Zegna Investor Presentation Deck

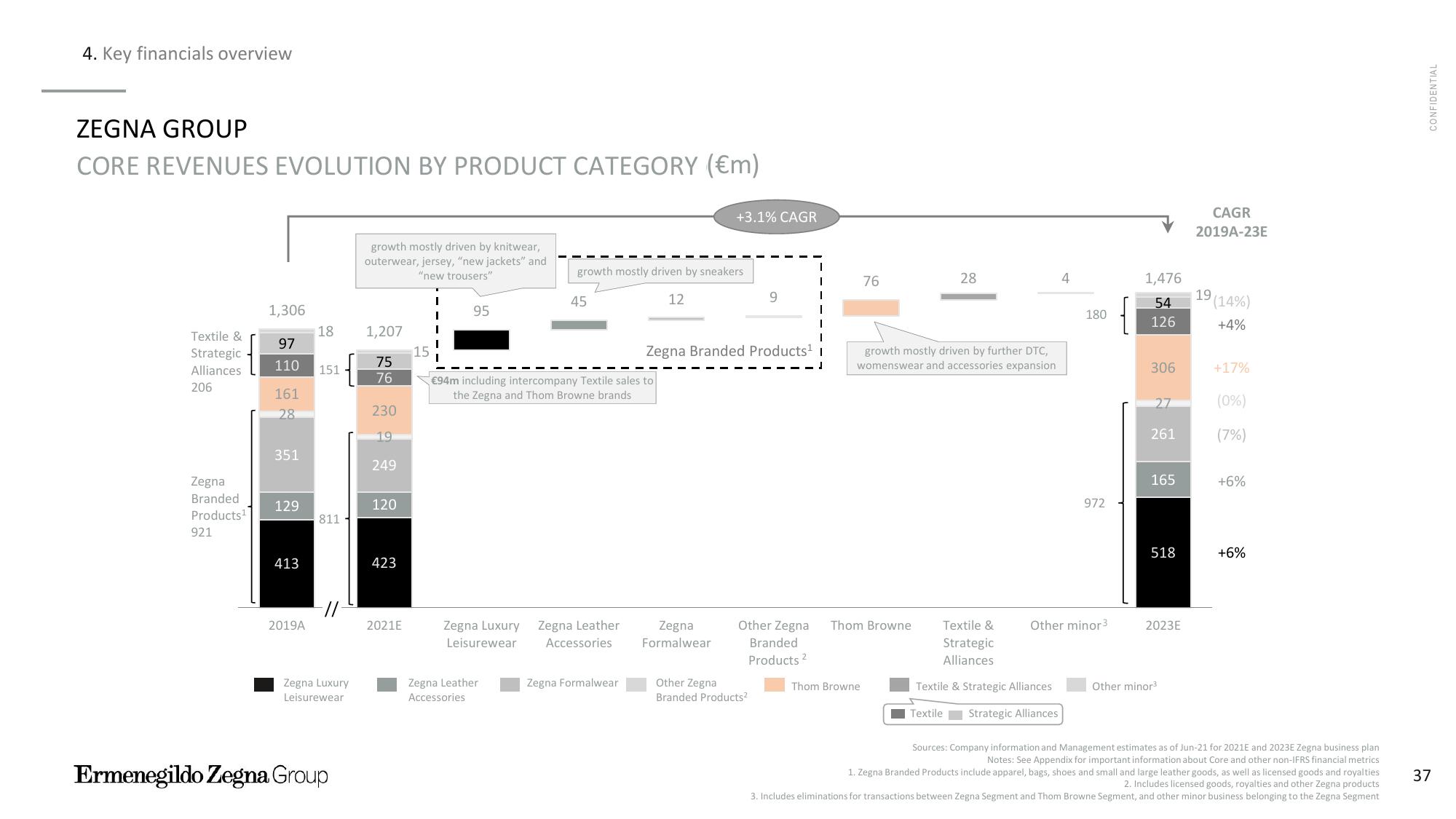

4. Key financials overview

ZEGNA GROUP

CORE REVENUES EVOLUTION BY PRODUCT CATEGORY (€m)

Textile

Strategic

Alliances

206

Zegna

Branded

Products¹

921

1,306

97

110

161

28

351

129

413

2019A

18

151

811-

Zegna Luxury

Leisurewear

Ermenegildo Zegna Group

growth mostly driven by knitwear,

outerwear, jersey, "new jackets" and

"new trousers"

1,207

75

76

230

19

249

120

423

2021E

15

I

I

95

growth mostly driven by sneakers

12

45

Zegna Leather

Accessories

€94m including intercompany Textile sales to

the Zegna and Thom Browne brands

Zegna Luxury Zegna Leather

Leisurewear Accessories

Zegna Formalwear

+3.1% CAGR

Zegna

Formalwear

Zegna Branded Products¹ 1

J

9

Other Zegna

Branded

Products ²

Other Zegna

Branded Products²

I

I

1

76

growth mostly driven by further DTC,

womenswear and accessories expansion

Thom Browne

Thom Browne

28

Textile &

Strategic

Alliances

4

Textile & Strategic Alliances

Textile Strategic Alliances

180

972

Other minor 3

1,476

54

126

306

27

261

165

518

2023E

Other minor³

CAGR

2019A-23E

19

(14%)

+4%

+17%

(0%)

(7%)

+6%

+6%

Sources: Company information and Management estimates as of Jun-21 for 2021E and 2023E Zegna business plan.

Notes: See Appendix for important information about Core and other non-IFRS financial metrics

1. Zegna Branded Products include apparel, bags, shoes and small and large leather goods, as well as licensed goods and royalties

2. Includes licensed goods, royalties and other Zegna products

3. Includes eliminations for transactions between Zegna Segment and Thom Browne Segment, and other minor business belonging to the Zegna Segment

CONFIDENTIAL

37View entire presentation