Credit Suisse Results Presentation Deck

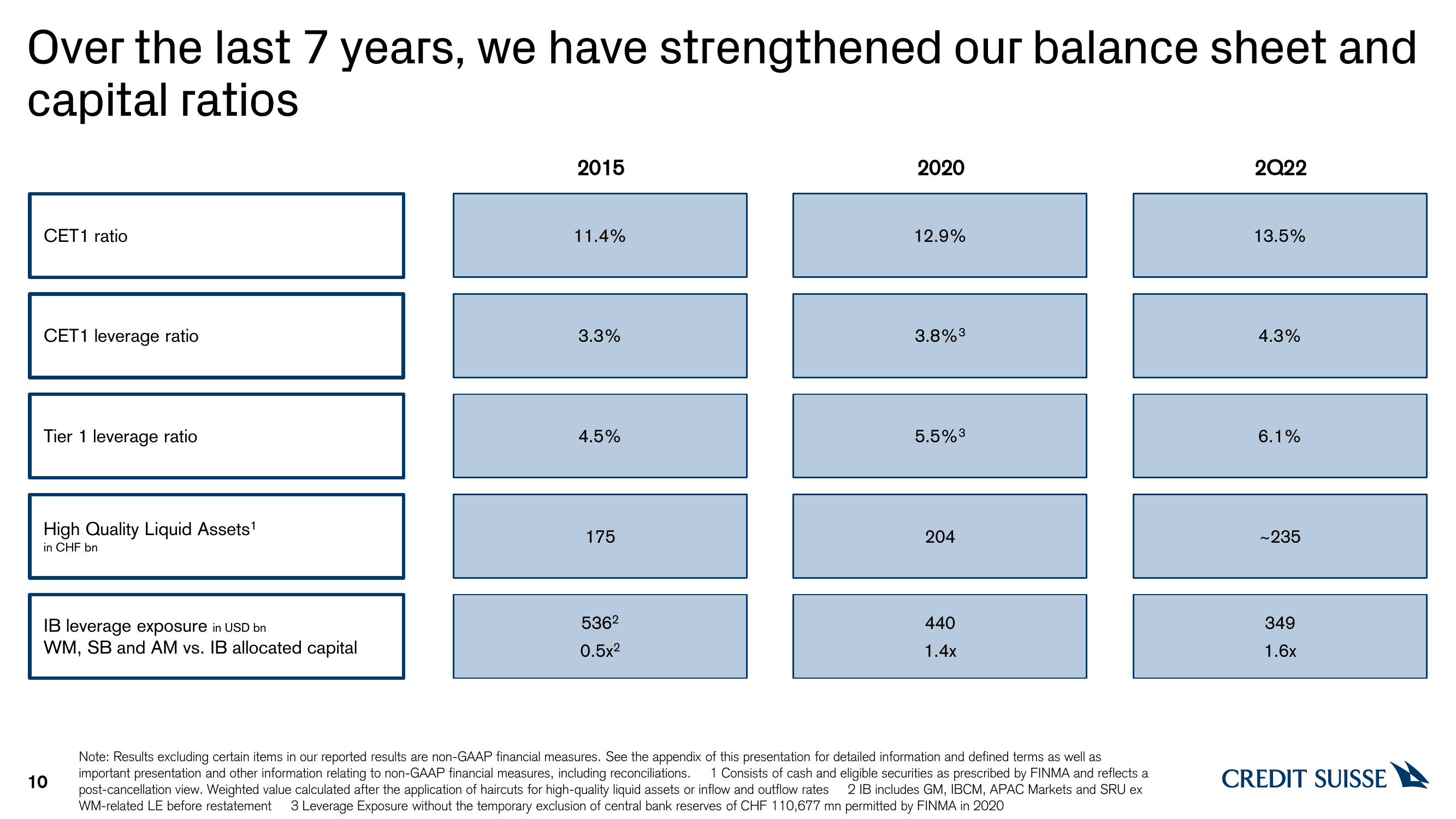

Over the last 7 years, we have strengthened our balance sheet and

capital ratios

CET1 ratio

CET1 leverage ratio

Tier 1 leverage ratio

High Quality Liquid Assets¹

in CHF bn

IB leverage exposure in USD bn

WM, SB and AM vs. IB allocated capital

10

2015

11.4%

3.3%

4.5%

175

536²

0.5x2

2020

12.9%

3.8%³

5.5%³

204

440

1.4x

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as

important presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Consists of cash and eligible securities as prescribed by FINMA and reflects a

post-cancellation view. Weighted value calculated after the application of haircuts for high-quality liquid assets or inflow and outflow rates 2 IB includes GM, IBCM, APAC Markets and SRU ex

WM-related LE before restatement 3 Leverage Exposure without the temporary exclusion of central bank reserves of CHF 110,677 mn permitted by FINMA in 2020

2022

13.5%

4.3%

6.1%

~235

349

1.6x

CREDIT SUISSEView entire presentation