OSP Value Fund IV LP Q4 2022

OSP

Source

Opportunities

Profile vs

Investment

Bull's-eye

Scope DD

vs Reps

Mobilize

Resources

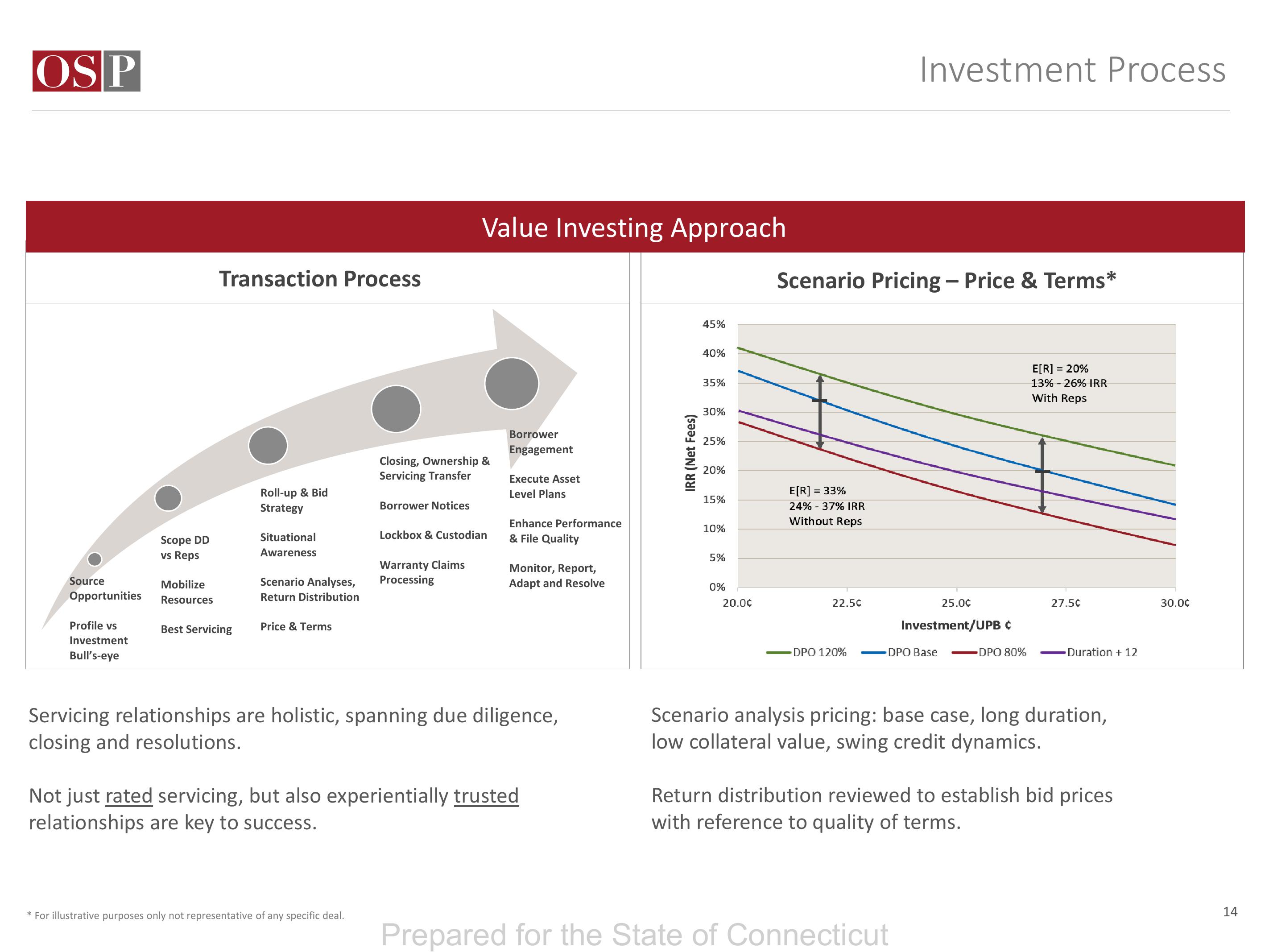

Transaction Process

Best Servicing

Roll-up & Bid

Strategy

Situational

Awareness

Scenario Analyses,

Return Distribution

Price & Terms

Closing, Ownership &

Servicing Transfer

Borrower Notices

* For illustrative purposes only not representative of any specific deal.

Value Investing Approach

Lockbox & Custodian

Warranty Claims

Processing

Borrower

Engagement

Execute Asset

Level Plans

Enhance Performance

& File Quality

Monitor, Report,

Adapt and Resolve

Servicing relationships are holistic, spanning due diligence,

closing and resolutions.

Not just rated servicing, but also experientially trusted

relationships are key to success.

IRR (Net Fees)

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

20.0¢

Scenario Pricing - Price & Terms*

E[R] = 33%

24% -37% IRR

Without Reps

22.5¢

DPO 120%

Investment Process

25.0¢

Investment/UPB ¢

DPO Base

Prepared for the State of Connecticut

DPO 80%

E[R] = 20%

13% -26% IRR

With Reps

27.56

- Duration + 12

Scenario analysis pricing: base case, long duration,

low collateral value, swing credit dynamics.

Return distribution reviewed to establish bid prices

with reference to quality of terms.

30.00

14View entire presentation