Apollo Global Management Investor Day Presentation Deck

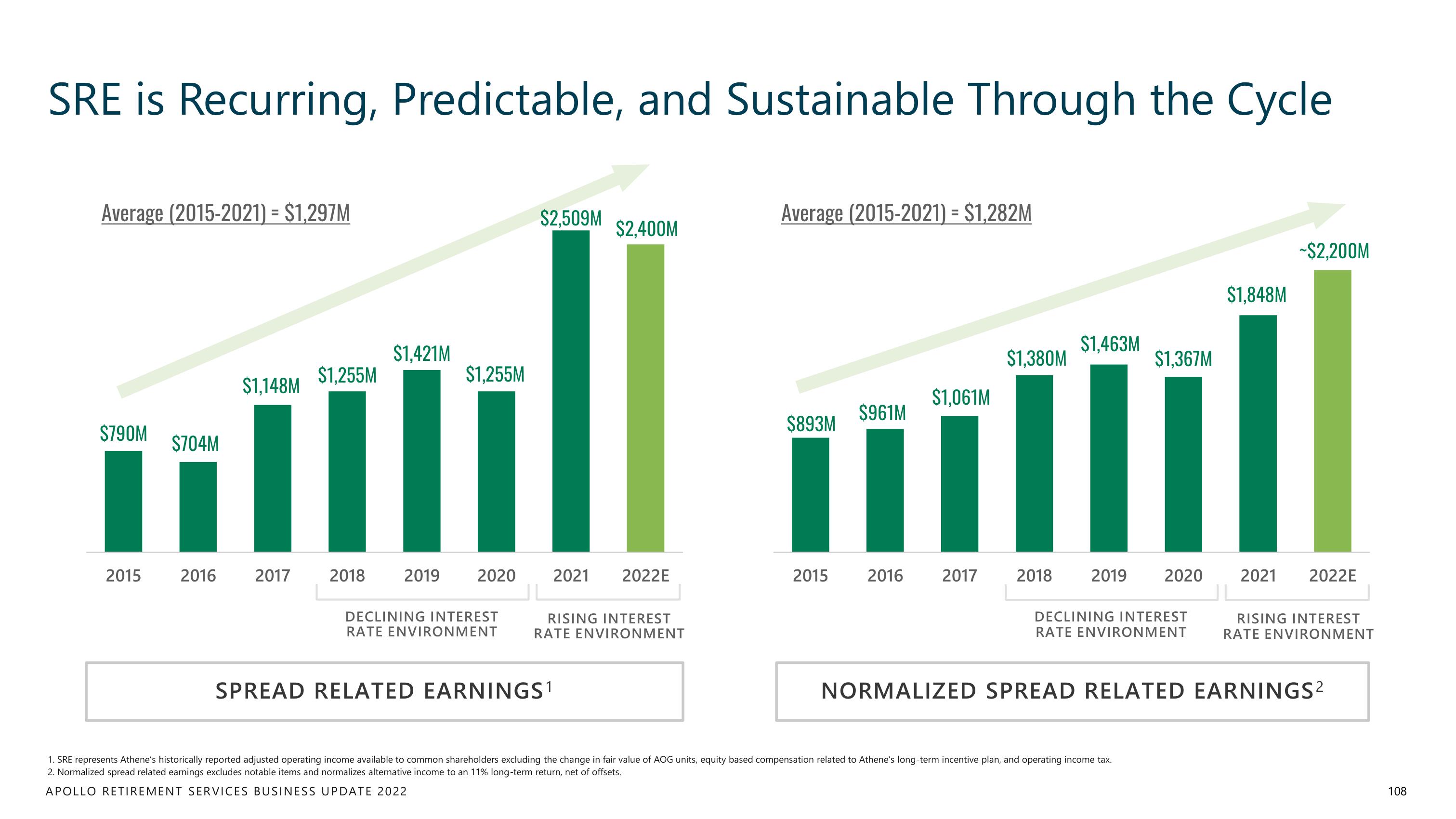

SRE is Recurring, Predictable, and Sustainable Through the Cycle

Average (2015-2021) = $1,297M

$790M

2015

$704M

$1,255M

2016

$1,148M

ill 11

2017

$1,421M

2018

$1,255M

2019

2020

DECLINING INTEREST

RATE ENVIRONMENT

$2,509M

$2,400M

SPREAD RELATED EARNINGS¹

2021 2022E

RISING INTEREST

RATE ENVIRONMENT

Average (2015-2021) = $1,282M

$893M

2015

$961M

2016

$1,061M

2017

$1,380M

2018

$1,463M

2019

$1,367M

2020

DECLINING INTEREST

RATE ENVIRONMENT

1. SRE represents Athene's historically reported adjusted operating income available to common shareholders excluding the change in fair value of AOG units, equity based compensation related to Athene's long-term incentive plan, and operating income tax.

2. Normalized spread related earnings excludes notable items and normalizes alternative income to an 11% long-term return, net of offsets.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

$1,848M

-$2,200M

||

2021 2022E

RISING INTEREST

RATE ENVIRONMENT

NORMALIZED SPREAD RELATED EARNINGS²

108View entire presentation