Credit Suisse Results Presentation Deck

Group Overview

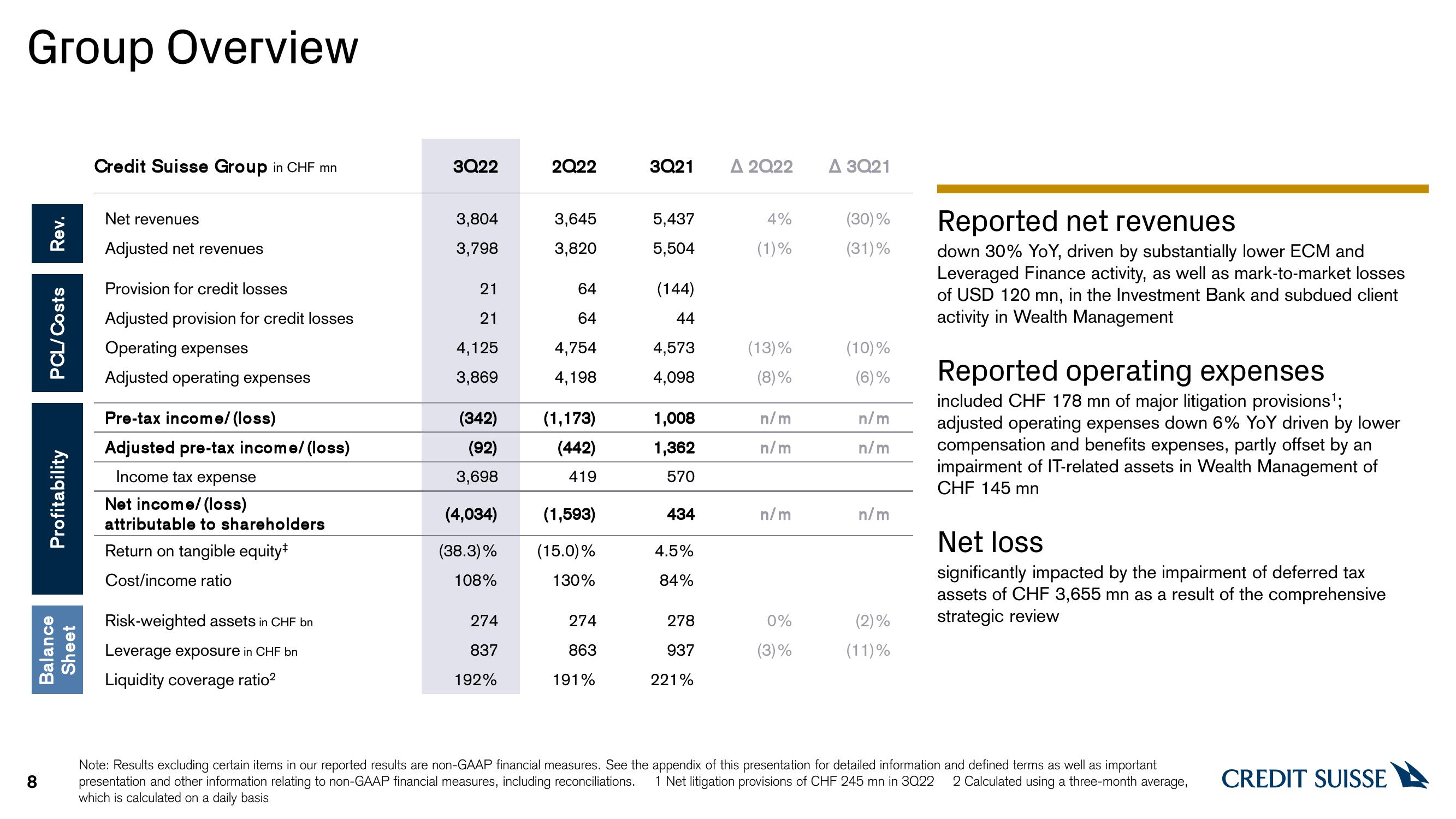

Rev.

8

PCL/Costs

Profitability

Balance

Sheet

Credit Suisse Group in CHF mn

Net revenues

Adjusted net revenues

Provision for credit losses

Adjusted provision for credit losses

Operating expenses

Adjusted operating expenses

Pre-tax income/(loss)

Adjusted pre-tax income/ (loss)

Income tax expense

Net income/(loss)

attributable to shareholders

Return on tangible equity

Cost/income ratio

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

Liquidity coverage ratio²

3Q22

3,804

3,798

21

21

4,125

3,869

(342)

(92)

3,698

(4,034)

(38.3)%

108%

274

837

192%

2Q22

3,645

3,820

64

64

4,754

4,198

(1,173)

(442)

419

(1,593)

(15.0)%

130%

274

863

191%

3Q21

5,437

5,504

(144)

44

4,573

4,098

1,008

1,362

570

434

4.5%

84%

278

937

221%

A 2022

4%

(1) %

(13)%

(8)%

n/m

n/m

n/m

0%

(3)%

A 3Q21

(30)%

(31)%

(10)%

(6) %

n/m

n/m

n/m

(2)%

(11)%

Reported net revenues

down 30% YoY, driven by substantially lower ECM and

Leveraged Finance activity, as well as mark-to-market losses

of USD 120 mn, in the Investment Bank and subdued client

activity in Wealth Management

Reported operating expenses

included CHF 178 mn of major litigation provisions¹;

adjusted operating expenses down 6% YoY driven by lower

compensation and benefits expenses, partly offset by an

impairment of IT-related assets in Wealth Management of

CHF 145 mn

Net loss

significantly impacted by the impairment of deferred tax

assets of CHF 3,655 mn as a result of the comprehensive

strategic review

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Net litigation provisions of CHF 245 mn in 3022 2 Calculated using a three-month average,

which is calculated on a daily basis

CREDIT SUISSEView entire presentation