Trian Partners Activist Presentation Deck

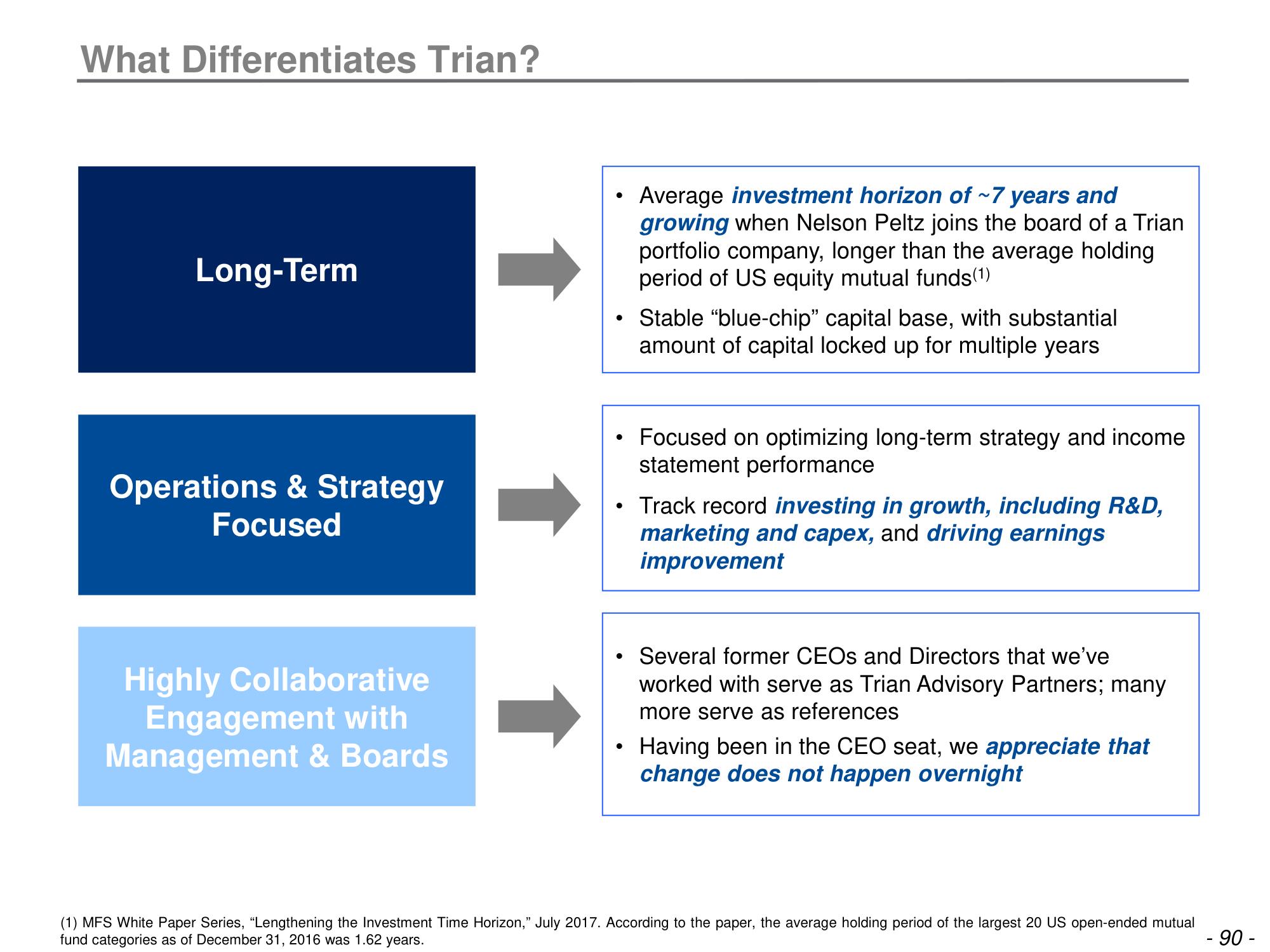

What Differentiates Trian?

Long-Term

Operations & Strategy

Focused

Highly Collaborative

Engagement with

Management & Boards

●

Average investment horizon of ~7 years and

growing when Nelson Peltz joins the board of a Trian

portfolio company, longer than the average holding

period of US equity mutual funds(1)

Stable "blue-chip" capital base, with substantial

amount of capital locked up for multiple years

Focused on optimizing long-term strategy and income

statement performance

Track record investing in growth, including R&D,

marketing and capex, and driving earnings

improvement

Several former CEOs and Directors that we've

worked with serve as Trian Advisory Partners; many

more serve as references

Having been in the CEO seat, we appreciate that

change does not happen overnight

(1) MFS White Paper Series, "Lengthening the Investment Time Horizon," July 2017. According to the paper, the average holding period of the largest 20 US open-ended mutual

fund categories as of December 31, 2016 was 1.62 years.

- 90 -View entire presentation