Investor Presentation

NEPTUNE ACQUISITION

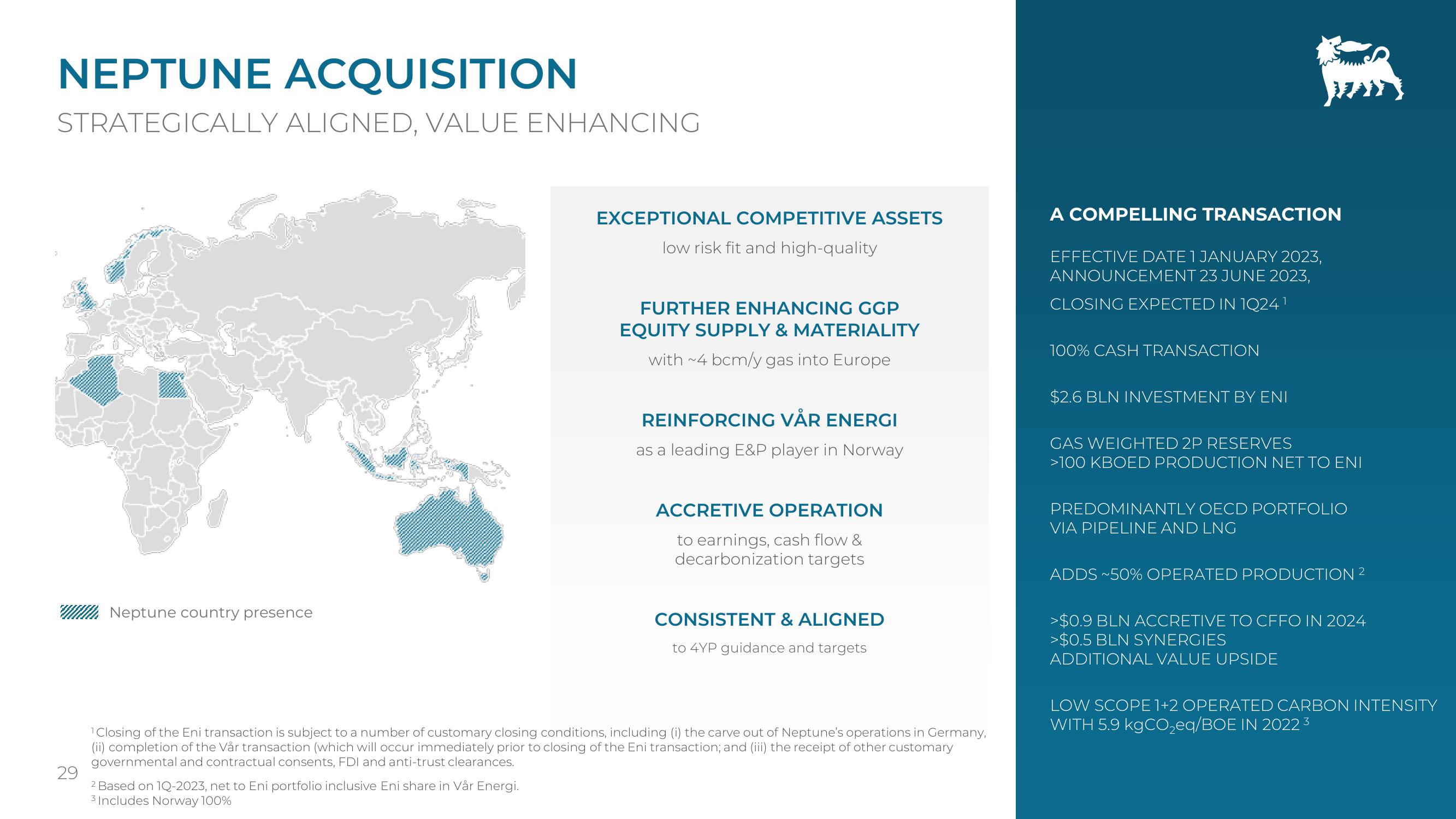

STRATEGICALLY ALIGNED, VALUE ENHANCING

29

EXCEPTIONAL COMPETITIVE ASSETS

low risk fit and high-quality

FURTHER ENHANCING GGP

EQUITY SUPPLY & MATERIALITY

with ~4 bcm/y gas into Europe

REINFORCING VÅR ENERGI

as a leading E&P player in Norway

A COMPELLING TRANSACTION

EFFECTIVE DATE 1 JANUARY 2023,

ANNOUNCEMENT 23 JUNE 2023,

CLOSING EXPECTED IN 1Q241

100% CASH TRANSACTION

$2.6 BLN INVESTMENT BY ENI

GAS WEIGHTED 2P RESERVES

>100 KBOED PRODUCTION NET TO ENI

Neptune country presence

ACCRETIVE OPERATION

to earnings, cash flow &

decarbonization targets

CONSISTENT & ALIGNED

to 4YP guidance and targets

1 Closing of the Eni transaction is subject to a number of customary closing conditions, including (i) the carve out of Neptune's operations in Germany,

(ii) completion of the Vår transaction (which will occur immediately prior to closing of the Eni transaction; and (iii) the receipt of other customary

governmental and contractual consents, FDI and anti-trust clearances.

2 Based on 1Q-2023, net to Eni portfolio inclusive Eni share in Vår Energi.

PREDOMINANTLY OECD PORTFOLIO

VIA PIPELINE AND LNG

ADDS ~50% OPERATED PRODUCTION 2

>$0.9 BLN ACCRETIVE TO CFFO IN 2024

>$0.5 BLN SYNERGIES

ADDITIONAL VALUE UPSIDE

LOW SCOPE 1+2 OPERATED CARBON INTENSITY

WITH 5.9 kgCO2eq/BOE IN 20223

3 Includes Norway 100%View entire presentation