Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Structural hedge

Hedge notional

(£bn)

GBP 5 Year

swap rate¹ (%)

Gross hedge

contribution

(£m)

PERFORMANCE

171

1.5

1.0

Dec-19 Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21

0.5

0.0

Q120

174

2016

435

hay

ASSET QUALITY

431

2017 2018 2019

-Zero Yield Close

Q220 Q320 Q420

28 | Barclays Q4 2021 Results | 23 February 2022

174 181 188 192 198

407

¹ UK Pound Sterling SONIA OIS Zero 5 Year Point (Refinitiv: GBPOIS5YZ=R) |

CAPITAL

& LEVERAGE

377

350

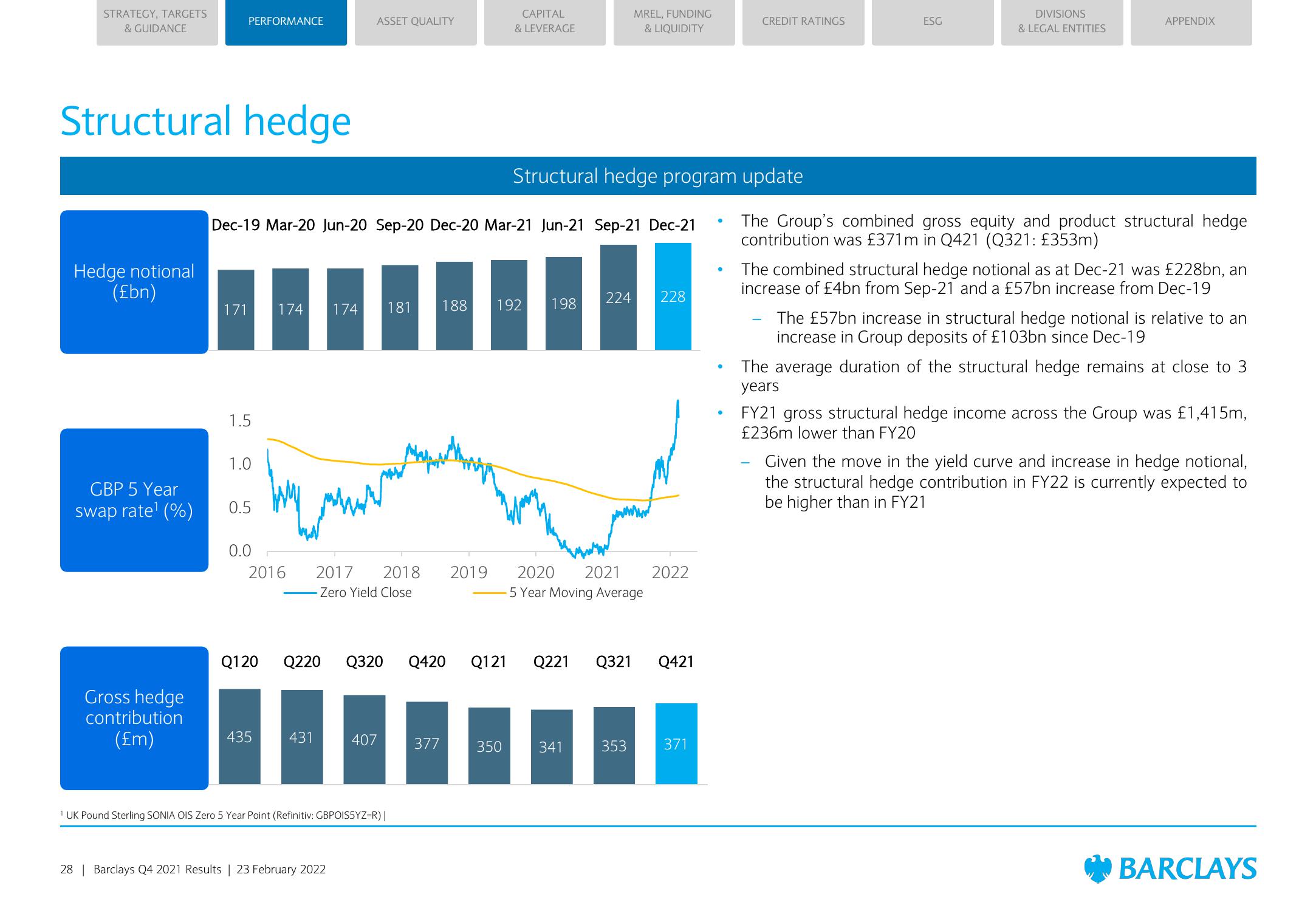

Structural hedge program update

MREL, FUNDING

& LIQUIDITY

224 228

2020 2021

5 Year Moving Average

341

Q121 Q221 Q321 Q421

353

2022

371

.

CREDIT RATINGS

ESG

-

DIVISIONS

& LEGAL ENTITIES

APPENDIX

The Group's combined gross equity and product structural hedge

contribution was £371m in Q421 (Q321: £353m)

The combined structural hedge notional as at Dec-21 was £228bn, an

increase of £4bn from Sep-21 and a £57bn increase from Dec-19

The £57bn increase in structural hedge notional is relative to an

increase in Group deposits of £103bn since Dec-19

The average duration of the structural hedge remains at close to 3

years

FY21 gross structural hedge income across the Group was £1,415m,

£236m lower than FY20

Given the move in the yield curve and increase in hedge notional,

the structural hedge contribution in FY22 is currently expected to

be higher than in FY21

BARCLAYSView entire presentation