Engine No. 1 Activist Presentation Deck

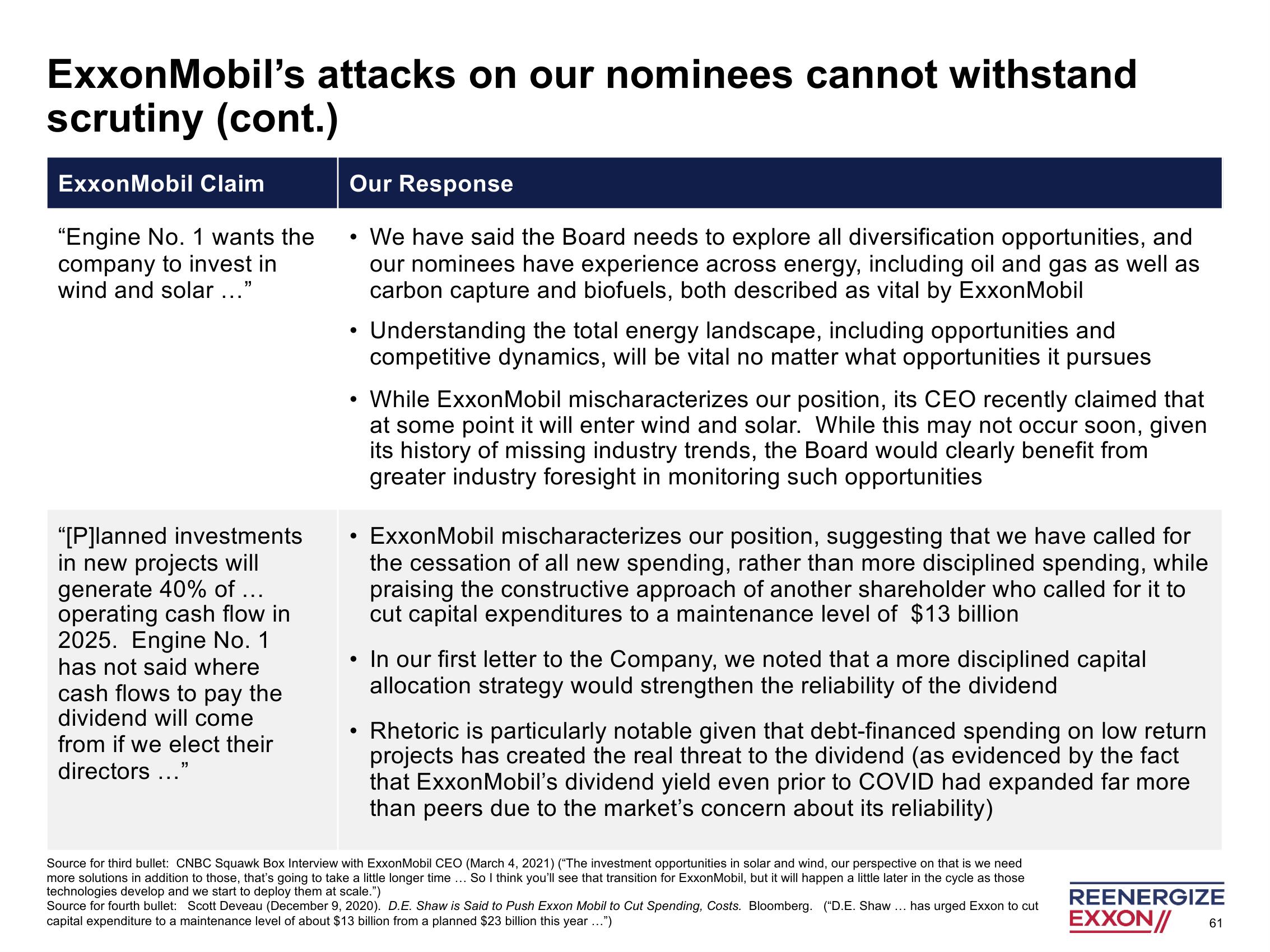

ExxonMobil's attacks on our nominees cannot withstand

scrutiny (cont.)

ExxonMobil Claim

"Engine No. 1 wants the

company to invest in

wind and solar ..."

"[P]lanned investments

in new projects will

generate 40% of ...

operating cash flow in

2025. Engine No. 1

has not said where

cash flows to pay the

dividend will come

from if we elect their

directors ..."

Our Response

We have said the Board needs to explore all diversification opportunities, and

our nominees have experience across energy, including oil and gas as well as

carbon capture and biofuels, both described as vital by ExxonMobil

●

●

• While ExxonMobil mischaracterizes our position, its CEO recently claimed that

at some point it will enter wind and solar. While this may not occur soon, given

its history of missing industry trends, the Board would clearly benefit from

greater industry foresight in monitoring such opportunities

●

Understanding the total energy landscape, including opportunities and

competitive dynamics, will be vital no matter what opportunities it pursues

●

ExxonMobil mischaracterizes our position, suggesting that we have called for

the cessation of all new spending, rather than more disciplined spending, while

praising the constructive approach of another shareholder who called for it to

cut capital expenditures to a maintenance level of $13 billion

In our first letter to the Company, we noted that a more disciplined capital

allocation strategy would strengthen the reliability of the dividend

Rhetoric is particularly notable given that debt-financed spending on low return

projects has created the real threat to the dividend (as evidenced by the fact

that ExxonMobil's dividend yield even prior to COVID had expanded far more

than peers due to the market's concern about its reliability)

Source for third bullet: CNBC Squawk Box Interview with ExxonMobil CEO (March 4, 2021) ("The investment opportunities in solar and wind, our perspective on that is we need

more solutions in addition to those, that's going to take a little longer time ... So I think you'll see that transition for ExxonMobil, but it will happen a little later in the cycle as those

technologies develop and we start to deploy them at scale.")

Source for fourth bullet: Scott Deveau (December 9, 2020). D.E. Shaw is Said to Push Exxon Mobil to Cut Spending, Costs. Bloomberg. ("D.E. Shaw ... has urged Exxon to cut

capital expenditure to a maintenance level of about $13 billion from a planned $23 billion this year ...")

REENERGIZE

EXXON// 61View entire presentation