Tradeweb Results Presentation Deck

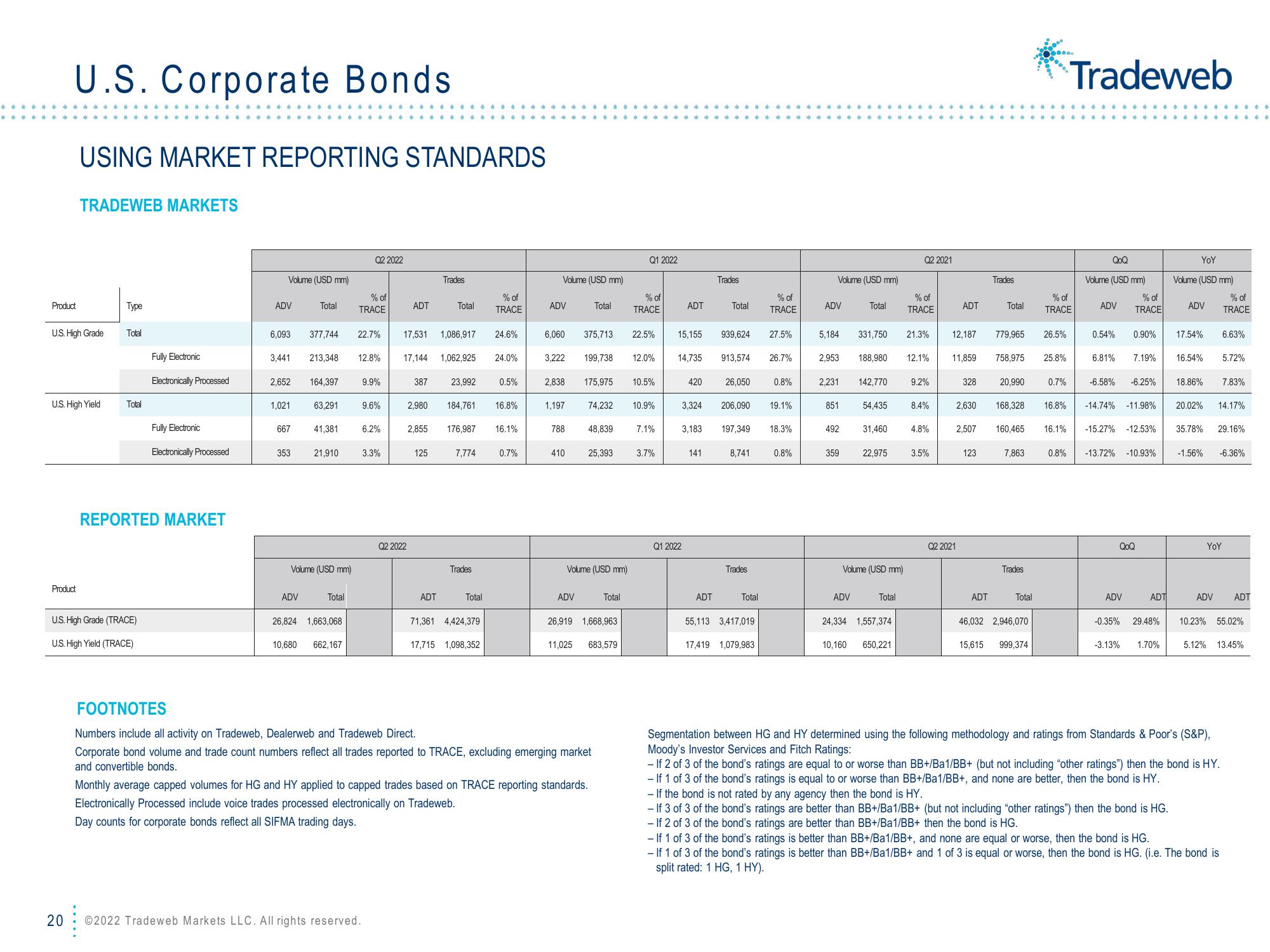

U.S. Corporate Bonds

Product

USING MARKET REPORTING STANDARDS

U.S. High Grade

Product

TRADEWEB MARKETS

U.S. High Yield

20

Type

Total

Total

U.S. High Grade (TRACE)

U.S. High Yield (TRACE)

Fully Electronic

Electronically Processed

Fully Electronic

Electronically Processed

REPORTED MARKET

Volume (USD mm)

ADV

6,093

3,441

2,652

1,021

667

353

Total

ADV

164,397

377,744 22.7%

213,348 12.8%

63,291

41,381

Volume (USD mm)

Total

26,824 1,663,068

Q2 2022

% of

TRACE

10,680 662,167

21,910 3.3%

9.9%

9.6%

©2022 Tradeweb Markets LLC. All rights reserved.

6.2%

ADT

387

Q2 2022

17,531 1,086,917

17,144 1,062,925 24.0%

2.855

Trades

125

Total

ADT

23,992

2.980 184,761 16.8%

176,987

7,774

Trades

% of

TRACE

Total

71,361 4,424,379

17,715 1,098,352

24.6%

0.5%

16.1%

0.7%

Volume (USD mm)

ADV

3,222

2,838

1,197

788

410

6,060 375,713 22.5% 15,155 939,624 27.5%

ADV

Total

11,025

175,975

199,738 12.0%

48,839

Volume (USD mm)

25,393

74,232 10.9%

FOOTNOTES

Numbers include all activity on Tradeweb, Dealerweb and Tradeweb Direct.

Corporate bond volume and trade count numbers reflect all trades reported to TRACE, excluding emerging market

and convertible bonds.

26,919 1,668,963

683,579

Monthly average capped volumes for HG and HY applied to capped trades based on TRACE reporting standards.

Electronically Processed include voice trades processed electronically on Tradeweb.

Day counts for corporate bonds reflect all SIFMA trading days.

Q1 2022

% of

TRACE

Total

10.5%

7.1%

3.7%

ADT

Q1 2022

Trades

Total

14,735 913,574 26.7%

420 26,050

141

ADT

3,324 206,090 19.1%

3,183

197,349

8,741

% of

TRACE

Trades

Total

55,113 3,417,019

17,419 1,079,983

0.8%

18.3%

0.8%

Volume (USD mm)

ADV

5,184

2,231

2,953 188,980

851

492

359

Total

331,750

ADV

142,770

54,435

31,460

22,975

Volume (USD mm)

Total

24,334 1,557,374

10,160

650,221

Q2 2021

% of

TRACE

21.3%

12.1%

9.2%

8.4%

4.8%

3.5%

ADT

Q2 2021

328

12,187 779,965 26.5%

11,859 758,975 25.8%

2,630

2.507

123

ADT

Trades

Total

15,615

20,990

168,328 16.8%

160,465 16.1%

Trades

% of

TRACE

7,863 0.8%

Total

46,032 2,946,070

0.7%

999,374

Tradeweb

QOQ

Volume (USD mm)

ADV

6.81%

% of

TRACE

0.54% 0.90% 17.54% 6.63%

7.19%

-15.27% -12.53%

-13.72% -10.93%

ADV

QoQ

-3.13%

-6.58% -6.25% 18.86% 7.83%

-14.74% -11.98% 20.02% 14.17%

ADT

-0.35% 29.48%

YoY

Volume (USD mm)

ADV

1.70%

-If the bond is not rated by any agency then the bond is HY.

- If 3 of 3 of the bond's ratings are better than BB+/Ba1/BB+ (but not including "other ratings") then the bond is HG.

- If 2 of 3 of the bond's ratings are better than BB+/Ba1/BB+ then the bond is HG.

16.54% 5.72%

% of

TRACE

35.78% 29.16%

-1.56% -6.36%

YOY

ADV ADT

10.23% 55.02%

Segmentation between HG and HY determined using the following methodology and ratings from Standards & Poor's (S&P),

Moody's Investor Services and Fitch Ratings:

- If 2 of 3 of the bond's ratings are equal to or worse than BB+/Ba1/BB+ (but not including "other ratings") then the bond is HY.

- If 1 of 3 of the bond's ratings is equal to or worse than BB+/Ba1/BB+, and none are better, then the bond is HY.

5.12% 13.45%

- If 1 of 3 of the bond's ratings is better than BB+/Ba1/BB+, and none are equal or worse, then the bond is HG.

- If 1 of 3 of the bond's ratings is better than BB+/Ba1/BB+ and 1 of 3 is equal or worse, then the bond is HG. (i.e. The bond is

split rated: 1 HG, 1 HY).View entire presentation