Nerdy SPAC Presentation Deck

Sources & Uses / Pro-Forma Valuation

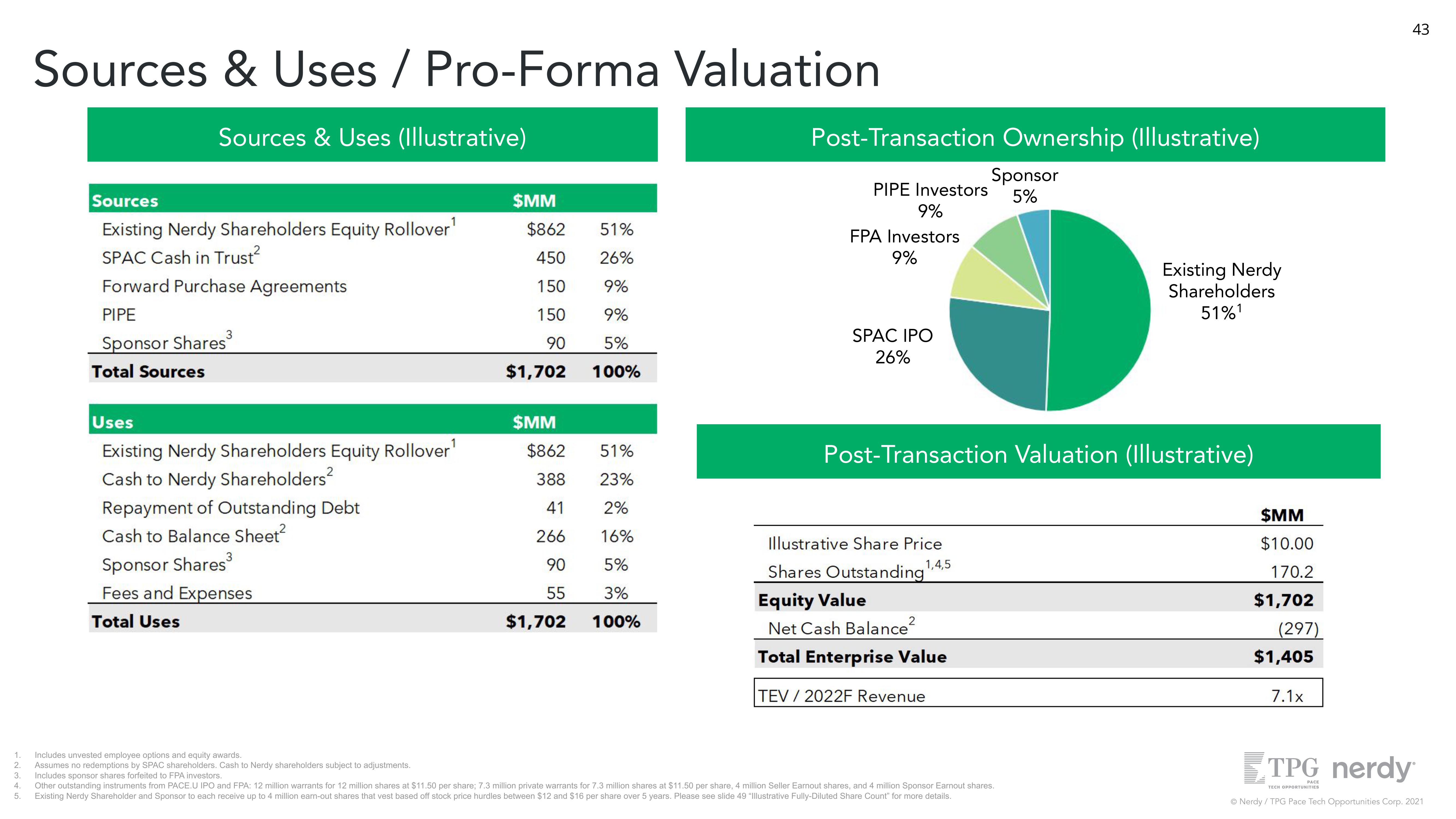

Sources & Uses (Illustrative)

3.

4.

5.

Sources

Existing Nerdy Shareholders Equity Rollover¹

SPAC Cash in Trust²

Forward Purchase Agreements

PIPE

Sponsor Shares

Total Sources

Uses

Existing Nerdy Shareholders Equity Rollover¹

Cash to Nerdy Shareholders²

Repayment of Outstanding Debt

Cash to Balance Sheet²

Sponsor Shares

Fees and Expenses

Total Uses

$MM

$862

450

150

150

90

51%

26%

9%

9%

5%

$1,702 100%

$MM

$862

388

41

266

90

55

$1,702

51%

23%

2%

16%

5%

3%

100%

Post-Transaction Ownership (Illustrative)

Sponsor

5%

PIPE Investors

9%

FPA Investors

9%

SPAC IPO

26%

Post-Transaction Valuation (Illustrative)

Illustrative Share Price

1,4,5

Shares Outstanding"

Equity Value

Net Cash Balance²

Total Enterprise Value

TEV / 2022F Revenue

1 Includes unvested employee options and equity awards.

2

Assumes no redemptions by SPAC shareholders. Cash to Nerdy shareholders subject to adjustments.

Includes sponsor shares forfeited to FPA investors.

Other outstanding instruments from PACE.U IPO and FPA: 12 million warrants for 12 million shares at $11.50 per share; 7.3 million private warrants for 7.3 million shares at $11.50 per share, 4 million Seller Earnout shares, and 4 million Sponsor Earnout shares.

Existing Nerdy Shareholder and Sponsor to each receive up to 4 million earn-out shares that vest based off stock price hurdles between $12 and $16 per share over 5 years. Please see slide 49 "Illustrative Fully-Diluted Share Count" for more details.

Existing Nerdy

Shareholders

51%¹

$MM

$10.00

170.2

$1,702

(297)

$1,405

7.1x

43

TPG nerdy

PACE

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021View entire presentation