J.P.Morgan Results Presentation Deck

Asset & Wealth Management¹

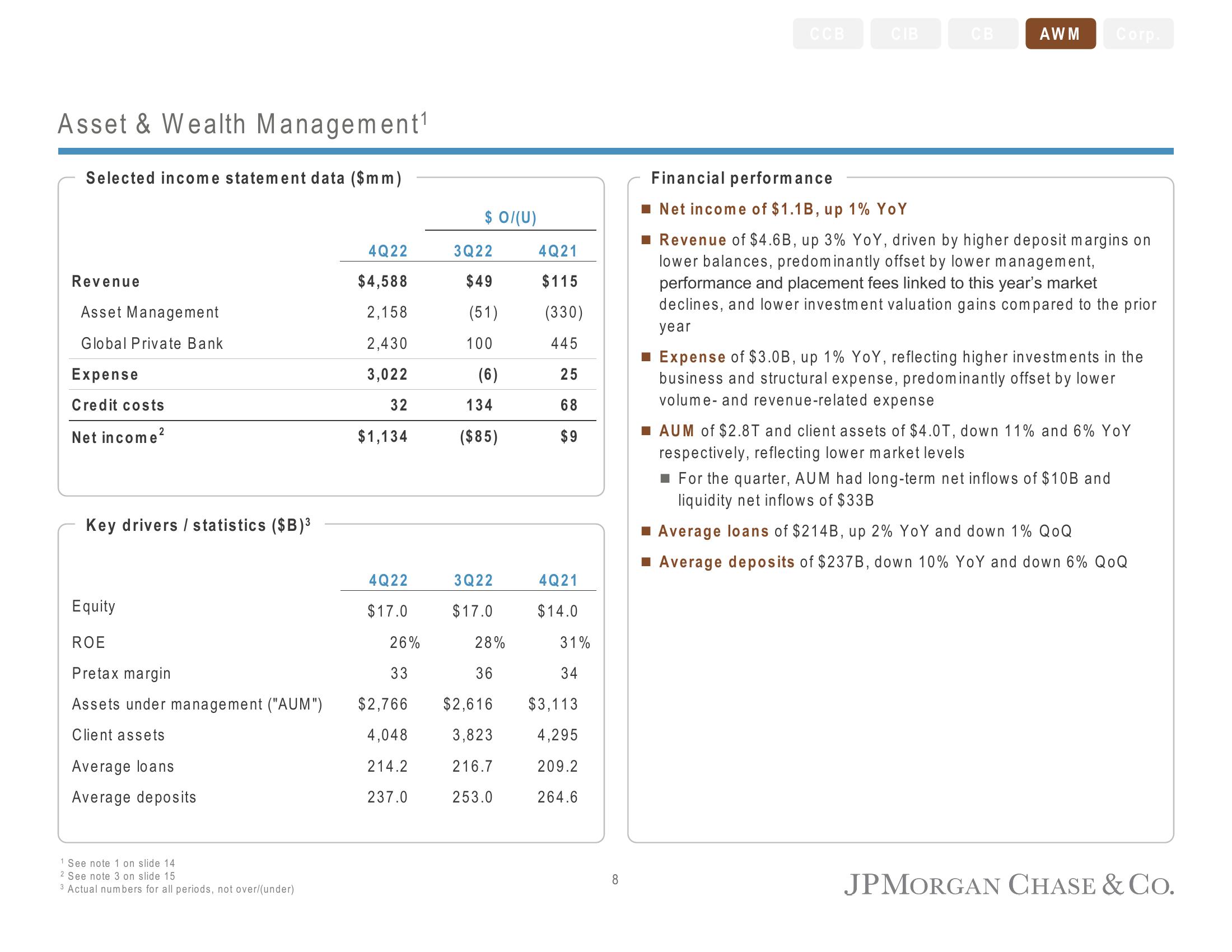

Selected income statement data ($mm)

Revenue

Asset Management

Global Private Bank

Expense

Credit costs

Net income²

Key drivers / statistics ($B)³

Equity

ROE

Pretax margin

Assets under management ("AUM")

Client assets

Average loans

Average deposits

1 See note 1 on slide 14

2 See note 3 on slide 15

3 Actual numbers for all periods, not over/(under)

4Q22

$4,588

2,158

2,430

3,022

32

$1,134

4Q22

$17.0

26%

33

$2,766

4,048

214.2

237.0

$ 0/(U)

3Q22

$49

(51)

100

(6)

134

($85)

3Q22

$17.0

28%

36

$2,616

3,823

216.7

253.0

4Q21

$115

(330)

445

25

68

$9

4Q21

$14.0

31%

34

$3,113

4,295

209.2

264.6

8

CCB

CIB

CB

AWM Corp.

Financial performance

■ Net income of $1.1B, up 1% YoY

Revenue of $4.6B, up 3% YoY, driven by higher deposit margins on

lower balances, predominantly offset by lower management,

performance and placement fees linked to this year's market

declines, and lower investment valuation gains compared to the prior

year

■ Expense of $3.0B, up 1% YoY, reflecting higher investments in the

business and structural expense, predominantly offset by lower

volume- and revenue-related expense

■AUM of $2.8T and client assets of $4.0T, down 11% and 6% YoY

respectively, reflecting lower market levels

■ For the quarter, AUM had long-term net inflows of $10B and

liquidity net inflows of $33B

■ Average loans of $214B, up 2% YoY and down 1% QOQ

■ Average deposits of $237B, down 10% YoY and down 6% QOQ

JPMORGAN CHASE & Co.View entire presentation