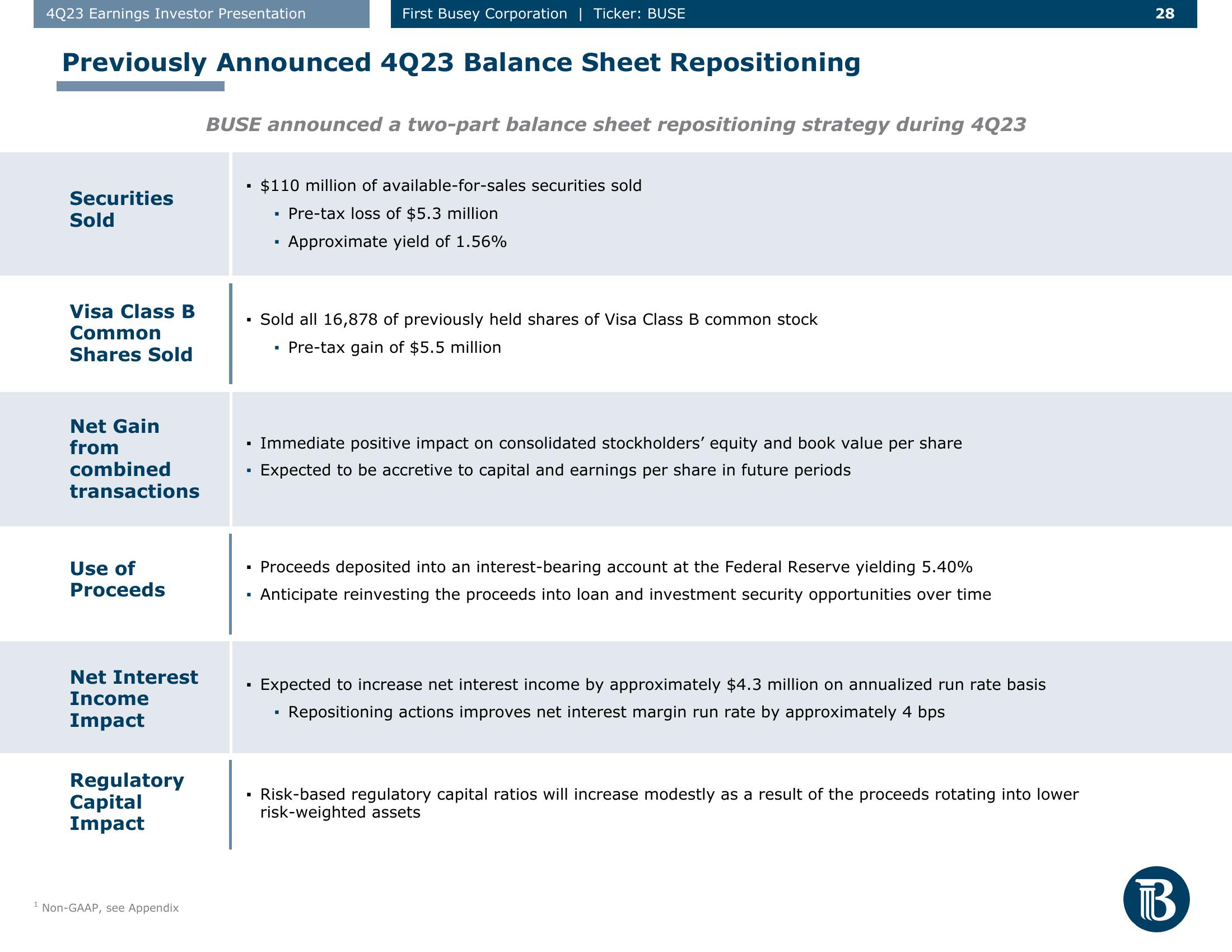

BUSE announced a two-part balance sheet repositioning strategy during 4Q23

▪ $110 million of available-for-sales securities sold

Pre-tax loss of $5.3 million

Approximate yield of 1.56%

■

I

First Busey Corporation | Ticker: BUSE

■

■

■

▪ Immediate positive impact on consolidated stockholders' equity and book value per share

▪ Expected to be accretive to capital and earnings per share in future periods

Sold all 16,878 of previously held shares of Visa Class B common stock

Pre-tax gain of $5.5 million

Proceeds deposited into an interest-bearing account at the Federal Reserve yielding 5.40%

Anticipate reinvesting the proceeds into loan and investment security opportunities over time

Expected to increase net interest income by approximately $4.3 million on annualized run rate basis

Repositioning actions improves net interest margin run rate by approximately 4 bps

I

Risk-based regulatory capital ratios will increase modestly as a result of the proceeds rotating into lower

risk-weighted assets

28

BView entire presentation