Investor Day

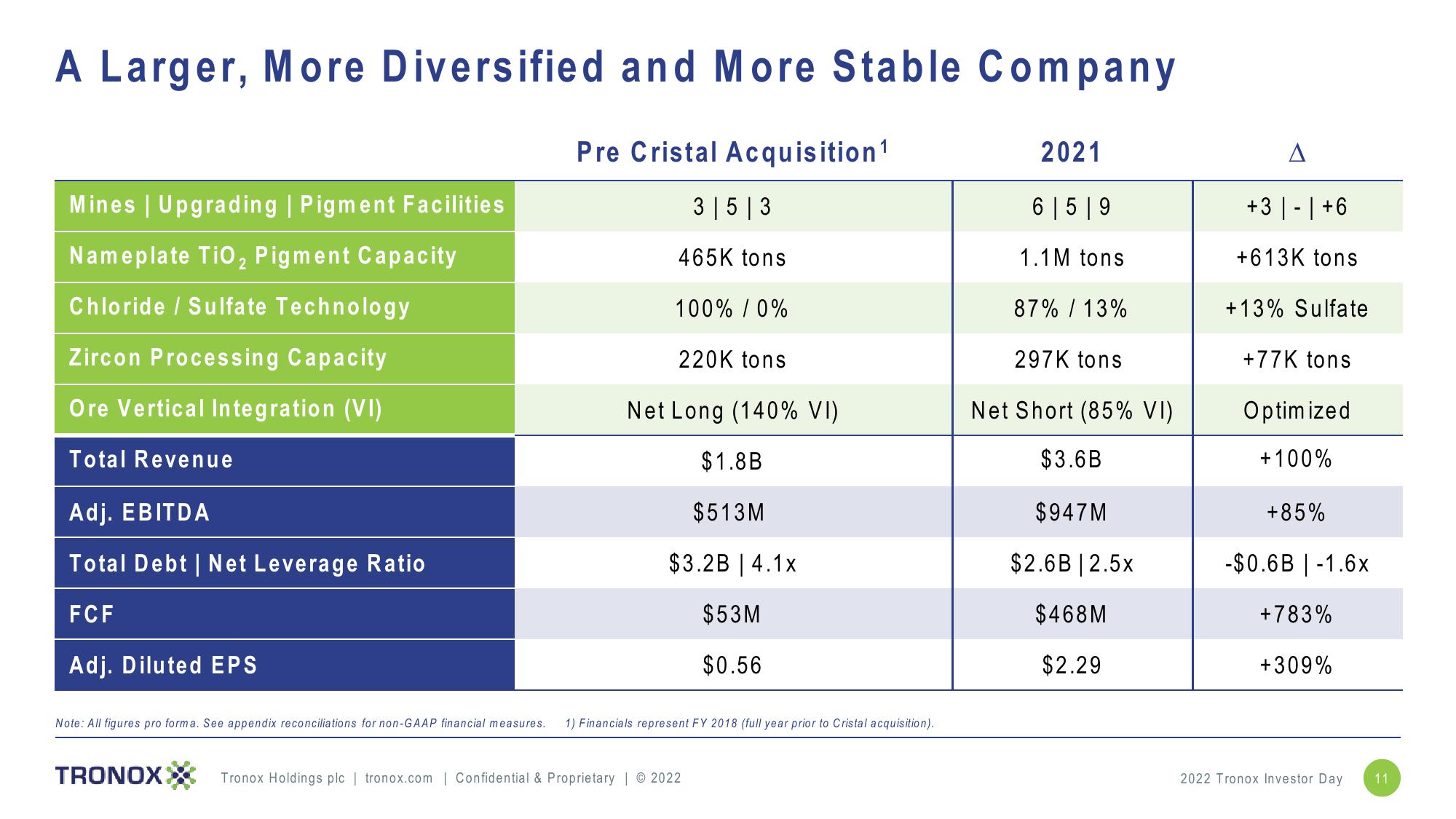

A Larger, More Diversified and More Stable Company

Pre Cristal Acquisition ¹

Mines | Upgrading | Pigment Facilities

Nameplate TiO₂ Pigment Capacity

2

Chloride / Sulfate Technology

Zircon Processing Capacity

Ore Vertical Integration (VI)

Total Revenue

Adj. EBITDA

Total Debt | Net Leverage Ratio

FCF

Adj. Diluted EPS

TRONOX

35 3

465K tons

100% / 0%

220K tons

Net Long (140% VI)

$1.8B

$513M

$3.2B | 4.1x

$53M

$0.56

Note: All figures pro forma. See appendix reconciliations for non-GAAP financial measures. 1) Financials represent FY 2018 (full year prior to Cristal acquisition).

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2022

2021

6 5 9

1.1M tons

87% / 13%

297K tons

Net Short (85% VI)

$3.6B

$947M

$2.6B 2.5x

$468M

$2.29

A

+3+6

+613K tons

+13% Sulfate

+77K tons

Optimized

+100%

+85%

-$0.6B | -1.6x

+783%

+309%

2022 Tronox Investor Day 11View entire presentation