CorpAcq SPAC Presentation Deck

$mm

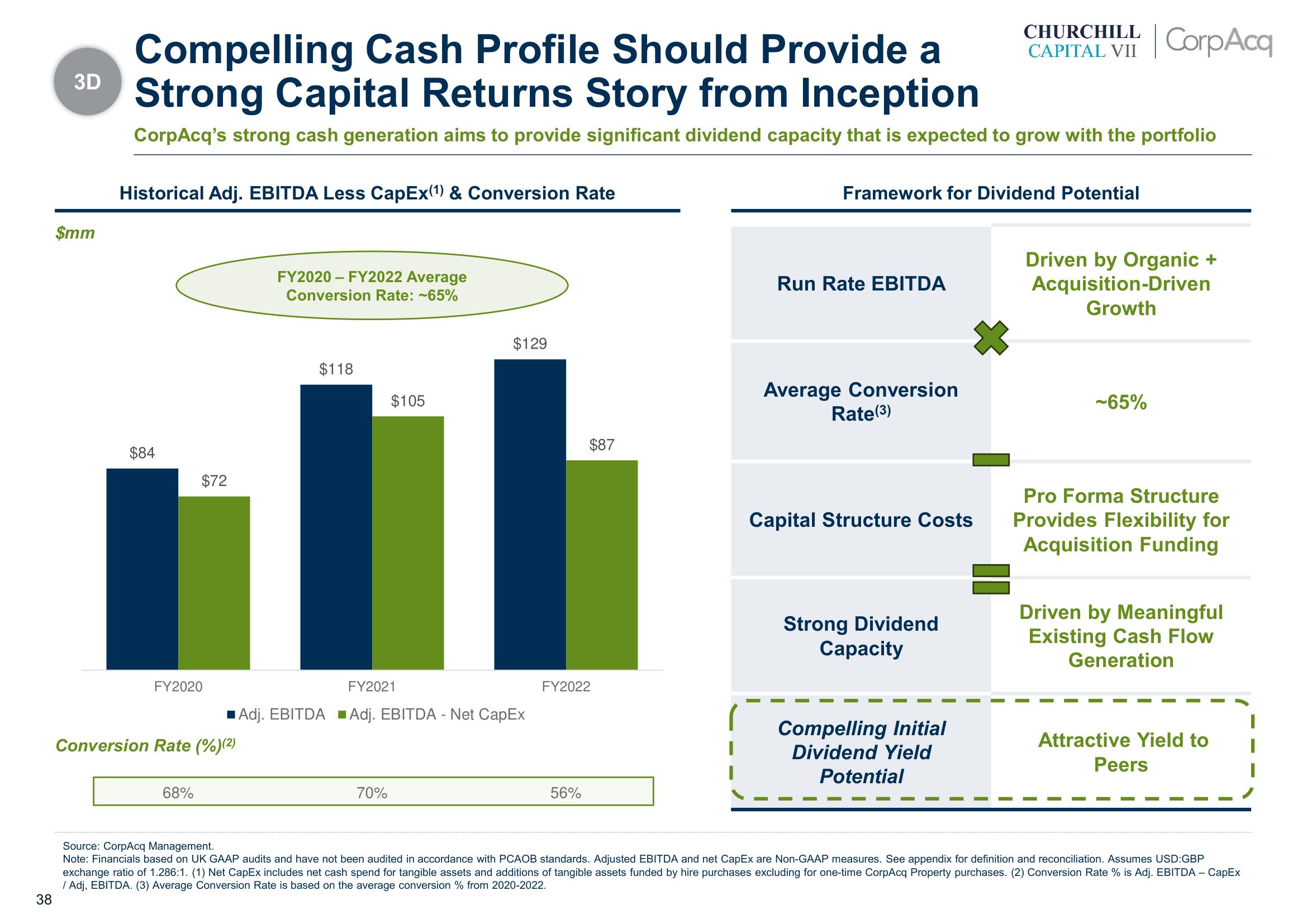

Compelling Cash Profile Should Provide a

3D Strong Capital Returns Story from Inception

CorpAcq's strong cash generation aims to provide significant dividend capacity that is expected to grow with the portfolio

Historical Adj. EBITDA Less CapEx(1) & Conversion Rate

$84

$72

FY2020

68%

Conversion Rate (%)(2)

FY2020-FY2022 Average

Conversion Rate: -65%

$118

$105

FY2021

■Adj. EBITDA Adj. EBITDA - Net CapEx

70%

$129

$87

FY2022

56%

Framework for Dividend Potential

Run Rate EBITDA

Average Conversion

Rate(3)

Capital Structure Costs

CHURCHILL

CAPITAL VII

Strong Dividend

Capacity

Compelling Initial

Dividend Yield

Potential

CorpAcq

Driven by Organic +

Acquisition-Driven

Growth

-65%

Pro Forma Structure

Provides Flexibility for

Acquisition Funding

Driven by Meaningful

Existing Cash Flow

Generation

Attractive Yield to

Peers

Source: CorpAcq Management.

Note: Financials based on UK GAAP audits and have not been audited in accordance with PCAOB standards. Adjusted EBITDA and net CapEx are Non-GAAP measures. See appendix for definition and reconciliation. Assumes USD:GBP

exchange ratio of 1.286:1. (1) Net CapEx includes net cash spend for tangible assets and additions of tangible assets funded by hire purchases excluding for one-time CorpAcq Property purchases. (2) Conversion Rate % is Adj. EBITDA - CapEx

/ Adj, EBITDA. (3) Average Conversion Rate is based on the average conversion % from 2020-2022.

38View entire presentation